DSP BlackRock Tax Saver Fund Invest Online

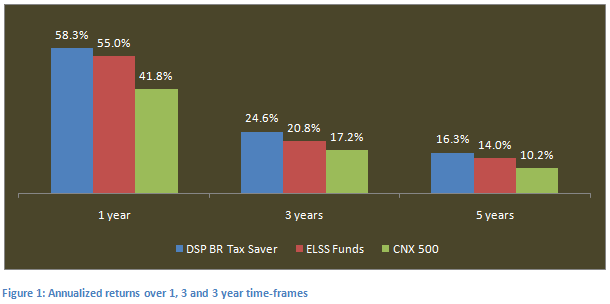

ELSS funds offer triple benefits of tax savings, capital appreciation and tax free returns to the investor. The DSP BlackRock Tax Saver fund, one of the top ELSS funds, has outperformed the tax saving funds category by delivering two times returns in the last three years. The fund has consistently given superior returns relative to the ELSS funds category and the broader market, over the different time periods. The chart below shows the annualized trailing returns of the DSP BlackRock Tax Saver fund growth option, regular plan, over the last 1, 3 and 5 year time periods, compared to the ELSS funds category and the CNX 500 index. NAVs as on June September 19 2014.

Fund Overview

The DSP BlackRock Tax Saver Fund was launched in November 2006 and has performed very well relative to the market since its inception. The fund has र 814 crores of assets under management. The expense ratio of the fund is 2.66%. The manager of this fund is Apoorva Shah. Apoorva has delivered good returns for all the funds that he is managing for DSP BlackRock. The minimum investment for this fund is र 5000. Morningstar has a 4 star rating for this fund. The fund is suitable for investors planning to make 80C investments for long term investment objectives, like retirement planning, children's education etc. The fund is open for both growth and dividend options.

Portfolio Composition

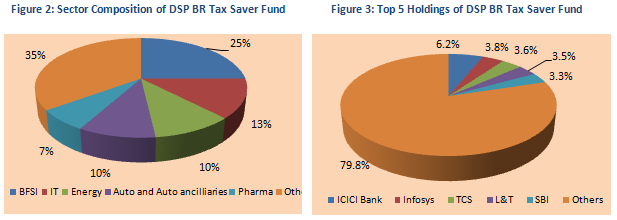

The fund has a large cap, growth oriented focus. The fund manager has a bottoms-up portfolio construction approach. The fund manager tries to identify stocks with high growth potential for this portfolio. He also invests in stocks that are trading at attractive valuations. The portfolio is overweight on cyclical sectors like BFSI, Oil & Gas, Automobile & Auto Ancillaries etc. To balance its exposure to cyclical, the portfolio also has allocations to defensive sectors, with IT and Pharmaceuticals comprising nearly 15% of the portfolio holdings, as on May 31 2014. With cyclical sectors poised to do well with the revival in economic growth and capex cycle, the DSP BlackRock Tax Saver fund has the potential to deliver good returns over the short to medium term. The portfolio is very well diversified in terms of company concentration. The top 5 companies in the fund portfolio, ICICI Bank, Infosys, TCS, Larsen & Toubro, and SBI account for only 20% of the portfolio value. Even the top 10 companies in the fund's portfolio account for less than 34% of the portfolio holdings.

Comparison with Peer Sets

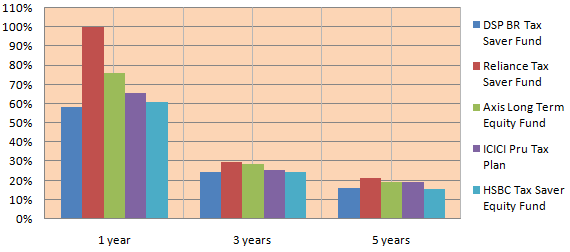

DSP BlackRock Tax Saver fund is one the top performing ELSS funds. The chart below shows the comparison of 1 year, 3 years and 5 years annualized returns of the DSP BlackRock Tax Saver with other top performing ELSS funds.

Risk and Return

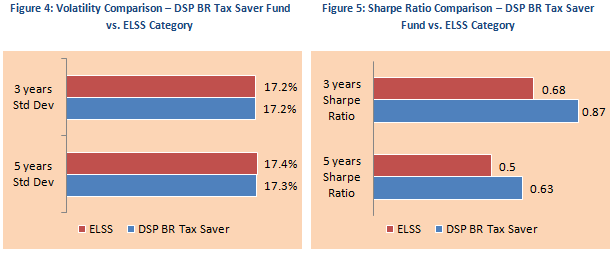

The DSP BlackRock Tax Saver fund has consistently outperformed the ELSS funds category and the CNX 500 over the last 3 years. The fund gave a trailing return of over 58% and 24% in the last one and three years respectively. In terms of risk measures, the annualized standard deviation of monthly returns of the DSP BlackRock Tax Saver fund is in line with the ELSS funds category. However, on a risk adjusted returns basis, as measured by Sharpe Ratio, the DSP BlackRock Tax Saver fund has outperformed the ELSS funds category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. See charts below for comparison of volatilities and Sharpe ratios of the DSP BlackRock Tax Saver and the ELSS Funds Category

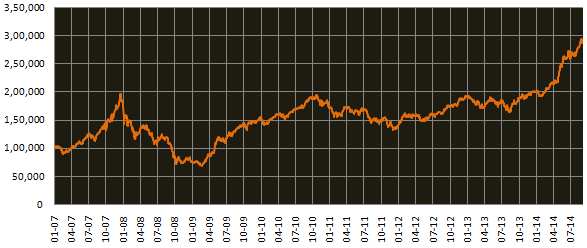

र 1 lac lump sum investment in the fund NFO (growth option) would be at a value of र 2.93 lacs as on Sep 19 2014. The chart below shows the growth of र 1 lac investment in the DSP BlackRock Tax saver fund (growth option).

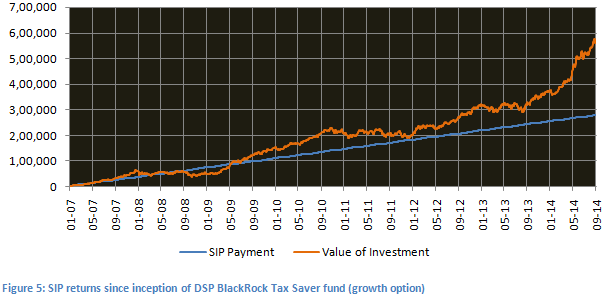

The chart below shows the returns since inception of र 3000 monthly SIP in the DSP BlackRock Tax Saver fund (growth option). The SIP date has been assumed to first working day of the month. The chart below shows the SIP returns of the fund.

The chart above shows that a monthly SIP of र 3000 started at inception of the DSP BlackRock Tax saver fund (growth option) would have grown to over र 5.7 lacs by Sep 19 2014, while the investor would have invested in total only about र 2.8 lacs. The SIP return (XIRR) is over 18% since inception.

Conclusion

The DSP BlackRock tax saver fund has delivered over 7 years of strong performance. This fund is suitable for 80C investors with a long time horizon. Investors can consider investing in the scheme through the systematic investment plan (SIP) or lump sum route. Investors should consult with Prajna Capital, if DSP BlackRock Tax Saver fund is suitable for their tax planning needs.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------