Pradhan Mantri Suraksha Bima Yojana under Budget 2015-16

While presenting Budget 2015-16, Finance Minister Arun Jaitely has unearthed a low-premium insurance scheme named "Pradhan Mantri Suraksha Bima Yojana" which aims to increase the insurance penetration in India by providing life cover at a very low annual premium. This social security scheme will be linked to the popular scheme "Pradhan Mantri Jan Dhan Yojana".

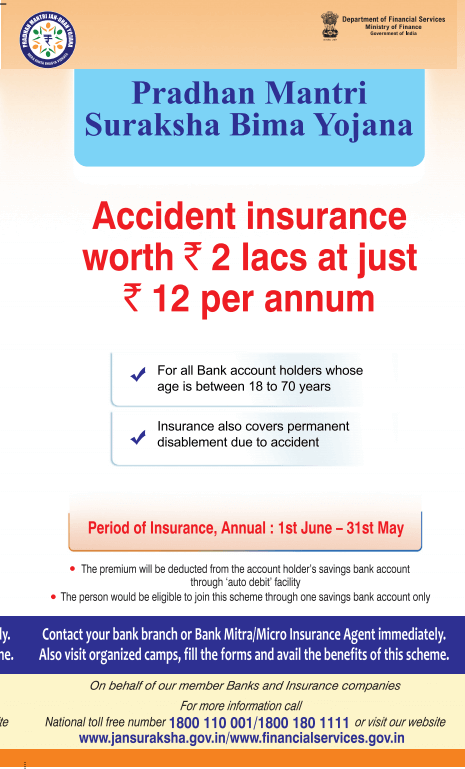

Pradhan Mantri Suraksha Bima Yojana will provide insurance cover against accidental death & disability for one year and should be renewed from year to year before 31st May every year.

Pradhan Mantri Suraksha Bima Yojana features:

Eligibility:

Pradhan Mantri Suraksha Bima Yojana is available to the people falls in the age group of 18 years (completed) to 70 years (running) having savings bank account.

In case, individual is having more than one savings account with the same bank or other bank, he would only be eligible to apply for the scheme through any one savings bank account. This means one person can possess only one insurance policy under Pradhan Mantri Suraksha Bima Yojana.

In case, it is found that individual is holding more than one policy i.e. he has applied for this scheme from other savings bank account also. Only one policy shall be continued and all the premiums paid through various savings accounts shall be forfeited.

How to Apply for Pradhan Mantri Suraksha Bima Yojana ?

Interested individual shall first link their Aadhaar card which is mandatory with their savings bank account. Once it is done, a simple consent cum declaration form is to be filled every year and to be submitted to the bank before 1st of June, in order to avail the benefit of this scheme.

Download: Pradhan Mantri Suraksha Bima Yojana Consent/Application Form

There is no time limit for subscribing to this scheme. New eligible entrants can join the scheme in any year on payment of annual premium through auto-debit facility.

Individuals who opted out from this scheme can also at any point rejoin this scheme on the payment of premium subject to the eligibility criteria.

Nomination

Nominee name is to be given in the form along with relationship. In case the nominee is minor, name of the guardian is also to be given.

Annual Premium

The premium for this scheme is as low as Rs.12 per annum i.e. Rs.1 per month. However, in case where auto-debit of the account takes place after 1st June, the insurance cover would commence from the first day of the next month i.e. if auto-debit is done on 15th August, than the cover under this scheme would start from 1st September.

Payment Mode of Premium

The eligibility criteria includes person to have savings bank account because the payment mode for the premium is fixed as direct debit from the Bank Account.

This means premium of Rs.12 would be auto debited from your bank account in one installment in the month of May every year.

Currently, only auto-debit facility is available for premium payment.

Risk-Coverage

There are two types of insurance covers provided in this scheme:

| S.No. | Risk-Coverage/Benefits | Sum Insured |

| 1. | Death (Natural or Accidental) | Rs.2 lakhs |

| 2. | Total and irrecoverable loss of both eyes or loss of use of both hands and feet or loss of sight of one eye and loss of use of hand or foot. | Rs.2 lakhs |

| 3. | Total and irrecoverable loss of sight of one eye or loss of use of one hand or foot. | Rs.1 lakh |

Term of Risk Coverage:

Pradhan Mantri Suraksha Bima Yojana would provide insurance coverage for one year stretching from 1st June to 31st May every year.

There are two options to get the risk-coverage:

- Every year before 1st June, policy holder is required to fill form and renew the scheme, to continue availing the benefits. The premium will be auto-debited once the form is submitted to the bank.

- There is also a long-term option, say 2 to 4 years, in the form which can be chosen to avail long-term risk coverage without any break. If this option is chosen, banks will auto-debit the annual premium every year.

Where to get this Scheme?

All the public sector general insurance companies such as LIC offers this scheme. Other private insurers can also offer this scheme but has to tie-up with the banks such as SBI, PNB, BOB etc.

Termination of the Insurance Cover:

There are few instances where the insurance cover under Pradhan Mantri Suraksha Bima Yojana would come to an end:

- On attaining/completing the age of 70 years.

- Closure of the savings bank account through which enrollment was done. This means policy is not transferable; you have to stick with the same bank throughout the policy tenure.

- Insufficient balance to pay for the premium. This condition, I think would never be a problem for any one. J

- In case the premium is not paid on time due to any technical glitch, the risk cover would be terminated for the period of non-payment. Subsequent payment of premium would restore the cover.

Taxation

The premium paid will be tax-free under section 80C and also the proceeds amount will get tax-exemption u/s 10(10D).

But if the proceeds from insurance policy exceed Rs.1 lakh and no Form 15G or Form 15H is submitted to the insurer, there shall be deduction of TDS at the rate of 2% from the total proceeds.

So it is advisable to submit Form 15G or Form 15H as applicable each year to the insurer.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300