Unit Linked Insurance Plan (ULIP) Charges and Returns

What are ULIPs

Unit Linked Insurance Plan is probably the most controversial investment product in the recent history. It was marketed aggressively by the insurance companies, and there was low awareness among investors about the fee structures. Under the revised IRDA guidelines the fees have been revised and ULIPs are now more attractive as investment option, than in the past. ULIPs are combined investment and insurance plans. The investors may choose between equity and debt allocations of their premiums, depending upon their financial planning considerations. ULIP also offers life cover, on the investor's annual premium. ULIPs have lock in period, usually ranging from 3 to 5 years. ULIP premiums are eligible for deduction from taxable income under Section 80C of the Income Tax Act. The maturity proceeds from ULIPs are also tax exempt under Section 10 (10D). In terms of gross investment returns ULIPs have performed comparably with mutual funds over a 5 year period, with top ULIPs giving annualized returns of 16 – 18%. However, net returns to investors would be very different due to various applicable charges.

When the investors pay their premiums in ULIP, the insurance company deducts various charges from the premium and invests the balance amount in units of a fund chosen by the investor like equity fund, fixed income or bond fund, liquid funds and balanced or hybrid funds, to generate capital growth or income for the investor. The insurance cover or sum assured, offered by ULIP is a multiple of the premium, usually ranging from 5 times to 10 times of the annual premium.

What are the applicable charges in ULIPs

Premium allocation charges:

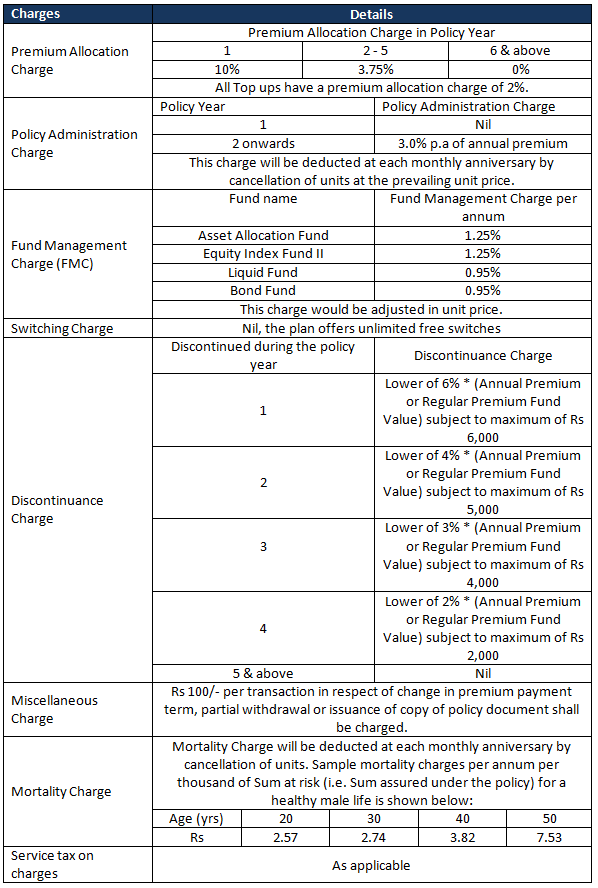

This is a percentage of the premium to be deducted upfront, before the units are allotted. This charge normally includes initial and renewal expenses apart from commission expenses.Policy administration charges:

These are the fees for administration of the plan and levied by cancellation of units. This could be flat throughout the policy term or vary at a pre-determined rateMortality charges:

It is the fee for your insurance cover. It depends on the age of the investor and the amount of cover.Fund Management charges:

These are fees levied for fund management and are deducted before arriving at the Net Asset Value (NAV)Surrender charges:

If you are unable to pay the premium within the lock in period of 5 years, then surrender charges would apply for encashment of the units- Other charges may also apply

In this article we will understand these applicable charges in greater details with an example, and see how these charges affect the returns of the investor. These charges differ from plan to plan, and therefore investors should read the product brochures of the ULIPs very carefully to understand these charges. For the purpose of illustration, we have taken the example of Max Advantage ULIP offered by Bajaj Allianz. The product brochure of the plan has all the details of the different charges and policy features, as shown in the table below.

