PAHAL (DBTL) Scheme for LPG Subsidy

Pratyaksh Hanstantrit Labh (PAHAL) scheme also called as Direct Benefit Transfer for LPG (DBTL) was launched to provide liquified petroleum gas (LPG) cylinder of Bharat, Indane, HP at subsidised rate to the Indian consumer. This will mark an end to duplicate or misuse of LPG connections which are very common in India. Customers who get enrolled in PAHAL scheme are referred to as Cash Transfer Compliant (CTC). Last date to join the scheme is 31stMarch 2015

Benefits to the consumer

- Once the customer is enrolled in PAHAL and books cylinder for the first time, he/she will get cash subsidy (Rs. 568) as an permanent advance directly into

their bank account which can be used to pay for the first cylinder. - This advance then can be used to buy 12 LPG cylinders weighing 14.2 Kgs OR 34 5 Kgs cylinders. Subsidy amount = Current subsidised rate – market price. This difference amount is credited to the customer's bank account.

- New LPG's would be available in the market in a much simpler way as compared to previous process as back logs would be reduced.

How to get LPG cylinder at subsidised rate?

- Those to want to get enrolled into PAHAL scheme to get gas cylinder at subsidised rate should have either Aadhar number or an active bank account.

Hurry, those who do not have bank account, can open zero balance account under Pradhanmantri Jan Dhan Yojana (PMJDY) which offers many benefits. - Aadhar card holder should get Aadhar number linked to the bank account in order to avail the subsidy amount.

- Individuals meeting above mandatory requirement, then needs to link Aadhar number or bank account number to the 17 digit LPG connection ID.

- For linking, individual should approach his/her area's LPG distributor who will then save these details in their computer system.

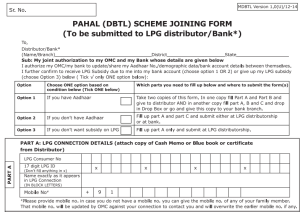

PAHAL Scheme Joining Form

It's a one page form and looks like below (due to space constraints, I've split it into 2 images):

Pahal Scheme Joining Form – (I)

There are 3 sections to be filled as mentioned below depending on which option you've checked from 1-3.

Part-A: Put your 17 digit LPG consumer number/ID and exact name as mentioned in LPG connection. You can get this number from blue book or cash receipt of the gas cylinder.

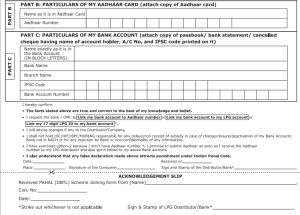

Pahal Scheme Joining Form (II)

Part-B: Mention your 12 digit Aadhar card number

- Bank account number and branch name

- Account holder name (this

Sign on the declaration by entering date and place. Finally you'll get an acknowledgement slip.

Other documents required: Photo copy of Aadhar card, LPG bill or blue copy with your 17 digit LPG consumer number and one cross check in the name of LPG distributor.

How to track status of your enrolment?

LPG consumers who have provided their mobile numbers with their distributors when they join PAHAL scheme will receive SMS about the status. So make sure to provide mobile number while filing joining form.

How to opt out of DBTL scheme

It is very easy procedure. In order to do this, you need to fill subsidy surrender form and give it to LPG distributor.

Top 10 Tax Saving Mutual Funds to invest in India for 2016 or Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300