Electronic Verification Code (EVC) to e-verify Income Tax Returns

Government is trying hard to go green but the necessity of sending signed ITR-V form to Bangalore was becoming an obstacle to make e-filing process completely paperless. Digital Signature has already been mandated for the companies to file and verify their returns but individuals were given an option to sign the physical copy of ITR-V and send it to CPC, Bangalore.

Government has come out with the Electronic Verification Code for verifying the income tax return to get rid of this last piece of paper and make the e-filing process completely paperless. Now, you just have to put an EVC after filing your return and you are done with e-filing, no need to send signed ITR-V to CPC, Bangalore within 120 days' time frame.

What is Electronic Verification Code (EVC)?

Electronic Verification Code (EVC) is a 10 digits alpha numeric code to verify your income tax return and can be generated via various methods. Let's see the features and usage of Electronic Verification code to e-verify your income tax return.

- EVC is a 10 digit alpha numeric code which would verify the identity of the person filing the income tax return.

- The EVC could be used to verify ITR 1 (Sahaj) / ITR 2 / ITR 2A / ITR 3 / ITR 4 /ITR 4S (Sugam).

- EVC would be unique and can be used only with the PAN of the person furnishing the income tax return. This means one EVC for one PAN.

- One EVC can be used to validate only one ITR whether it is original or revised return.

- The EVC remains valid for 72 hours but can be generated various times through various modes.

- In case the tax returns are already filed or uploaded, the verification needs to be done within 120 days of filing of return.

Important Note:

1. If the Taxpayers Total Income is greater than 5 lakhs or if there is refund, Taxpayers are provided with only one option "EVC – Through Net Banking"

2. "EVC – to Registered Email Id and Mobile Number" option would be available for taxpayer whose Total income is Less than 5 Lakhs and there is no Refund.

How to Generate Electronic Verification Code (EVC)?

CBDT has notified four methods to generate Electronic Verification Code (EVC). Before proceeding to generate EVC please ensure that the mobile number and email address registered with the CBDT is accessible by you.

1. Generate EVC through e-filing website

I consider this as the simplest method because you just need to click few buttons and you will get EVC on your mobile and registered email.

But this method is only available if your salary income is up to Rs.5 lacs and you are not claiming any tax refunds.

- Simply login to your account with PAN number as user id and your password.

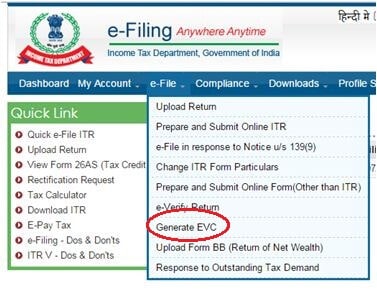

- Click on the e-file tab and select Generate EVC as shown in the image below:

- You would then receive EVC on your registered mobile number as well on your registered email address.

- Put the code in the box on the screen and the process of e-filing gets completed.

2. Generate EVC through Linking Aadhaar Card with PAN

Before generating EVC through Aadhaar Card, make sure that your mobile number should be registered with your aadhaar. (I faced this problem generating EVC).

How to link your aadhaar with PAN?

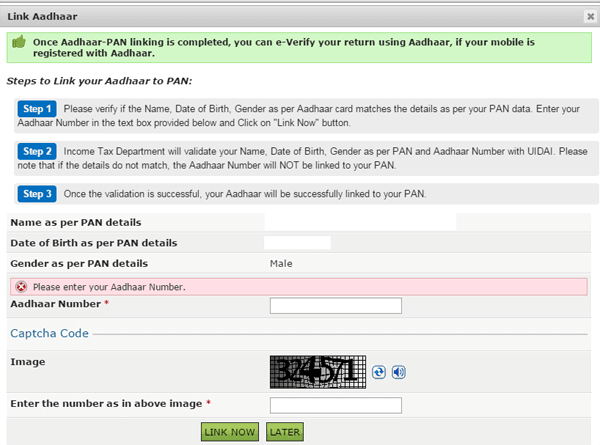

After login, you would see "Profile Settings" Tab besides downloads. Click on it and a drop-down menu would appear, select Link Aadhaar with PAN.

You would then be presented with the image as shown below:

Fill in the required details and click on Link Now to complete the process.

Next Step would be to generate EVC and for that you have to select "I would like to generate Aadhaar OTP to e-Verify my return" at the time of e-verifying your tax return.

3. Generate EVC through Bank ATM (Automatic Teller Machine)

For this option you have to use the ATM card of the bank which is registered with the IT department. You can generate EVC by selecting "generate EVC for ITR filing" appears on the ATM Screen. The EVC would be sent to your registered mobile number with Bank.

4. Generate EVC through Net Banking Facility

Generating EVC using Net Banking requires you to route your process of e-filing through the bank which is registered with IT Department. You would have to login into your net banking account and seek the redirection to income tax e-filing website where you can generate EVC. The EVC would be sent to your registered mobile number with Bank.

