To widen the reach of financial inclusion program and maximizing cashless transactions IRCTC in collaboration with Union Bank of India (UBI) and the National Payments Corporation of India (NPCI) has launched the RuPay Debit Card to book tickets online which will be called as "IRCTC-UBI RuPay pre-paid card" as shown below:

What is IRCTC RuPAY Debit Card?

RuPay is the country's own card payment gateway network like Visa and Master Card, and provides an alternative system for banks to provide a debit card service.

Apart from enabling online tickets booking, IRCTC RuPAY Debit Card will also facilitate user to make payment of service and do shopping online but in second phase.

Benefits of IRCTC RuPAY Debit Card

- IRCTC RuPAY Debit Card Holder will get accident insurance of Rs.1 lakh but after furnishing full KYC details.

- First Five ticket bookings per card per month are free for initial 6 months. 6th transaction will attract a charge of Rs.10 per transaction.

- After 6 months of free usage, Rs.10 will be charged for each transaction.

- Similar to other cards, rewards points will also be awarded for each transaction. Redemption process is still to be specified by IRCTC.

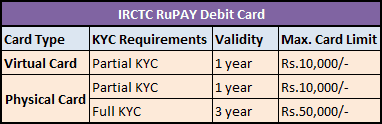

Types of IRCTC RuPAY Debit Card

1. Virtual Card

Virtual Card is completely free of charge and can be obtained with furnishing partial KYC norms. Virtual Card comes with a low limit of Rs.10,000 and a validity of 1 year. The card details i.e. card number, expiry year and CVV will be sent to the registered email address which can be used for booking tickets online.

2. Physical Card

Physical card bears a cost of Rs.500. It comes with two options. The first option is same as of virtual card i.e. limit of Rs.10,000 with 1 year validity.

Under second option, the limit and validity can be increased to Rs.50,000 and to 3 years by furnishing full KYC details.

The card will be sent to the registered mailing address.

How to get IRCTC RuPAY Debit Card?

First of all there is no need to have Union Bank of India Account to get IRCTC RuPAY Debit Card. The Cards can be made available either from the UBI Office or through IRCTC site.

UBI Office:

- Approach to nearest UBI branch and ask for the .

- You need to provide details of your PAN card (mandatory) and Aadhaar Card (optional).

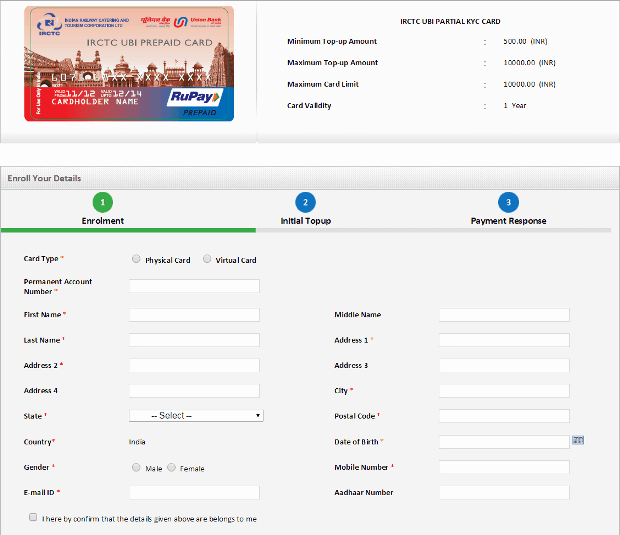

Online through IRCTC:

1. You can also apply for IRCTC RuPAY Debit Card at:https://acm.fssnet.co.in/ACM/portal/ci_hp/1_1.acm#

2. Click on the Request for new card.

3. Fill the required details as asked.

4. Pay initial topup of Rs.500 by netbanking, credit card or debit card.

5. The card will be sent to the mailing or email address according to the type of card chosen.

Initial Top-up or Reloading your IRCTC RuPAY Debit Card

- Initial topup amount is Rs.500 at the time of purchasing card.

- Subsequent topup amount should be minimum Rs.500 with maximum of permissible card limit.

- Cards can be reloaded either through the net banking or via NEFT by visiting the UBI Branch.

- No additional charges will be levied on reloading.

Closing or Surrendering your IRCTC RuPAY Debit Card

- In case you wish to surrender your card than a fee of Rs.100 will be charged and deducted from your card balance.

- Remaining balance will be transferred via NEFT only.

- If the card balance is less than Rs.100 than card cannot be surrendered.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300