Axis Long Term Equity Fund Invest Online

Equity Linked Savings Scheme (ELSS) is one of the most popular tax saving investments under section 80C of the Income Tax Act. With Equity Linked Savings Schemes, investors can avail the triple benefits of tax savings, capital appreciation and tax free returns. In the 2014 budget the overall limit under section 80C has been increased to Rs 1.5 lacs. This gives investors an opportunity of saving more tax and allocating more investment to ELSS, which in turn will help them with higher capital appreciation over the long term.

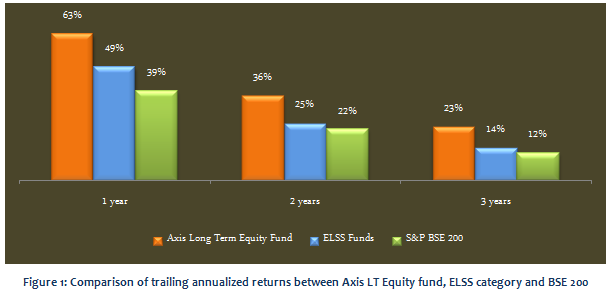

Axis Long Term Equity fund (formerly Axis Tax Saver Fund) has been a top ELSS performer in recent years. This fund launched in Dec 2009, has beaten the returns of ELSS category and generated significant alphas, every year since its inception. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between Axis Long Term Equity fund (Growth), the ELSS Category and the benchmark S&P BSE 200 index (NAVs as on August 1).

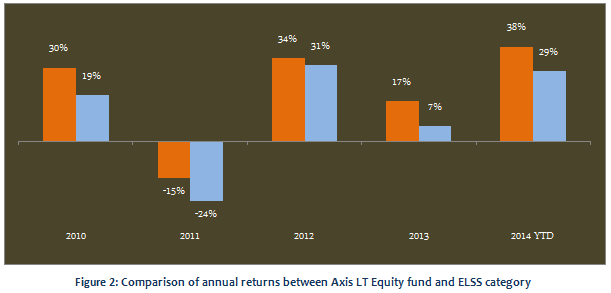

Even in terms of annual returns the fund's performance has been outstanding, making this fund one of the most consistent performers in the ELSS category. Consistency of performance is one of the most important performance factors in mutual funds. The chart below shows the annual returns of the Axis Long Term Equity Fund (Growth) and the ELSS category, since the inception of the fund.

The fund has been ranked a "Very Good" performer (Rank 1) by CRISIL for several successive quarters. Morningstar has assigned a 5 star rating for this fund.

Fund Overview

This fund is suitable for investors looking for tax planning investment options under 80C with the expectation of long term capital appreciation. However, since this is essentially a diversified equity fund, it is subject to market risk and volatility as compared to other tax saving instruments like PPF, NSC etc. However, equities as an asset class generate superior returns over the long term and serves as an effective hedge against inflation. As such, the fund is suitable for investors planning for long term financial objectives like retirement planning, children's education, marriage etc. The fund has an AUM base of over Rs 1,300 crores, with an expense ratio of 2.74%. While the expense ratio is slightly on the higher side, the funds excellent performance has more than made up for it. The fund manager of this scheme is Jinesh Gopani since 2011. The current NAV (as on Aug 1 2014) is 23.5 for the growth plan and 18.7 for the dividend plan.

Portfolio Construction

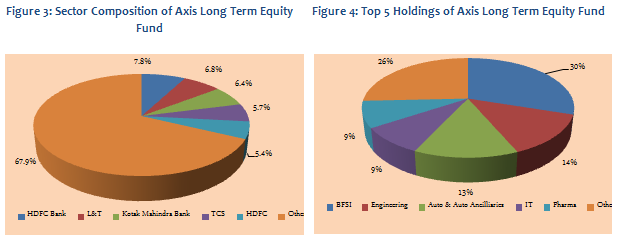

Though the fund portfolio has a large cap bias, the fund manager has a flexible approach towards market capitalization and sector allocations. The fund manager identifies stocks and sectors with attractive valuations. About 45% of the portfolio holding is in small and midcap stocks. From a sector perspective, the portfolio has a bias for cyclical sectors like BFSI, Engineering, Automobiles and Auto Ancillaries, but it also has substantial allocations to defensive sectors like IT and Pharmaceuticals. This portfolio construction enables the fund manager to get good returns across different market conditions. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, HDFC Bank, L&T, Kotak Mahindra Bank, TCS and HDFC Industries accounting for only 32% of the total portfolio value. The top 10 stocks account for little over 50% of the portfolio holdings.