Let us assume Ravi is an investor in the Bajaj Allianz Max Advantage ULIP. Ravi is a 30 year old male. He pays an annual premium of Rs 1 lakh, for which he gets a sum assured of Rs 10 lakhs. We will not discuss in this article, if Rs 10 lakhs of sum assured is adequate for Ravi's life insurance. For his investment Ravi has chosen the equity index fund II. Let us assume this fund gives an annual gross return of 20%. For the sake of simplicity, let us assume the return is uniform throughout the year. Therefore the monthly return is 1.53% (1.53% return compounded monthly implies an annual return of 20%). Let us now see, how the various charges impact Ravi's return on investment.

Premium Allocation Charge:

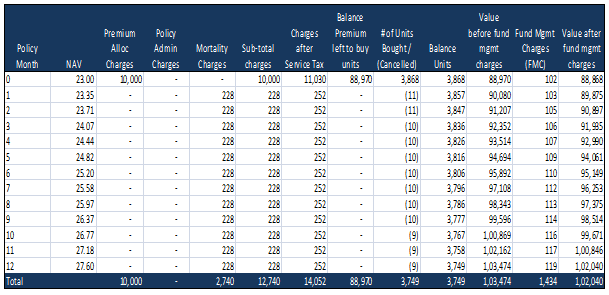

10% of Ravi's premium is deducted upfront for premium allocation charges. Since the Union Budget of 2011, all ULIP charges fall under the gamut of service tax, including premium allocation charges. After deduction of premium allocation charges and the applicable service tax, only Rs 88,970 is available for investment. Let us assume that, when Ravi made the investment, the NAV of the fund was 23 and he was allotted 3,868 units.Policy Administration Charges:

Policy administration charge for Year 1 is zero. So Ravi does not have to pay Policy Administration Charges.Mortality Charge:

Since Ravi is 30 years and has a sum assured of Rs 10 lakhs, his mortality charge is Rs 2,740. This is deducted each month by cancelling his units at the applicable NAVs. Service tax also applies to mortality charges. Ravi's monthly mortality charges including service tax is Rs 252. If the NAV at the end of the month 1 is 23.35, 10.8 units will be reduced from his balance (Rs 252 monthly mortality charges including service tax ÷ by month end NAV of 23.35 = 10.8 units). At the end of month 2, additional 10.6 units will be reduced from Ravi's balance (Rs 252 mortality charges including service tax ÷ by month end NAV of 23.71 = 10.6 units) and so on. In the first year 119 units will be reduced from Ravi's balance and he will be left with 3,749 units.Fund Management Charge:

Fund management charge for the fund chosen by Ravi is 1.25%. Total fund management charge paid by Ravi for the full year is Rs 1,434. The fund management charges are adjusted in unit NAVs, but for sake of illustration we have considered it separately.

The table below shows the monthly schedule of Ravi's ULIP charges for year 1, based on the above calculations.

The value of Ravi's investment at the end of year 1 is Rs 1.02 lakhs. Therefore, even though the fund gave a gross return of 20%, which is great by any standard, Ravi's net return is only 2%. This is because a significant part of the premium goes into the charges and is not invested in the fund.

