The complete guide to Employee Pension Scheme (EPS) 1995

When I wrote a post about recent changes in the Employee Provident Fund (EPF), I received so many queries related to Employee Pension Scheme because there is a huge misconception among employees about EPS. Hence, let me write a post on this in detail.

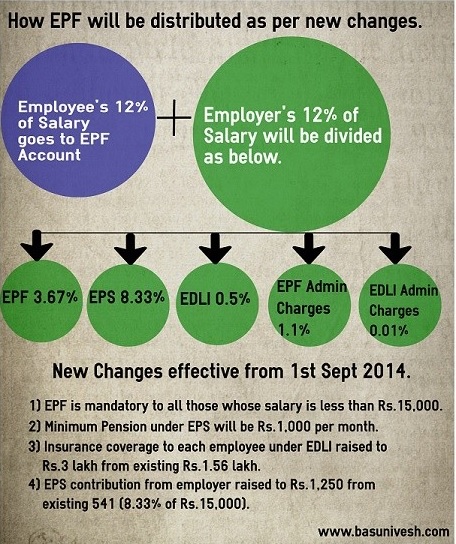

In the below image, I have tried to explain how your's and employer's EPF contribution is distributed. Many of EPF members at the first instance do not know that they have a pension scheme and for which their employer is contributing.

You will notice that the major portion of your employer contribution will go towards the Employee Pension Scheme (EPS). However, the majority of employees are ignorant about this.

Few features of these schemes are-

- Employees who are members of EPF will automatically become the members of EPS.

- Along with your employer contribution of 8.33% of your salary, Central Govt. also contributes 1.16% of employees' monthly salary. Here the meaning of salary means Basic+DA. The rulebook still sticks to the old salary limit of Rs.6, 500 limits for an employer and central government contribution. However, in my view after the new rules, the limit should be raised to Rs.15, 000.

- You will not get any interest on your EPS contribution.

- For calculation purposes, if your service is more than or equal to 6 months, then it will be rounded to next year. If it is less than 6 months, then such fraction of service period is not considered for calculation. For example, suppose you worked for 21 yrs and 7 months. In this case, your service is considered as 22 years. However, if your service is 21 yrs and 2 months, then service will be considered as 21 yrs only.

- Pensioner receives a pension for life long and upon his death will go to spouse and two children below 25 years of age

- Employees are eligible for EPS only if they complete 10 Yrs of service or attain the age of 58 or 50 Yrs of age.

- You will not be eligible to receive more than one pension from EPS.

What is an eligible service for EPS?

As I said above, for calculation purpose, if your service is more than or equal to 6 months, then it will be rounded to next year. If it is less than 6 months, then such fraction of service period is not considered for calculation. For example, suppose you worked for 21 yrs and 7 months. In this case, your service is considered as 22 years. However, if your service is 21 yrs and 2 months, then service will be considered as 21 yrs only.

What is pensionable service for EPS?

The pensionable service is determined by the number of years your employer contributed on behalf of you. If your employer failed to deposit the amount then such months are not considered for calculation of service. Also, in case if an employee completed 58 yrs of age and completed 20 yrs of service or more, his pensionable service will be increased by 2 years for calculation purpose.

What is a pensionable salary for EPS?

It is the last 12 months average salary during contribution period preceding the date of exit from the membership of EPS. In case employee did not receive full payment during that last 12 months, the average of last 12 months full pay drawn by him during the period for which contribution to the EPS was recovered, will be considered for EPS calculation.

In case of such last 12 months, employee hasn't contributed to EPS, including cases like where the employee has drawn a salary as part of a month, the total salary during the 12 month span will be divided by the actual number of days for which salary has been drawn. The amount so derived will be multiplied by 30 to arrive at an average monthly salary.

When employees get the pension?

a) Superannuation-To avail such pension, you must complete 10 yrs of service and your age must be 58 yrs or above. An employee can continue his job while receiving his monthly pension. However, he cannot be a member of EPS and hence no more fresh contribution to EPS.

b) Early Pension-To avail such pension, you must complete 10 years of service and age between 50 yrs to 58 yrs. To avail such early pension, an employee must not be working.

c) Death of an employee-Employee is eligible for EPS if death occurs as below.

- If death occurs during the service-If at least one-month contribution is done to EPS then his nominee will be eligible to receive the EPS.

- If death occurs while not in service-If death occurs after the service but before attaining the age of 58 years.

In both the cases also employee family eligible for a pension. In case of dead employee having a family, a pension is payable to the spouse and two children below 25 years of age. When a child reaches 25 years of age, the third child below 25 yrs of age will be given a pension and so on.

