Kotak Assured Income Plan (AIP) is a flagship product from Kotak Life Insurance Company. It aims to provide guaranteed income to the policy holder, along with a life insurance cover, for a period of 30 years.

How the plan works

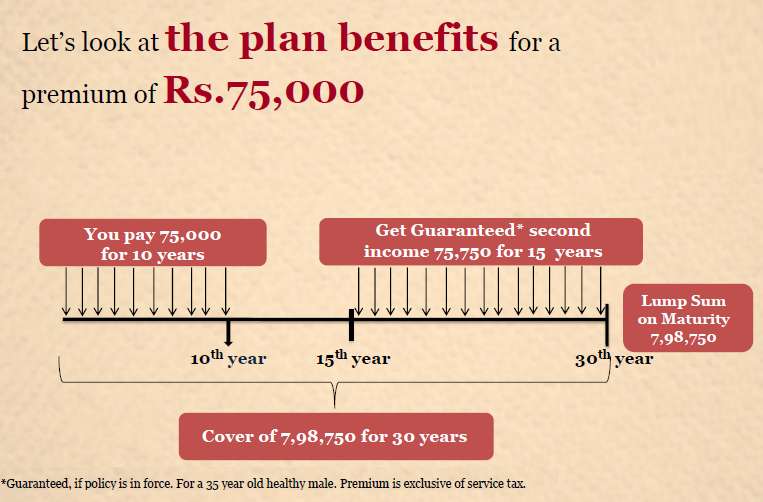

In this plan, the premium needs to be paid for a fixed tenure of 10 years, while the policy continues for 30 years. However, from the 15th policy year onwards, 9.1% – 10.1% of the Sum Assured is paid out to the life insured till the 29th policy year, as long as he/she is alive. Apart from this Annual Payout, there is a Maturity Benefit between 104% – 110% of the Sum Assured at the end of the policy year.

The Survival Benefit is calculated according to the Annual Premium. The Maturity Benefit will vary from 104% to 110% of the Sum Assured at the end of the policy term, which depends on the age of the policy holder at the time of entry.

However, if the life insured dies within the policy tenure, the Sum Assured is immediately paid as Death Benefit, irrespective of the amount already paid out, and the policy terminates.

Key features

- Assured income for 15 years

- Additional lump sum on maturity

- Provides protection for 30 years

- Additional protection through riders (Critical Illness, Accidental Death Benefit and Permanent Disability)

- Both the payouts and the maturity benefits are tax-free for the policy holder

Is this suitable for you

As this plan provides guaranteed payouts and long term protection to investors, it could be suitable for individuals who are looking out for regular income, coupled with a life cover. It is ideal for individuals in the age group of 40-50 years who would like some peaceful retirement income.

The return analysis

The Internal Rate of Return (IRR) for this product is close to 5.5%.

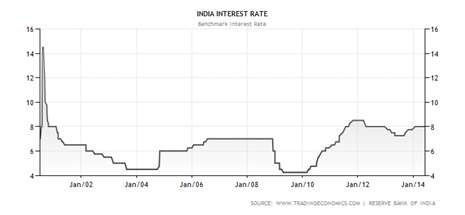

If you like guaranteed payouts coupled with a life cover, then we think this product may be good for you. The rationale behind this recommendation is that the interest rates of long-term fixed deposits in India were last recorded at 8%. This rate averaged to 7.38% from 2000 until 2013, reaching an all time high of 10% in the year 2000, and a record low of 5.25% in the year 2003 (as reported by the Reserve Bank of India).

We are of the opinion that the Indian economy grows well in the long term and hence, interest rates will obviously go down. The average interest rate stood at 7.38% which is taxable. If you come under the 30% tax slab, then the returns on fixed deposits would be close to 5.16%. In such a scenario, this product provides post tax returns of 5.5%, along with the advantage of long-term protection without taking any risk. Though the interest rates of fixed deposits and the returns from endowment plans are incomparable, it is still worthwhile to look at them from the angle of investments.

To conclude, this product is suitable for risk averse investors who are looking for a regular flow of income post retirement, and for investors who are looking out for well-disciplined investments.

Let's assume that there is a 45-year-old investor who wishes to retire when he turns 60. So, he decides to start accumulating corpus for his retirement. The financial planner calculated his overall retirement cash flow needs to be about Rs. 5,00,000 per annum, and the present investment requirement to be Rs. 2,00,000 per annum. In such a scenario, one has to follow an asset allocation of 70:30, where 70% of the investment should be in equity and about 30% in debt to clock better average annual returns. In this case, one can choose equity mutual funds for the equity portion and the debt portion can be invested in Kotak's AIP to lock in investments and get assured returns, as interest rates are changing rapidly from time-to-time.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan

2.Reliance Tax Saver (ELSS) Fund

3.HDFC TaxSaver

4.DSP BlackRock Tax Saver Fund

5.Religare Tax Plan

6.Franklin India TaxShield

7.Canara Robeco Equity Tax Saver

8.IDFC Tax Advantage (ELSS) Fund

9.Axis Tax Saver Fund

10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online -

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

---------------------------------------------

Invest Mutual Funds Online

Download Mutual Fund Application Forms from all AMCs