Transfer or Gift Shares in Demat Form

Are you holding shares and would like to gift it to your spouse or children or any other person? Yes!! Then read the article below explaining the:

- Procedure for gift or transfer of shares in demat form.

- Taxation on the Gift of Share.

- Taxation on income from the transferred share after the transaction.

Procedure to Gift Shares

Shares can be gifted both in demat form and physical form, but the procedure is bit different. Gifting of shares to another is legally termed as Transfer of Shares. Let us see how you (donor) can gift or transfer shares to a specific person (donee):-

Gifting Shares – In DEMAT Form:

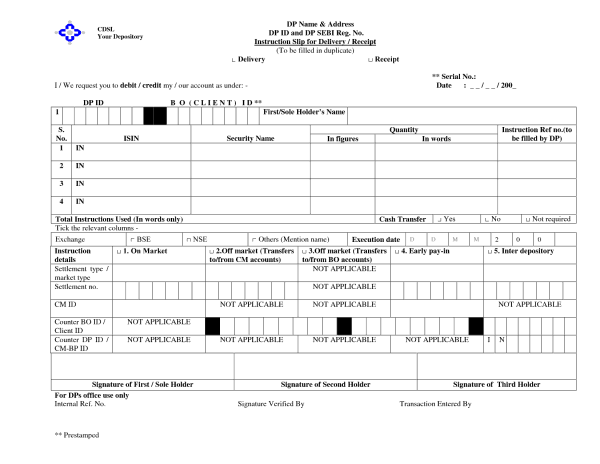

Step 1: The Donor is required to initiate an off-market transaction by submitting a Delivery Instruction Slip (DIS) to his Depository Participant (DP) (in simple words DEMAT Account provider) for transferring shares from his (donor) demat account to the donee's demat account.

Step 2: The Delivery Instruction Slip (DIS) should have the following details:

- Name of the Donee

- Donee's Demat Account Details

- Share/Stock to be transferred

- ISIN Number of the Company

- Quantity of the Shares to be transferred

Step 3: On the other hand Donee is required to give a receipt instruction to his DP (DEMAT Account Provider) to accept these shares, if he has not already given a standing receipt instruction.

Step 4: It is advisable to execute a gift deed on a non-judicial stamp paper my mentioning the details of the transaction for legal records and to avoid any tax queries in future.

Download: Gift Deed Format

Gifting Shares – In Paper Form:

If the shares are in physical/paper/certificate form, a share transfer deed in Form 7B, filled and signed by the donor, needs to be executed and registered. The stamp duty is payable at the rate of 25 paisa for every Rs. 100 of the face value, or the market value of shares prevailing on the date of the document, whichever is higher. Once the transfer deed is registered, the share transfer is complete.

Points to Note:

- Details of DIS submitted by Donor and Receipt Instruction submitted by Donee must match; else the transfer will not be made.

- One should convert share certificate in demat form to avoid the stamp value.

Tax on the Gift or Transfer of Shares

Tax on gift is governed by Section 56 of the Income Tax Act, 1961. The tax liability is computed keeping in mind the receiver of the gift and amount of the gift. To get the better understanding of the Tax on the Gift of shares, let's divide the donee into two categories:

- Blood Relatives

- Others

Gift to Blood Relatives

In case the donee is a blood relative of the donor then the gift is completely exempt from tax irrespective of amount of the gift under section 56(2)(vii) of Income Tax Act, 1961.

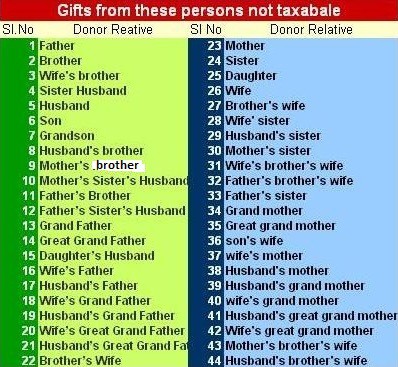

Note: Section 56(2)(vii) defines Relatives means :

(a) Spouse of the individual;

(b) Brother or sister of the individual;

(c) Brother or sister of the spouse of the individual;

(d) Brother or sister of either of the parents of the individual;

(e) Any lineal ascendant or descendent of the individual;

(f) Any lineal ascendant or descendent of the spouse of the individual;

(g) Spouse of the persons referred to in (b) to (f).

The entire list of Relatives from whom Gift is Exempt from Tax is depicted below:

Gift to other person

If the donee is not a blood relative of the donor as stated above, then the gift in excess of Rs.50,000 is taxable in the hands of the donee. In case of shares the fair market value of the shares will be considered as the amount of gift and if exceeds Rs.50,000 in a year, than whole of such gift is taxable under the income from other sources in the hands of the donee.

Only on the occasion of marriage or any other such ceremonial occasions the gift in excess of Rs.50,000 would not be liable to income tax at all.

Tax on Income after the shares are gifted

Gifts to the spouse, daughter-in-law and minor children are exempt from tax but the income earned from such gifts will be clubbed with the income of the donor.

But if the gift is made to the dependent major children (above 18 years) the income earned from such gift will be taxed in the hands of the children not yours.

As for example: You have gifted 1000 shares of Reliance (Market Value 800) to your spouse. Since spouse comes under the definition of relative so there would be no tax on the gift, but the dividend received by the spouse after the transfer would be clubbed with your income and taxed accordingly. But if the same is gifted to major children the dividend income will be taxed in the hands of the children.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300