This option requires a valid PAN to be linked with your Bank account as per KYC norms and ITR should be for same PAN number.

Update: The banks which provide EVC Generation facility as of now are – Allahabad Bank, Andhra Bank, Axis Bank Ltd, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, City Union Bank Ltd, Corporation Bank-Corporate Banking, Corporation Bank-Retail Banking, Dena Bank, HDFC Bank, ICICI Bank, IDBI Bank, Indian Bank, Indian Overseas Rank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, State Bank of India, Syndicate Bank, UCO Bank, Union Bank of India, United Bank of India and Vijaya Bank

How to use Electronic Verification Code (EVC) to verify Income Tax Return?

Electronic Verification Code (EVC) for e-verification process of Income Tax Return can be used while:

- Uploading of Return using Net Banking

- Uploading of Return without using Net Banking

- For already Uploaded Return

1. In case you are Uploading Tax Return without using Net Banking than as soon as you are finished with uploading of return, a screen having following options would popup:

- Option-1 – "I already have an EVC and I would like to Submit EVC"

- Option-2 – "I do not have an EVC and I would like to generate an EVC"

- Option-3 – "I would like to generate Aadhaar OTP to e-Verify my return"

- Option-4 – "I would like to e-Verify later! I would like to send ITR-V"

You can use any one of the above options (1 to 3) to e-verify your Income Tax Return and download the Acknowledgement (No Further action required).

Option 1 requires you to put the EVC you have already generated and then download the Acknowledgement (No Further action required).

Option 2 requires you to generate EVC either through AMT or E-filing website.

Option 3 would use generating EVC through Aadhaar Card (As described above).

Option 4 would means you don't want to use the new method of EVC and would like to go with the old method of ITR-V signing and sending it to CPC Bangalore.

2. In case you have routed to e-filing website through net banking account then after you finish uploading tax return three options would be shown on your screen:

- Option-1 – "I would like to e-Verify my return now"

- Option-2 – "I would like to generate Aadhaar OTP to e-Verify my return"

- Option-3 – "I would like to e-Verify later! I would like to send ITR-V"

You can use any one of the above options (1 and 2) to e-verify your Income Tax Return and download the Acknowledgement (No Further action required).

Option 1 would simply need you to confirm the verification of ITR by clicking on "Continue" button. Download the Acknowledgement (No further action is required).

Option 2 remains same as in above case and ECV would be sent to your registered mobile number.

Option 3 would be old method of ITR-V signing.

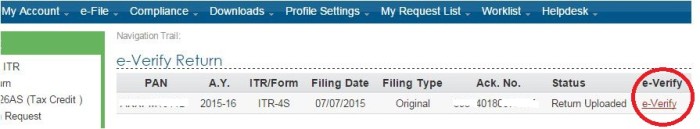

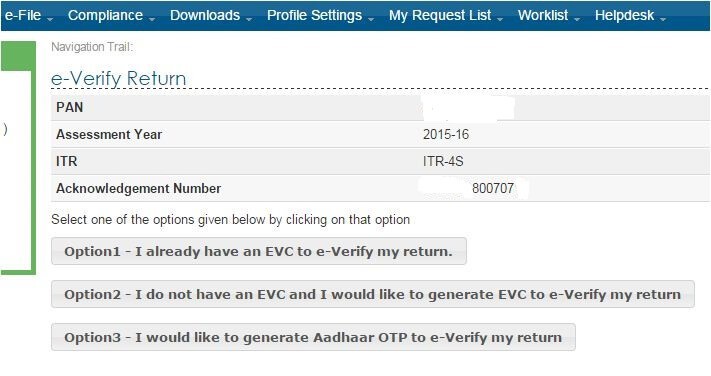

3. Verification of Already Uploaded Returns requires you to verify them within 120 days of submission or uploading by following below mentioned steps:

- Login to your income tax e-filing website.

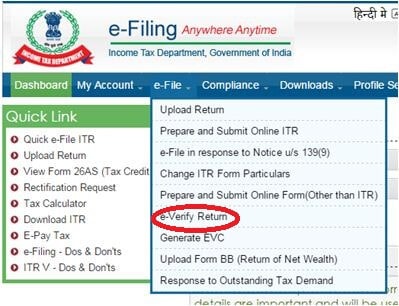

- Click on e-file button and select e-verify in the drop-down menu.

- List of all the ITRs which are pending for e-verification will be displayed.

- Click on the e-verify link as shown in the image

- You would be directed to the screen with three options to e-verify your tax return.

- Select any of the options to complete the e-verification process of Income Tax Return.

Update: Vide Notification no. F.No. 2251141/2015/ITA.II dated 20th July, 2015 CBDT has allowed validation of previous years tax return through EVC. Here previous year refers to the belated tax returns pertaining to Assessment Year 2013-14 and 2014-15 filed without digital signature. The time limit of submission of ITR-V for both the above mentioned assessment years has already been extended to 31st October, 2015 and the same time limit applies to validation through Electronic Verification Code (EVC).

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300