Performance comparison with Peer Set

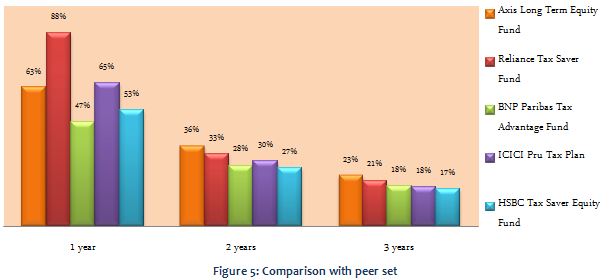

A comparison of annualized returns of Axis Long Term Equity Fund versus its peer set over various time periods shows why this fund is considered a chart topper among ELSS funds. In terms of trailing annualized returns, the fund has beaten all its peers across most time periods. See chart below for comparison of annualized returns over one, two and three year periods. NAVs as on August 1 2014.

Risk & Return

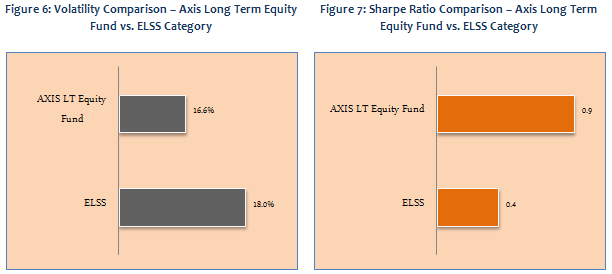

Even though the Axis Long Term Equity Fund has outperformed the ELSS category in terms of returns, from a risk perspective, the volatility of the fund is lower than that of the ELSS category. The annualized standard deviation of monthly returns of Axis Long Term Equity Fund over the last three years is 16.5% compared to 18% for the ELSS category. It is no surprise that on a risk adjusted return basis, as measured by Sharpe Ratio the fund has outperformed the ELSS category. See charts below for comparison of volatilities and Sharpe ratios between Axis Long Term Equity Fund and ELSS funds category.

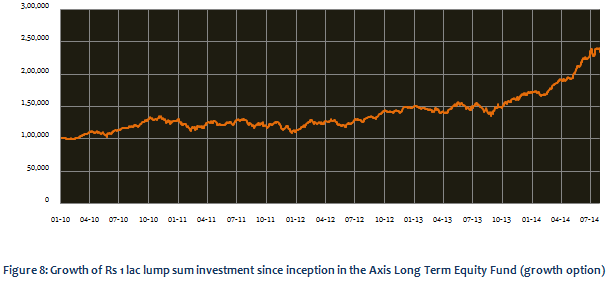

Rs 1 lac lump sum investment in the Axis Long Term Equity fund NFO (growth option) would have grown to value of nearly Rs 2.4 lacs as on Aug 1 2014. The chart below shows the growth of Rs 1 lac investment in the Axis Long Term Equity fund (growth option).

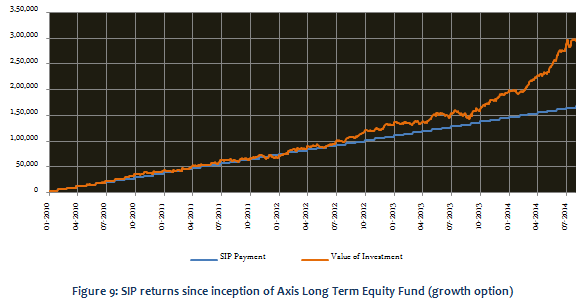

The chart below shows the returns since inception of Rs. 3000 invested monthly through Systematic Investment plan (SIP) route in the Axis Long Term Equity fund (growth option). The SIP date has been assumed to first working day of the month. The chart below shows the SIP returns of the fund based on NAV as on Aug 1 2014.

The chart above shows that a monthly SIP of Rs. 3000 started at inception of the Axis Long Term Equity fund (growth option) would have grown to over Rs 3 lacs by August 1 2014, while the investor would have invested in total less than Rs 1.7 lacs. The SIP return (as measured by XIRR) since inception of the fund is nearly 25%. Surely, no other tax saving investments gave such returns in the last three or four years.

Conclusion

Axis Long Term Equity fund has established itself as one the best ELSS funds in the last few years. It has outperformed its peers and the benchmark during both bull and bear market cycles. Investors planning for tax saving investments can consider investing the scheme through the systematic investment plan (SIP) or lump sum route with a long time horizon. Investors should also ensure that the investment objectives of the fund are aligned with their individual risk profiles and time horizons. They should consult with theiPrajna Capital if Axis Long Term Equity fund is suitable for their investment portfolio.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------