Indian equity markets are rallying. The Nifty closed at an all time high of 7,796 on July 23. In the last 6 months Nifty gained 22.9%, while the Sensex gained 22.3%. Even the broader markets have performed very strongly with the CNX 500 index gaining 27.7% in the last 6 months. While the equity markets have surged this year, how have the mutual funds fund done? As expected, equity mutual funds have also done exceedingly well. In fact large cap funds as a category have beaten the Nifty and given average returns of more than 26% in the last 6 months. Diversified equity funds, which comprise of both large cap and mid cap stocks, have done even better. Diversified equity funds as a category have beaten the CNX 500 index and given average returns of more than 31% in the last 6 months. Within the large cap and diversified equity funds categories some funds have done exceedingly well and given very high returns to their investors in the last 6 months. In this article, we will discuss the buzzing large cap and diversified equity funds in 2014, based on the returns in the last 6 months.

For our selection of buzzing funds, we have applied a few filters. Firstly, we have selected only those funds which have at least Rs 100 crores of assets under management (AUM). Also, we have excluded funds, which have been ranked "Below Average Performers" or "Relatively Weak Performers" by CRISIL in their latest mutual fund ranking, even though they may have given very high returns in 2014. Finally, in this article we have shown the returns of the Regular Plans only. Direct plans can give a few percentage points higher returns than Regular Plans. Investors should note that, we are not making fund recommendations here. We are just reporting funds that gave the highest returns based on the criteria mentioned above. Investors should not go with short term performance, when selecting mutual funds for investment, because short term performance may not be sustained in the future. However, investors can put these buzzing funds in their watch list and continue to monitor their performance in the future.

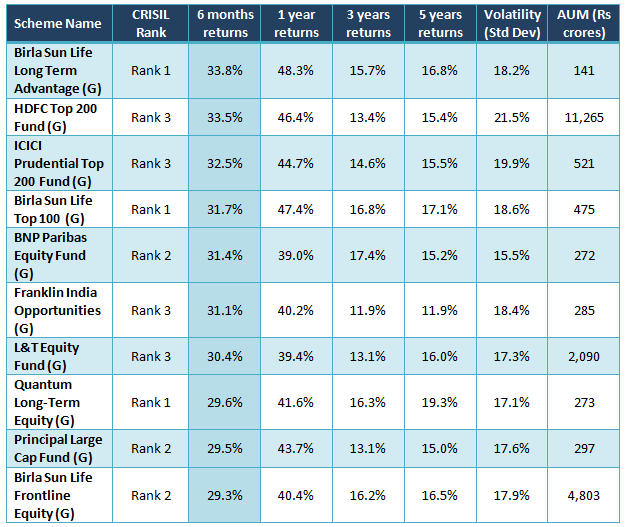

Buzzing Large Cap Funds

As discussed earlier, large cap funds as a category has given average returns of more than 26% in the last 6 months. Large cap funds, which comprise mainly of large cap stocks, have the lowest risk among equity funds, since large cap stocks are less volatile than small and midcap stocks. The buzzing funds in this category have given the highest returns in the last 6 months, based on the criteria discussed earlier, and include perennial favourites like the HDFC Top 200, Birla Sun Life Frontline Equity and L&T Equity funds along with a number of funds with much smaller AUMs. These may turn out to be the hidden gems. The buzzing funds in this category have given returns of over 29% in just the last six months. The table below shows the buzzing large cap funds.

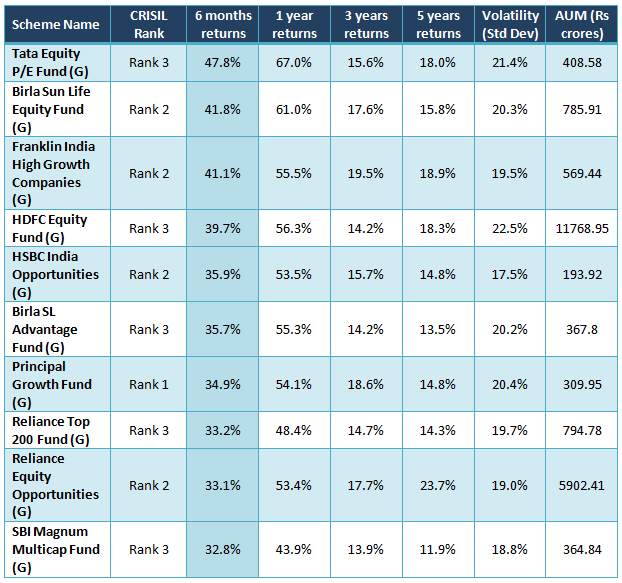

Buzzing Diversified Equity Funds

Diversified equity funds as a category has given average returns of more than 31% in the last 6 months. Diversified equity funds comprise of both large cap and midcap stocks. These funds carry slightly higher risk than large cap funds but also give higher returns. The buzzing funds in this category have given the highest returns in the last 6 months and have outperformed the benchmark broader market index, the CNX – 500, by a significant margin. These include top favourites like the HDFC Equity, Reliance Equity Opportunities, Reliance Top 200, and Birla Sun Life Equity funds. But the buzzing funds also include a number of funds with much smaller AUMs, which have given stellar returns this year. These funds have given returns of over 32% in just the last six months. The table below shows the buzzing diversified equity funds.

Conclusion

In this blog we have discussed the buzzing large cap and diversified equity funds in 2014. As discussed earlier, investors should not rely purely on short term return as a performance measure, when selecting mutual funds for investment. Investors can add these buzzing funds to their investment watch-list. If these funds are able to sustain the strong performance they have shown this year to date in the future, investors should discuss with their financial advisers, if they are suitable investment options. In our next article, we will discuss buzzing funds in other equity funds categories.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------