Negative Post Tax Returns from Fixed Deposits

Have you ever thought that you might be losing your hard money by locking it in fixed deposits? Instead of multiplying your money, fixed deposits might be eating-up your money. Baffled!!! Let's see how fixed deposits are not a good investment avenue as most of us thinks.

Real Rate of Return of Fixed Deposits

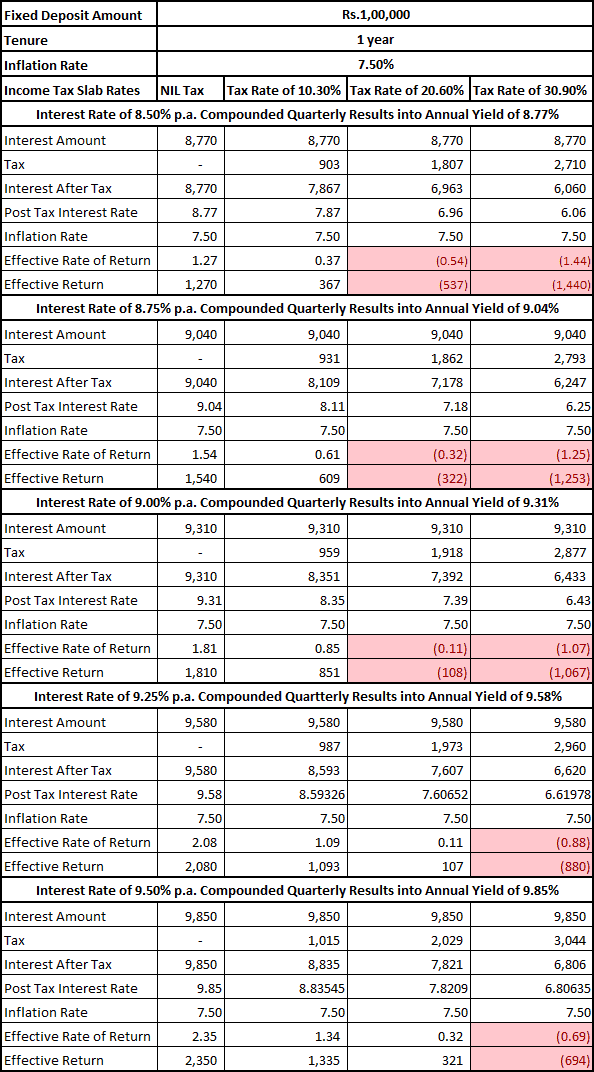

Most of the Institutions that are authorized by RBI to provide Fixed Deposits facilities such as banks, NBFCs, Companies, Housing Finance Companies etc. offer fixed deposits with interest rate ranging from 8.50% to 9.50% for tenure of 1 year. The interest may vary for longer term but usually lies in between the above ambit.

So, for calculation purpose we take the following figures:

- Investment Amount: Rs.1 lakh

- Interest Rate: 8.50% p.a. to 9.50% p.a.

- Interest Compounding : Quarterly

- Inflation Rate: 7.00%

Inflation rate indicates the rise in the prices from the base price. Let's say the product you could have bought for Rs.100 few years back, would cost you Rs.107.5 at present i.e. 7.00% costlier.

This inflation rate when combines with the tax rate depletes your return tremendously even to the negative figure.

Let's see how inflation + tax rate affects your fixed deposit return

As you can see from the highlighted cells shows the negative returns in terms of rates as well as amount.

What we say from the above calculation is that people falls in the tax bracket of 20% and above losses their money when parked in fixed deposits. While fixed deposits seems to give moderate returns to the people falls in the lowest tax bracket of 10%.

Alternative Investment Avenue

Debt Mutual Funds are one of the best alternatives of fixed deposits. Both debt fund and fixed deposits falls in the category of debt investments and the return from the debt funds is similar to fixed deposits.

Debt Mutual Funds vs. Fixed Deposits

| Points | Debt Mutual Funds | Fixed Deposits |

| Rate of Return | 7 % p.a. to 12% p.a. | 7% p.a. to 10% p.a. |

| Interest Rate | MFs are linked to market and thus returns are variable. | The rate of return is fixed for entire tenure. |

| Flexibility | Any amount can be invested or any amount can be redeemed any time from the existing debt fund. | Once the amount is invested in fixed deposits, no addition can be made. New FD is to be created for additional amount. |

| Liquidity | Redemption can be made at any time but if made within 1 year, the exit load of 1% may be levied. | Once the amount is invested in fixed deposits, the premature withdrawn is permissible only after penalty of 1%. |

| Underlying Assets | State and Central Government Bonds, treasury bills, corporate NCDs etc. | N.A. |

| Guarantee of Principal and Return | Theoretically, no, as these funds are market linked and subject to interest rate and credit risks. However, Historically certain debt funds have never lost/reduced the investment principal or gave negative return. | Yes, up to Rs.1 lakhs |

How Post tax benefits of Debt Mutual Funds beats Fixed Deposits?

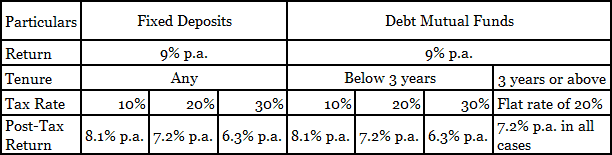

Pre-Tax Return of fixed deposits and debt mutual funds are almost similar but post-tax returns have material differences. This is because returns from fixed deposits are taxed as per tax slabs of the investor while returns from debt mutual funds are taxed as capital gains or tax slabs.

If the investment horizon is of less than 3 years, then the return from debt mutual funds are termed as short-term capital gain and taxed as per the slab of investor, similar to fixed deposits but if the investment horizon is of 3 years or more than the actual tax benefit of debt mutual fund can be achieved by combing tax rate with indexation.

The table below gives you the complete understanding of the taxation of debt mutual funds and fixed deposits.

Another tax benefit of opting debt mutual funds over fixed deposits is the deferment of tax. In case of Fixed Deposits, investor has to include the tax in the income every year and pay taxes while in case of debt mutual funds, if no redemption is done, no income is generated therefore no tax becomes payable, this means tax will be payable only when the units of mutual funds are sold.

Conclusion

Investors falls in the 30% tax bracket is at the loosing spree by investing in Fixed Deposits irrespective of the interest rate, they should look for the other investment avenue such as debt mutual funds, tax free bonds etc.

For investor falls in the tax slab of 20%, both debt mutual fund and fixed deposits are equally good if the return is at least 9.25% p.a.

Lastly, for the investor falls in the lowest tax bracket of 10%, the fixed deposits scores above any other investment avenue.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300