In this post, I thought to list the Top 5 Best ELSS or Tax Saving Mutual Funds to invest in 2016. Because ELSS or Tax Saving Mutual Funds are main hunt of salaried.

What is the tax benefit of investing in ELSS or Tax Saving Mutual Funds?

Many of you who searching for ELSS or Tax Saving Mutual Fund might know the taxation of these products. To simplify, whatever you invest in ELSS or Tax Saving Mutual Funds, will be eligible for deduction under Sec.80C of IT Act. These funds will come with a lock-in of 3 years. However, do remember that if you invested say Rs.1, 00,000 in October, 2015, then you can withdraw it ONLY in October, 2018.

Also, the important mistake individuals who invest in ELSS or Tax Saving Funds commit is, they start investing through SIP and consider the first SIP date as investment date and maturity will be after 3 years from 1st SIP. However, do remember that each SIP is considered as fresh investment. Hence, each monthly SIP must complete 3 years. Therefore, if starts monthly SIP in October, 2015 then this will be free to withdraw in October, 2018. The second month SIP i.e. November, 2015 SIP will be eligible to withdraw in November, 2018 and so on.

As these funds are equity oriented mutual funds, the returns from such funds are totally tax-free. So people throng to such products. Because it gives a tax benefit while investing, shortest lock-in (only 3 years) product available among tax saving instruments and after 3 years the return is tax-free.

In addition, being locked-in product, the commission is also high in such products. Therefore, definitely advisers push to SAVE TAX. However, sadly neither advisers nor investors completely forget the basic principle of equity INVESTMENT i.e. equity investment is meant for the LONG TERM. Finally, after 3 years, if investors have some positive return, then they cheer up, otherwise blame it on EQUITY.

Recently almost all mutual fund companies renamed these ELSS or Tax Saving Mutual Funds from their earlier name as "Tax Saving" to "Long Term Equity". For example, HDFC Tax Saver Fund now changed its name to "HDFC Long Term Advantage Fund". This is to make sure that at least by name investors can feel that such funds are meant for the LONG TERM.

How I shortlisted the funds?

First, I screened the top 15 funds in each category based on their returns to benchmark since inception. Those among top 15 and with consistency score of 100% are below-mentioned funds.

- Axis Long Term Equity Fund

- Birla Sunlife Tax Plan

- DSP BlackRock Tax Saver Fund

- Franklin India Tax Shield

- ICICI Pru Long Term Equity Fund

- IDBI Equity Advantage Fund

- Reliance Tax Saver

- Religare Invesco Tax Plan

It is hard to choose the BEST among these. However, I finally arrived based on the risk-return criteria. Below is the list of "Top 5 Best ELSS or Tax Saving Mutual Funds to invest in 2016". To arrive at the final decision, I checked the funds for below-mentioned tests and if the fund cleared all these tests and given me around a minimum of 80% score since inception, will be added to my list.

- Beta-Volatility measure and tell how much the fund changes for a given change in the Index. Lower the beta, lower the volatility. Hence, your fund must have lower beta.

- Standard deviation-It tells us how for a given set of returns, how much do fund returns deviate from the average. Lower the standard deviation, lower the volatility. Hence, your fund must have lower beta.

- Alpha-It is the risk-adjusted measure. By taking risks, how much the fund manager generated the return over the benchmark. Higher the alpha, higher the outperformance of the fund.

- Sharpe Ratio-It is the risk-adjusted measure. Higher the Sharpe ratio better is the performance.

- Sortino Ratio-It is the risk-adjusted measure. Higher the Sortino ratio better is the performance.

- Treynor Ratio-It is also be known as reward ratio. Higher the Treynor ratio better is the performance.

- Information Ratio-This is calculated by average excess return obtained compared to a benchmark and divides it by the standard deviation of excess returns. Higher the information ratio, the higher the consistency in beating the benchmark.

- Omega Ratio- It is a risk-return performance measure of an investment asset.

- Downside deviation-This is also be called as BAD RISK.

- Upside potential-This is exactly the opposite of Downside deviation.

- R-squared- It is a measure of how correlated the fund's NAV movement is with its index.

- SIP Returns-For how many times the fund's returns are above the index when we invest in SIP.

- Lump Sum Returns-For how many times the fund's returns are above the index when we invest in a lump sum.

1) Axis Long Term Equity Fund-This is the fund which is catching intention of many investors. I noticed that few invested in this fund because it has provided good returns since 5 years.

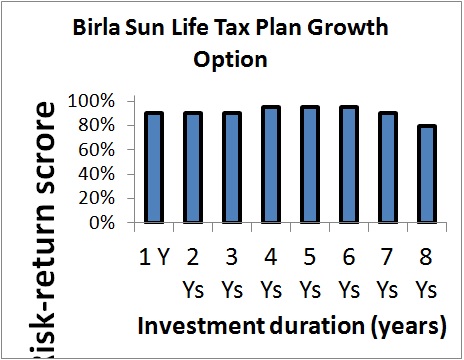

2) Birla Sunlife Tax Plan-The fund is in the market since 1999. Below is the result of its consistency and reason for why I selected this fund.

You notice the consistency of fund since 8 years and it is the eye-catching among many.

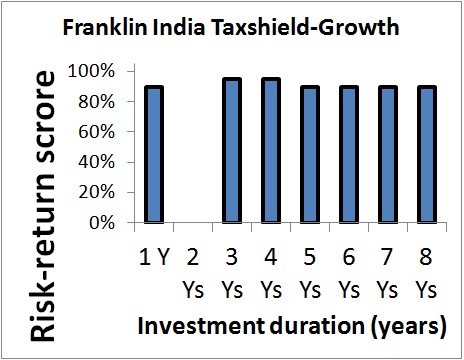

3) Franklin India Tax Shield-This is one my favorite fund, which is in top since its launch in 1999 and below is the result of the risk-return analyzer.

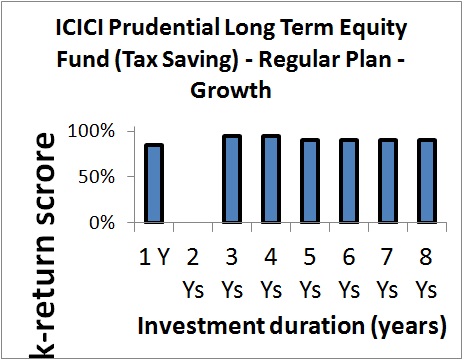

4) ICICI Prudential Long Term Equity Fund-This is the one more fund, which I suggested last year, along with Franklin India Taxshield Fund and I again recommend this fund.

5) DSP BlackRock Tax Saver Fund-This is the fund which is in the market since 2007 and consistently performed well. Hence, I included this fund in my list.

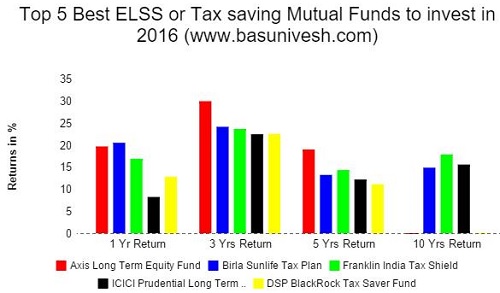

How these funds performed in case of returns?

You noticed that only 3 funds from above selection are more than 10 years old funds. Hence, I stress to consider those funds as a priority.

Hope this information will be useful in selecting the Best ELSS or Tax Saving Mutual Funds to invest in India in 2016.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------