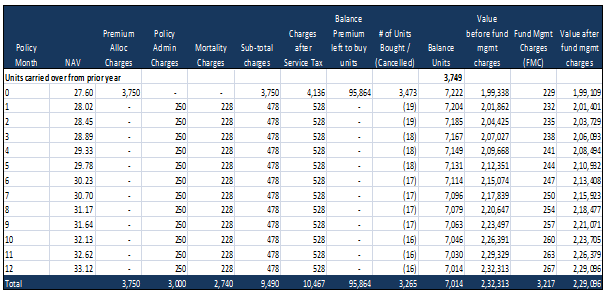

Some insurance agents say that the first year cost of ULIP is high, but returns from second year onwards are much better. There is some truth in what they say, but we should analyze objectively how much do the returns improve. Let us see how Ravi's ULIP performs in year 2. Let us assume that NAV continues to give a gross return of 20%. Let us briefly examine various charges for year 2.

Premium Allocation Charge:

The premium allocation charge for year 2 is 3.75%. So Rs 4,136 is deducted upfront and the balance Rs 95,865 was allocated to buy units at the applicable NAV.Policy Administration Charges:

Policy administration charge for Year 1 is zero, but from year 2 Ravi has to pay Rs 3,000 for Policy Administration Charges on an annual basis. This plus applicable service tax is deducted each month by cancellation of units at the applicable NAVs, as described above.Mortality Charge:

Ravi continues to pay mortality charge of Rs 2,740. This is deducted each month by cancellation of units at the applicable NAVs. This plus applicable service tax is deducted each month by cancellation of units at the applicable NAVs. In total, 208 units are reduced from Ravi's balance in year 2 for policy administration and mortality charges.Fund Management Charge:

Ravi continues to pay fund management charge of 1.25%.

The table below shows the monthly schedule of Ravi's ULIP charges for year 2, based on the above calculations. Please note, Ravi has carried over 3,749 units from year 1 (see table above).

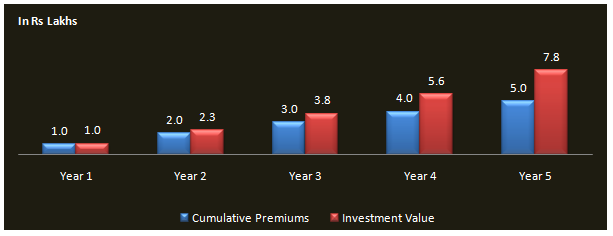

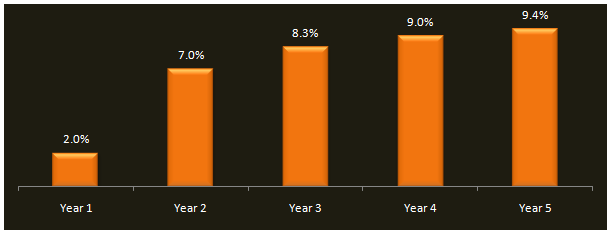

The second year returns are undoubtedly better and Ravi's investment value will be Rs 2.29 lakhs. But the two year annualized return is still only about 7%. This is because, out of his Rs 1 lakh annual premium, Ravi will still continue to pay over Rs 10,000 as charges, which do not get allocated to investments. Even by years 3, 4 and 5 the annualized returns do not improve very much. Please the chart below for first 5 years returns from this ULIP, based on the assumptions above. Amounts are in Rs Lakhs.

The chart below shows the one, two, three, four and five years annualized returns from this ULIP.

Though we have assumed here gross annualized return of 20% every year from this ULIP fund, an important fact to note here is that ULIPs are exposed to market risks. Therefore, the NAVs of the fund will be volatile. If there is a market slowdown during this period, it is quite possible that the returns will be negative. Beyond year 5, premium allocation charge will not apply and so the returns will be better. However, certain charges like policy administration charge, mortality charge and fund management charge will continue to apply. Mortality charge will increase as the age of the investor increases.

Conclusion

ULIPs are complex investment products. Investors need to have a long time horizon for ULIPs. As discussed in this article, the returns in the first few years are low due to the ULIP charges. Investors should clearly understand the charges of the ULIP by carefully reading the product brochure, and estimate the impact of the charges on their investment returns, as described in this article. Investors should consult with Prajna Capital, if ULIPs are suitable for their investment objectives.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------