If the child is disabled, he may get a pension until his death. Only 2 children will receive a pension at a time. In case of an employee not having a family, the pension is payable to single nominated person. If not nominated and having a dependent parent, the pension is payable first to Father and then on father's death to Mother.

d) Permanently and totally disabled-If an employee is unfit to do his job due to accidental permanent and total disability during a job, then also he is eligible for the pension.

How to calculate the Employee Pension Scheme pension?

There are two methods based on the service you joined. One is for those who joined before 15th November 1995 and another for those who joined after this date.

1) Employees who joined before 15th November 1995-

The pension is calculated separately for Past Service & Pensionable Service

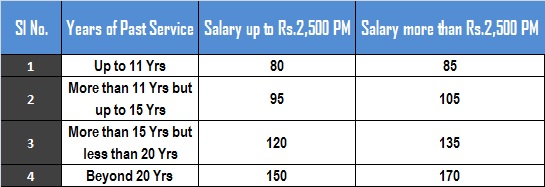

a) Procedure for Calculation of Past Service Pension

- Find out the total past service, i. e. subtract the Date of Joining from 15.11.1995 duly rounding the service in years.

- Find out the salary as of 15.11.1995 as to whether it is up to Rs.2500 or more than Rs.2500.

- Accordingly locate the past service benefit from the table given below.

- Find out the period that had elapsed between 16.11.1995 and the date of exit and based on this period locate the corresponding Table 'B' Factor. Date of Exit is Date of attaining 58 years for superannuation/early pension, Date of Death for widow pension and Date of Disablement for Disablement pension.

- Multiply the Past Service Benefit and the Table B factor, which gives the Past.

b) Procedure for calculation of Pensionable Service Pension–

- Find out the Category of the member as to whether he belongs to X, Y or Z Category.

- X – Date of commencement of pension is between 16.11.1995 and 15.11.2000 Y – Date of commencement of pension is between 16.11.2000 and 15.11.2005 Z – Date of commencement of pension on or after 16.11.2005.

- Find out the Pensionable Service and Pensionable Salary of the member and substitute the same in the formula given as below.

(Average Salary X Service)/70

- If the formula pension calculated is less than 335/438/635 respectively, for X, Y, Z categories, then only that minimum pension is to be given.

c) Procedure for the calculation of Total Pension-Add the Past Service Pension and the Formula Pension.

- Add the Past Service Pension and the Formula Pension.

- If the total pension is less than 500/600/800 respectively, for X,Y,Z categories, then that minimum pension shall be the total pension.

- But this total pension is for an eligible service of 24 years or more, and if the eligible service is less than 24 years, then this total pension has to be proportionately reduced subject to a minimum of 265/325/450 depending on X,Y,Z categories (only when the minimum pension is given).

- If the total pension itself is more than the minimum, then the proportionate reduction need not be made even if the eligible service is less than 24 years.

2) Employees who joined after 15th November 1995–

You can directly calculate by inserting the values in the formula as given below.

(Average Salary X Service)/70

You can find the wonderful, detailed calculation of this with an example at HERE or at HERE.

How to apply for the pension?

Once you complete the service of 10 years, then you get the scheme certificate. This scheme certificate can be used to claim your pension either from 58/50 Yrs.

The employee has to include all his past services to arrive at such 10 yrs of service and apply for pension once he attains the age of 58/50. He needs to fill the Form 10D and get attested by that bank manager with photo and other required documents. Submit the form to concerned EPFO.

Whether one can withdraw the EPS amount before 10 years also?

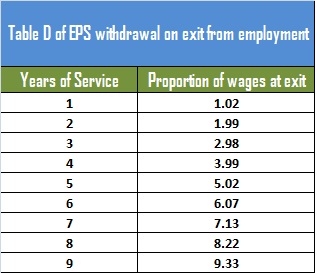

Yes, you can withdraw the contributed EPS amount along with your EPF balance. But the condition is you must not have completed 10 Yrs of service. When you withdraw EPF, then you receive EMPLOYEE+EMPLOYER EPF contribution+Interest earned on this EPF. Along with that, some % of EPS contribution also be paid. This % is determined by Table D of EPS, which is given below. Hence, whatever may be your contribution to EPS, you will get only some % of this based on the number of services and salary.

This is calculated as below.

Wages as on the date of exit X Corresponding Table 'D' factor. Here wages means Basic Salary+DA for EPS at the time of withdrawal. Therefore, suppose your salary is Rs.15,000 at the time of withdrawing and you completed 7 years, then you receive the EPS of Rs.1,06,950 (Rs.15,000*7.13). This is the amount you get, irrespective of your actual contribution to EPS. You have to submit the Form 10C along with other forms of EPF withdrawal to your HR.

Note-I found that still EPFO not updated the manual as per the new changes. Hence, I am unable to find the corresponding values for calculation. Whenever it is updated then I do changes here also.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------