Retirement planning is a complex but a very important topic, especially in today's context as our country is going through a process of economic and social transformation. Some of these changes are:-

- Shift from joint families to nuclear families

- Children are migrating to other cities for employment

- Higher inflation levels

- Increased life expectancy

- Rising cost of healthcare

These changes and probably others in the future, make it imperative for us to plan for retirement early in our working lives. It is important that we understand the fundamental goal of retirement planning, which is to achieve financial independence in your retirement years. The other important retirement planning goal is to be able to maintain your current lifestyle even during your retirement years. Retirement planning is a very structured process, the first step of which is to calculate your retirement needs. This is where most of us go wrong. A few years back an insurance agent visited me to sell a pension plan. He asked me, how much retirement corpus I need. I gave him a number based on my gut feel, based on which, he sold me a pension plan. Just five years later, I realized that number was way too small, after I made a more careful analysis of my retirement needs. The financial adviser should have helped me calculate my needs instead of asking me, how much money I need for my retirement. How much to save and where to invest comes only after we know, how much we need. In this article, we will discuss how you can calculate your retirement needs.

As discussed earlier, one of the most important retirement planning goals is to be able to maintain your current lifestyle even during your retirement. However, it is important to note that our lifestyle changes with time. If you are young, you are likely to have a lifestyle that fits your budget. However, as your family grows and income increases, your lifestyle is likely to change. Therefore, retirement planning should be a dynamic process. You should revisit retirement planning from time to time to see if your retirement plan is on track with your current lifestyle needs.

As with many aspects of personal finance, there are several heuristics or thumb rules for retirement planning. Heuristics are based on statistical evidence, but one must understand these are general guidelines only. Here are some heuristics for retirement planning:-

- Your retirement corpus should be 20 times of your annual expense

- You should save 10% of your income for your retirement

As discussed earlier, these rules are only general guidelines. However, you should not rely on heuristics alone for your retirement planning, because you may end up, underestimating (in most cases) or overestimating your retirement needs. Each one of us has different personal financial situations, and therefore we should employ a bottom-up approach to determining our retirement needs, depending on our own unique situations.

Since the goal of retirement planning is maintain our current lifestyle even during retirement years, the first step of retirement planning is to do an expense analysis. In this approach, we will analyze in fair amount of details, our regular expenses and project how much we will have to spend on our regular expenses, in our retirement years. We must be careful when we estimate regular expenses during our retirement years. We simply cannot take our regular expenses as a proxy for our expenses during retirement. We will end up, overestimating or underestimating the expenses during our retirement years. In the following cases, we will underestimate our retirement expenses, if we take our regular expenses as a proxy for our expenses during retirement:-

- If you are single with no dependents, the expenses in the retirement years will most likely be higher than your current expenses, because you will most likely have a spouse to support with your retirement income

- If you are living in a joint family, where a lot of expenses are shared, your retirement expenses are likely to be higher, if at a future point of time you are not living in a joint family

- You are young and your lifestyle changes as your income improves

- You are covered under your company's group health insurance plan. You will have to pay for health insurance or Mediclaim yourself after retirement

These are just a few examples. In the following cases, we will overestimate our expenses, if we take our regular expenses as a proxy for our expenses during retirement:-

- You have dependent children or parents. Your children will most likely be financially independent by the time you retire. However, if you have surviving parents after your retirement who you have to support, then you should make provisions for it in your retirement planning

- You may be paying life insurance premiums. It is your choice, whether you want to continue having life insurance after retirement. Life insurance is a protection for your family against the loss of income, in the event of an untimely death. In your retirement years, you do not have income, other than from your investments. Therefore, you may choose not to have life insurance after your retirement. Some people may continue to have life insurance policies even after retirement for a variety of reasons, which are outside the scope of this discussion. In that case your retirement income should cover your life insurance premiums

- You may be living in a rented house, in a city or town where you work. However, you may want to retire in your hometown, where you may have your own house, either one that you may have bought or one that you have or will inherit from your parents

- You may be paying EMIs on your home loan that may be paid in full before your retirement. However, if you are near retirement and you know that your home loan will not be paid in full by the time you retire, then you need make provisions for it in your retirement planning

Calculating your regular expenses

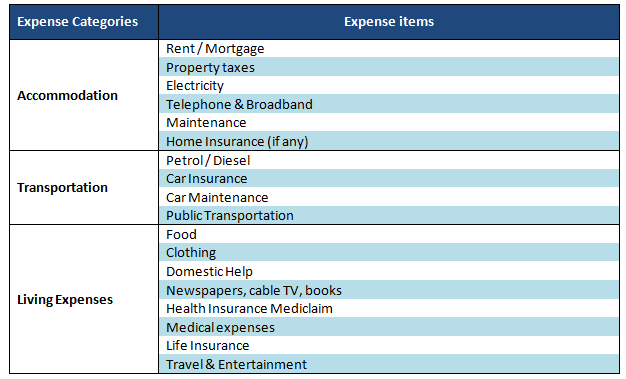

To estimate your regular expenses during your retirement, you should make a list of all your regular expenses. How much is your current expense, and how much will be your projected expense for retirement. You can use the following expense categories and items as a framework to calculate your own retirement needs. While these expense items should cover a major part of your regular expenses, if there are other major items that are not covered, then you should also include them in your calculation of retirement expenses.

