With equity markets zooming from September 2013 until now, you may either be feeling left out, or you may fear entering the market rather late. You don't have to, if you decide to go the Systematic Investment Plan (SIP) way. Why? Because SIPs are the best all-weather tools you can have to invest, especially in equities.

'Do SIPs always offer the best returns? – this may be a question that many of you may have asked yourself or your advisor. The answer is 'NO'. But what SIPs do is insulate your best against worst returns.

It is because of this insulation that you earn optimal, and very often superior, returns against the lump sum investing method.

In other words, SIPs build wealth by shielding your portfolio from market extremes. They offer the best downside protection by simply averaging at lower costs and lowering your overall investment cost. That said, many of you may have had a very forgettable experience with equity funds and therefore, you may have shut the door to this clear wealth building asset class.

Knowing when you can get hurt will help you do away with this fear.

When You Can Get Hurt

Broadly, there are a few reasons on why you may have burnt your fingers in the equity mutual fund market. They are:

1. Very poor choice of funds (when I say very poor I mean those at the bottom quartile of performance; even the middle-rung ones would have fetched you decent returns)

2. Investing lump sum or through SIPs for very short periods of say 1-2 years

3. Investing lump sum and such an investment was unfortunately made in the market peak 4. Stopping SIPs way ahead of the stated goal, or running SIPs over very short periods such as 1-2 years

Points 1 and 2 are not difficult to tackle. On point 1, if your fund has been underperforming its benchmark for over 4 quarters, then you should not have stuck to it. Else, the best you can do is ask your advisor to review your portfolio annually.

On point 2, you must remember that equities are for the long haul. If you had a very short time frame, equity funds are not the place to be.

So, the real problem comes from the other two points; and all they require you to do is keep it simple, and to keep it going with SIPs.

Lump Sum Vs. SIPs

If you had invested in the market peak of January 2008, losing about 55% of your capital by the end of that year is a classic example of the near-term impact of lump sum investing. But had you held on and been a good long-term investor, the market would not have disappointed you.

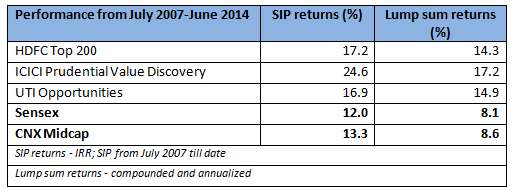

Better still, had you been doing an SIP, the equity market would have rewarded you more. Take a look at some of the steady performing funds from our 'Select Funds' list to know how SIPs reward you for patiently continuing your investments.

The table below shows the returns from lump sum investments made in mid-2007 (July 2007), when the markets were trending upwards, and the return on SIPs made from then on till date.

SIPs worked better. Why? Because of the opportunity to average costs at lower levels in 2009, 2011 and partly in 2013.

Lesson: Long-term investing is a must for equities. Even for the long term, while lump sums are ok, SIPs work harder for you.

Stopping SIPs

Investors often stop their SIPs even with good funds for two reasons:

- One, market goes down and they get jittery and stop investing

- Two, market goes up and you think averaging at higher costs will not help and therefore, you stop SIPs

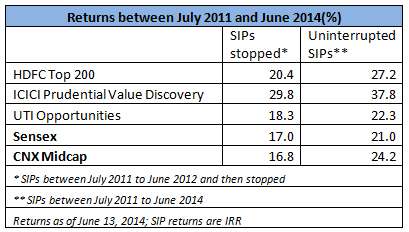

Let us take a more recent 3-year period to know what happens when you stop SIPs but hold your funds. Had you started SIPs in 2011 and continued for 1 year, and then you stopped your SIPs thinking that the market was going up, your returns would have been 7-8 percentage points lower than continuing SIPs till date.

Why? 2013 offered enough opportunities to average costs at lower levels. And with markets going up now, the average returns tend to be higher with the SIPs you continued.

Lesson: If you started your SIP for a specific long-term goal, keep the SIP running until your near the goal. Stopping either because the market has gone up or gone down, not only disrupts returns but prevents you from saving the necessary amount for the goal.

The Bounce Back

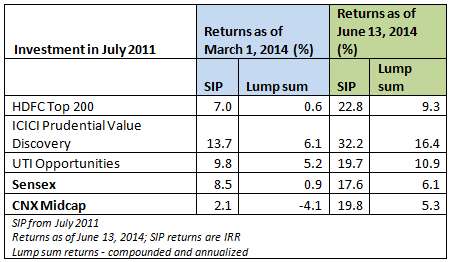

Above all these, the bounce back in the market is felt immediately in SIP portfolios. Just take a look at the data below. Not only have the SIP returns between March and now bounced back, the returns are also far superior to lump sum investing as a result of better averaging.

The lesson: The effect of all your averaging is felt in your portfolio in a market revival and quite fast too. Hence, the key is to keep it to SIPs and keep it going if you want to ride the equity market bulls and bears.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan

2.Reliance Tax Saver (ELSS) Fund

3.HDFC TaxSaver

4.DSP BlackRock Tax Saver Fund

5.Religare Tax Plan

6.Franklin India TaxShield

7.Canara Robeco Equity Tax Saver

8.IDFC Tax Advantage (ELSS) Fund

9.Axis Tax Saver Fund

10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online -

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

---------------------------------------------

Invest Mutual Funds Online

Download Mutual Fund Application Forms from all AMCs