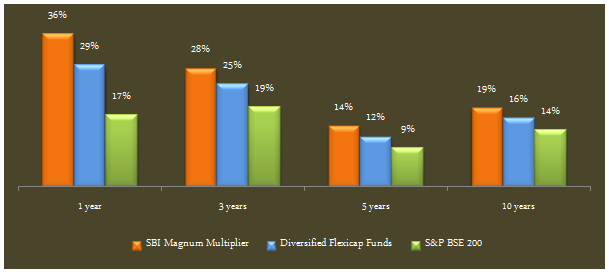

Mutual Funds which stand the test of the time and deliver strong returns across different market cycles become favourites with investors. SBI Magnum Multiplier fund launched in 1993 is one such fund. In the last few years, the fund delivered outstanding performance and consistently beaten the benchmark and the fund category. The chart below shows the trailing annualised returns of SBI Magnum Multiplier fund versus diversified equity (flexicap) category and the benchmark BSE 200 index, over the last 1 year, 3 years, 5 years and 10 years time periods (as on Aug 10 2015).

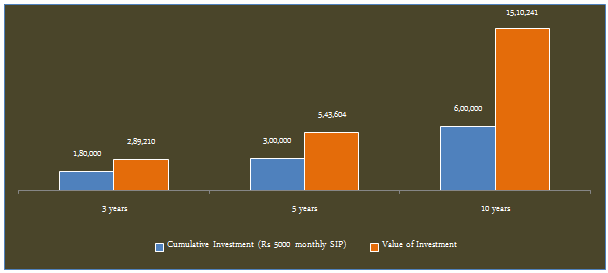

The Systematic Investment Plan returns of the fund over the last 3, 5 and 10 year periods have been especially outstanding. The fund has consistently been in the top quartile in its category in terms of SIP returns. The chart below shows the returns र 5,000 SIP in the SBI Magnum Multiplier Fund over various time periods.

Fund Overview of SBI Magnum Multiplier Fund

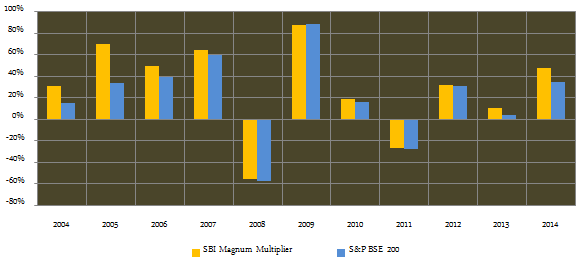

SBI Magnum Multiplier Fund, a diversified equity fund, was launched in February 1993. The fund's has an AUM base of around र 1500 crores. The expense ratio of the fund is slightly on the higher side at 2.47%. The fund is managed by Jayesh Shroff. The chart below shows the annual returns of the SBI Magnum Multiplier Fund from 2004 to 2014. The fund has outperformed its benchmark across both bull and bear market cycles.

CRISIL ranks the fund 2 in the diversified equity category. Morningstar has a 5 star rating for this fund.

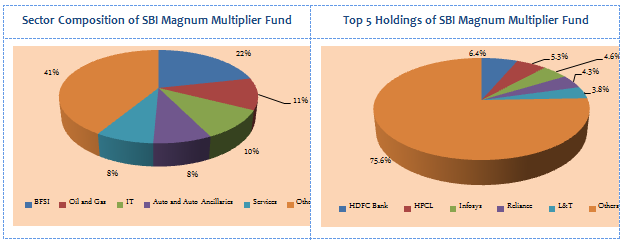

Portfolio Composition

The fund portfolio is has a bias towards large cap stocks. Large cap stocks comprise nearly 63% of the fund portfolio, while midcap and small cap stocks comprise another 27%. In terms of sector allocation, the portfolio has a bias towards cyclical sectors like Banking and Financial Services, Automobiles and automobile ancillaries, Oil and Gas etc. In terms of company concentration, the fund portfolio is fairly well diversified with the top 5 holdings accounting for only 25% of the total portfolio value. Even the top 10 company holdings account for a little over 41% of the total portfolio value.

Risk and Return

While the SBI Magnum Multiplier Fund has beaten the diversified (flexicap) funds category in terms of trailing returns, the volatility of the fund measured in terms standard deviation of monthly returns is significantly lower than that of category. While the 3 year standard deviation of the flexicap funds category is 16.8%, the standard deviation of SBI Magnum Multiplier fund is only 13.3%. Hence, in terms of risk adjusted returns, as measured by Sharpe ratio the fund has outperformed the diversified flexicap funds category.

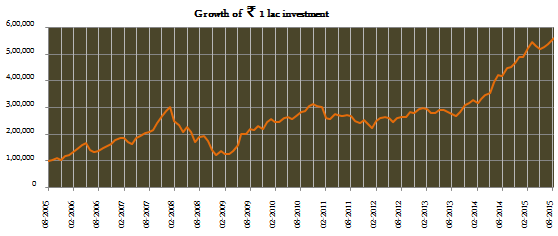

र 1 lac lump sum investment in the SBI Magnum Multiplier Fund (growth option) 10 years back would have grown nearly 6 times in the last 10 years. The chart below shows the growth of र 1 lac investment in the SBI Magnum Multiplier Fund (growth option).

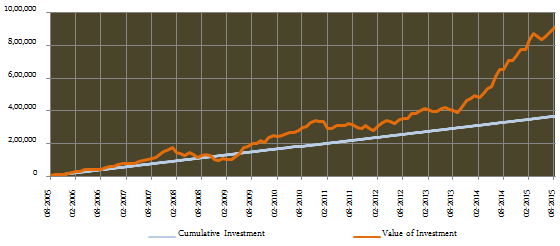

The chart below shows the returns over the last 10 years of र 3,000 invested monthly through Systematic Investment Plan route in the SBI Magnum Multiplier fund (growth option). The SIP date has been assumed to first working day of the month. The chart below shows the SIP returns of the fund.

The chart above shows that a monthly SIP of र 3,000, started 10 years back in the Birla Sun Life Advantage fund (growth option) would have grown to over र 9.1 lacs by August 10 2015, while the investor would have invested in total only about र 3.6 lacs. The SIP return (XIRR) is nearly 17% over the last nearly 10 years.

Conclusion

SBI Magnum Multiplier fund has completed over 22 years of strong performance. This fund is suitable for investors looking for high capital appreciation over a long time horizon, for long term financial objectives, such as retirement planning, children's education etc. Investors can consider investing in the scheme through the systematic investment plan (SIP) or lump sum mode with a long time horizon. Investors should consult with their financial advisors, if SBI Magnum Multiplier Fund is suitable for their investment portfolio.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------