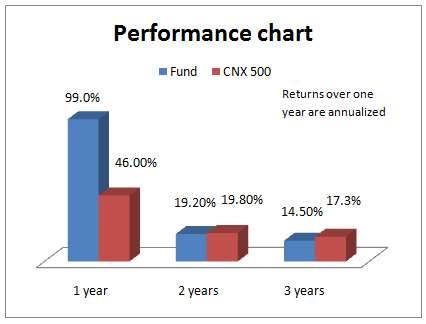

For those of you who saw the meteoric rise in the price of stocks from the engineering and infrastructure space, the temptation to own a fund that offers this theme may have been high. This temptation would increase manifold if you see an infrastructure fund delivering a whopping 99% in the past 1 year, outperforming its benchmark CNX 500's return of 44% and also dwarfing the CNX Infrastructure Index' performance of 41.5% in the same period. The fund with the above returns is HDFC Infrastructure Fund.

But should you enter the fund when returns and valuations of stocks in this space have already run up? Also, should you even hold such themes, especially given the prolonged pain this space can undergo, if 2008-13 was any evidence to that? Read on.

The Themes

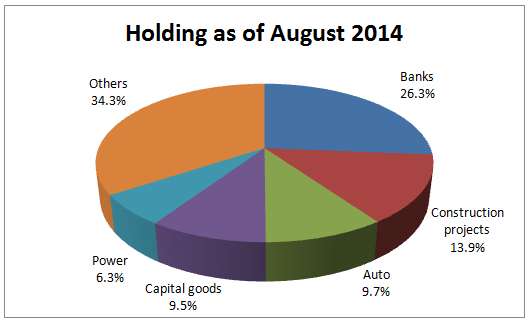

Infrastructure funds typically hold stocks from the financial space, engineering companies, construction and power companies, and even automobiles to name a few. So what exactly encompasses 'infrastructure?' Broadly, three themes and their allied themes – asset financiers, asset creators and asset owners/developers.

Asset financiers – Banks and infrastructure finance companies that provide debt for long-term infrastructure projects come under this category. This segment, although run up quite a bit, still has pockets of value either because of the broad concern about asset quality, or as a result of slowing credit growth in the economy.

Either way, their valuations provide opportunities for those willing to wait out for the long haul. You will find that stocks such as SBI, that HDFC Infrastructure held for long (although reduced in the last 1 year, with the stock delivering well), was part of such a strategy to pick at reasonably low valuations and hold.

Asset creators – These broadly fall under two categories. One segment would be contracting companies that take up project executions for a price. These could be builders of infrastructure projects, factories, or properties, or those who execute projects for power companies, or for any manufacturing company (steel, cement) and so on.

The other category is capital goods and engineering companies that manufacture equipments/goods that are used in any infrastructure project. Sometimes, these could go one step and also execute the projects (Engineering, Procurement and Construction companies). For instance, Larsen & Toubro, Crompton Greaves, Bharat Electronics, to name a few are some of the stocks in HDFC Infrastructure Fund's portfolio that fit this category.

Now, typically this is a large universe as it encompasses a range of companies across engineering, capital goods and even those that provide support services such as logistics and so on.

Asset owners/developers: These would be companies that own assets – for instance, companies that hold coal blocks or other mines, power generation companies, port/airport developers, or those that hold and operate roads and hold them as assets in their books.

This segment is not very large in number but considered risky in the Indian scenario as most of them are highly leveraged companies, and can go through very painful periods of slowdown in their revenue and their struggle to service their debt.

The Opportunity

In the three broad categories mentioned above, banks/financial companies still offer pockets of value, and this sector would receive the highest weight in most infrastructure funds as they have the highest weights in all key indices.

The second category, i.e., asset creators are split in terms of their potential, risk and return features. For instance, there are a number of companies in the space that are low on debt and have a high operating leverage – that is, they generate high earnings growth with a small pick up in revenue.

This is the segment that offers returns most often and as seen in HDFC Infrastructure's portfolio, is also subject to churn if they deliver returns too quickly. This segment can be expected to continue to deliver returns as they are available across market-cap segments, and across industries, and come leveraged or with nil leverage (depending on the business they are in).

For instance, stocks such as Sadbhav Engineering or Blue Star, which were seen in the fund's portfolio a year ago, were either pruned or moved out after delivering high returns, and others such as Larsen & Toubro or KEC International were bumped up.

The third segment – asset owners – is where more short-term returns came by, but risks still remain. Clearly,HDFC Infrastructure too saw these risks, but not without taking some gains off the table. Stocks such as GVK Power and Infrastructure, Coal India or Sesa Goa all exited the fund a while ago.

Long story short, cyclical sectors tend to move ahead of valuations in anticipation of an earnings recovery, which usually adequately makes up for the rally. However, in the current scenario, the recovery appears painful in some spaces (asset owners for example) and quite on track in others (pockets of asset creators).

Hence, while it would be fair to assume that the extraordinary rally period may be over; it provides us comfort in terms of moving away from mere trading opportunities to looking at valuation/recovery stories to ride the space over a 3-5 year period.

Suitability

Two lessons from the above discussion: one, the fund is not for those looking for extraordinary returns from here on. Two, with a recovery story in place, the fund could well beat diversified funds over a 3-year time frame; but then, during periods of volatility, you should be ready to be shaken by falls but not get too shaken. Three, the fund certainly cannot form the core of your portfolio and must account for not more than 10% of your portfolio.

Performance

With that above caveat in place, HDFC Infrastructure Fund reasonably survived the initial years of rout, thanks to its close-ended status until early 2011. While, its returns fell no less than indices (worst one-year returns of 54%), it was still better than peers and even mid-cap funds. More importantly, it did not have the redemption pressure that peers had.

With that above caveat in place, HDFC Infrastructure Fund reasonably survived the initial years of rout, thanks to its close-ended status until early 2011. While, its returns fell no less than indices (worst one-year returns of 54%), it was still better than peers and even mid-cap funds. More importantly, it did not have the redemption pressure that peers had.

Still, the fund only sports a 3-year return of 14.5% compounded annually – lower than 17.3% return of its benchmark CNX 500. But a 3-year SIP in the fund would have yielded a much higher IRR of 29.3% (23% by CNX 500), suggesting that its volatility worked well when it came to averaging using SIPs.

The fund held Rs. 1,690 crore of assets as of August 2014. It is managed by Prashant Jain and Srinivas Rao Ravuri.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan

2.Reliance Tax Saver (ELSS) Fund

3.HDFC TaxSaver

4.DSP BlackRock Tax Saver Fund

5.Religare Tax Plan

6.Franklin India TaxShield

7.Canara Robeco Equity Tax Saver

8.IDFC Tax Advantage (ELSS) Fund

9.Axis Tax Saver Fund

10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online -

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

---------------------------------------------

Invest Mutual Funds Online

Download Mutual Fund Application Forms from all AMCs