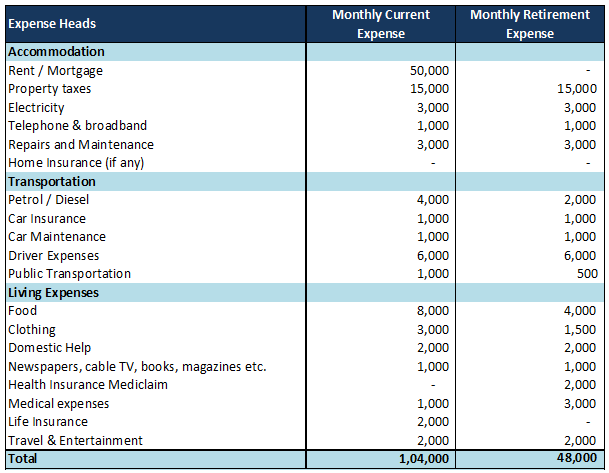

You will note that, this does not include expenses like children's education, which are relevant at an earlier stage of life but not retirement. You should list down your current expenses against each of these expense items, and also estimate what your expense for these items will be after your retirement. You should make appropriate adjustments to the cost to reflect actual need during retirement. For example, you may not have to provide for living expenses for your children after you retire, since your children will, hopefully, be financially independent by then. On the other hand, if you or your spouse is covered under the group health insurance policy of your employer, you need to budget for individual or family floater Mediclaim for your retirement. As discussed earlier, if you think there will be expenses in your retirement years, that are not included in the list above, you should include it, as part of your retirement needs. At this stage, you do not need to adjust for inflation. We will do that adjustment later. For the purpose of illustration, the table below shows an example of current and retirement monthly expenses for these various expense items. Please note that, some of the expenses as listed above need to be incurred quarterly or annually, ex. Car insurance premium, Mediclaim Premium etc. However, for the purpose of calculation, we should use the pro-rated monthly amounts to calculate our retirement needs. You should note another point, when you estimate your regular retirement expenses. There are certain elements in our lifestyle, that we consider a luxury. However, if we get used to those elements of our lifestyle, over a long period of time, then they are no longer luxuries but habits. It is very difficult to get rid of habits. Therefore, you should always be conservative, when projecting expenses.

Adjust for Inflation

Now that you have estimated your regular expenses as per the current cost of living, you should adjust it for inflation. Inflation is an ugly nine letter word that essentially reduces the value of money. We simply cannot wish away inflation. How much inflation do you need to factor in? It depends on the time horizon to retirement, and the state of our economy. If you are only a few years away from retirement, then you can assume one or two percentage points lower than the current levels of inflation. The current level of inflation is very high. Over a long period of time, it will surely come down significantly, as the economy matures. However, inflation in India will not come down to levels prevailing in the developed economies, 2 – 3%, for a very long time. Let us assume, our long term annual inflation rate is around 6% (you can assume a different inflation rate that you think will apply in the long term). You should apply the inflation rate as a compounding effect on your regular expenses, to determine the inflation adjusted expense for your retirement. The other factor that you need to include in your calculation of inflation adjusted expenses during retirement is your time horizon to retirement. Let us assume your time horizon to retirement is 25 years. Translate your monthly expense into annual expense. In the example above, your monthly expense is Rs 48,000. Therefore, your annual expense is Rs 5.76 Lakhs. You should use the following formula to calculate your inflation adjusted retirement expense:-

Inflation adjusted expense = Current Expense * (1 + Inflation Rate %) ^ (Time horizon to Retirement)

In our example above:-

Inflation adjusted expense = 576,000 * (1 + 6 %) ^25

Therefore, your annual inflation adjusted expense will be Rs 24.7 lakhs, which means that your post retirement cash flow should be least Rs 24.7 lakhs per annum.

How much Retirement Corpus do you need to build?

Thus far, we have estimated how much annual cash flow we will need after retirement. The next question, how much retirement corpus do you need to build. To answer that question, first you need to decide, how much estate, in other words, assets (both fixed and financial) that you want to leave behind for your successors, which include your spouse, your children and others, including charitable trusts. How much estate, you want to leave behind depends completely on you. If you want to leave behind an estate, you should factor that in your retirement planning calculations. Estates aside, let us calculate how much retirement corpus you will need? For that we need to make longevity assumptions. With improving living standards and advancement in healthcare, we are living longer now. Let us assume you will live at least another 25 years after retirement. In other words, if you retire at the age of 60, you will live till the age of 85. Next we need to make assumptions about rate of inflation and returns on our retirement corpus. The return on investment depends on our risk appetite. The risk appetite of retirees is generally low, but given a sufficiently long time horizon and financial condition, even retirees can assume a certain level of risk. Let us assume you have a low risk appetite after retirement and you put your retirement corpus in risk free investments like fixed deposits and post office monthly income schemes. One may assume that, the post tax return on risk free investment is nearly the same as inflation rate (in fact over the past year or so, inflation rate has been higher than post tax returns on risk free investments, resulting in negative real interest rate). Since one needs to have a retirement corpus that will last the lifetime of the retiree, if the post tax return on fixed deposits and other risk free investments is roughly equal to the rate of inflation, then the retirement corpus essentially should be the retirement expense per annum times the number of years the retiree will live after retirement. In our example the annual expense of the retiree is Rs 24.7 Lakhs, and he or she will live for 25 years after retirement. This implies that, the retirement corpus should be Rs 24.7 lakhs X 25 years, which is Rs 6.2 crores. If you want to leave an estate, you should add that amount to how much you need.

Conclusion

In this article, we have seen how we can calculate our retirement needs. Retirement planning is one of the most important aspects of financial planning. The earlier we start saving for retirement, the easier the task becomes, due the effect of compounding. We should give a lot of careful consideration to retirement planning. Retirement is an important phase of life. By planning for it, we can make retirement, the golden years of our lives.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------