Late Filing of Income Tax Return

If you have missed out the due date for filing the Income Tax Return and you have tax dues which are to be paid to the government, than you should first understand the interest liability that you'd incur while filing a belated return.

To understand different interest types of interest, we will have to gain knowledge about the provisions of section 234A, 234B and 234C dealing with interest for

- 234A – Delay in filing the return of income

- 234B – Non-payment or short payment of advance tax; and

- 234C- Non-payment or short payment of individual instalment or instalments of advance tax (i.e., deferment of advance tax)

First thing to be kept in mind while determining the interest payable under all these sections is that interest is to be calculated @ 1% per month or part thereof. So even if you are late in filing the return by 10 days, you'll incur the interest for a whole month.

Section 234A – Delay in filing the return of income

The taxpayer will be liable to pay the interest @ 1% per month or part thereof for delay in filing the Income Tax Return.

Illustration:

Mr. Darshan is a doctor. The due date of filing the return of income in his case is 31st July, 2015. He filed his return of income on 11th November, 2015. His tax liability for the financial year 2014-15 is Rs. 11,250 (which is paid on 11th November, 2015).

In this case, Mr. Darshan has filed his return after the due date and hence he will be liable to pay interest under section 234A

Interest Amount:- Rs. 11,250 x 4 months x 1% = Rs.450/-

Section 234B – Non-payment or short payment of advance tax

Interest under section 234B is to be paid in case of following two situations:

- If advance tax has not been paid even though the taxpayer is liable to pay advance tax or,

- Where the advance tax paid is less than 90% of the assessed tax*.

* Assessed tax = (Total tax liability – TDS/TCS)

As per section 208 of the Act, Advance tax is to be paid by the assessee if his estimated tax liability for a particular financial year is Rs. 10,000 or more.

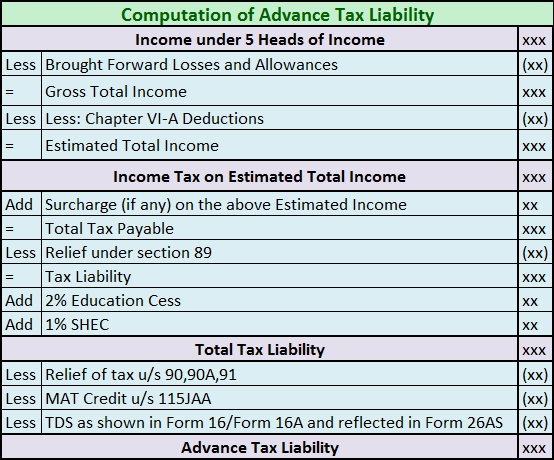

Calculation of Advance Tax

Advance Tax is to be paid by estimating the current year income and then applying the tax rates as per the Income Tax Slabs in force. The Advance Tax shall be computed as under:

Illustration:

Mr. Atul is running a small business. His tax liability for the year is Rs. 32,500. He has not paid any advance tax till 31st March but he has a TDS credit of Rs 5000. Entire tax was paid by him at the time of filing the return of income on 31st July.

In this case, since he has not paid any advance tax, interest will be calculated from the 1st day of the assessment year till the day of paying the tax and filing the return.

So interest under section 234B works out to be:

Rs. 27,500 i.e (Rs 32,500 – Rs 5000) x 4 months x 1% = Rs 1100

Section 234C- Non-payment or short payment of individual instalment or instalments of advance tax (i.e., deferment of advance tax)

As discussed above, an assessee is liable to pay advance tax as per section 208 of the Act, if his estimated tax liability for a particular financial year is Rs. 10,000 or more.

Advance tax is to be paid in instalments as given below:

| Status | By 15th June | By 15th Sept. | By 15th Dec. | By 15th March |

| Non-Corporate taxpayers | Nil | Upto 30% of advance tax | Upto 60% of advance tax | Upto 100% of advance tax |

| Corporate taxpayers | Upto 15% of advance tax | Upto 45% of advance tax | Upto 75% of advance tax | Upto 100% of advance tax |

So in case of deferment or short payment of advance tax in case of non-corporate assessee, interest is to be calculated as follows:

| Scenario | Interest |

| If paid Less than 30% of advance tax upto 15th September | 1% per month i.e. 3 months on the shortfall amount below 30% |

| Less than 60% upto 15th December | 1% per month i.e. 3 months on the shortfall amount below 60% |

| Not 100% Upto 15th March | 1% on the shortfall amount below 100% for 1 month |

Illustration:

Mr. Pratik is running a small shop. His tax liability is Rs. 41,500. He has paid advance tax as given below:

- Rs. 15,000 on 15th September,

- Rs. 5,000 on 15th December,

- Rs. 18,400 on 15th March.

So the interest liability will be calculated as follows:

For the First instalment of 15th September:

Advance tax to be paid = Rs. 41,500 x 30% = Rs. 12,450

Mr. Pratik has paid Rs. 15,000 so there is no shortfall and thus no interest is to be paid

For the Second instalment of 15th December:

Advance tax to be paid = Rs. 41,500 x 60% = Rs. 24,900

Total advance tax paid so far is Rs. 20,000 (Rs. 15,000 + Rs. 5000) so the interest on shortfall will be: (Rs. 24,900 – Rs. 20,000) x 3 months x 1% = Rs. 4900 x 3 months x 1% = Rs. 147

For the Third instalment of 15th March:

Advance tax to be paid = Rs. 41,500 x 100% = Rs. 41,500

Total advance tax paid so far is Rs. 3100 (Rs. 15,000 + Rs. 5000+ Rs 18,400) so the interest on shortfall will be: (Rs. 41,500 – Rs. 38,400) x 3 months x 1% = Rs. 3100 x 1 months x 1% = Rs. 31

Important Note: The last date for efiling of IT returns has been extended to 31st August for Assessment Year 2015-16.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300