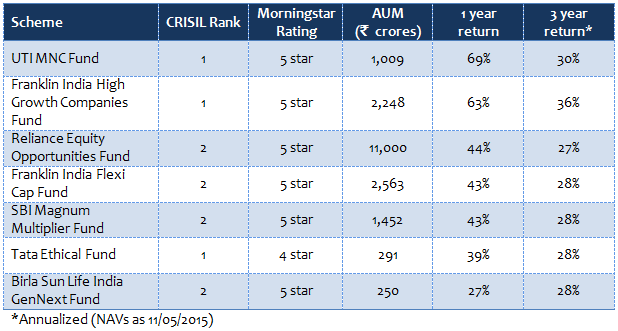

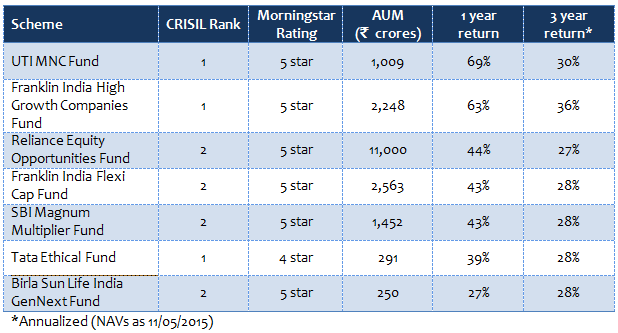

Flexi Cap funds, as the name suggests, are diversified equity funds which invest in stocks across different market capitalizations. The flexible mandate of these funds enable fund managers to spot opportunities across market segments. Flexi Cap funds or multi cap funds combine the best features of large cap and midcap funds. The large cap holdings of the flexi cap funds provide a certain degree of stability in volatile markets, while the small and midcap holdings enhance the returns in bull markets. As such, investment experts advise investors to allocate a significant portion of their mutual fund portfolio to Flexi Cap funds. In this 2 part blog we will review top 7 flexi cap funds based on CRISIL's mutual fund ranking and Morningstar ratings. Each of the 7 funds in our selection has been ranked either 1 or 2 by CRISIL. Also Morningstar has rated each of these funds either as a 4 star or 5 star fund. The table below shows the top 7 flexi cap funds from our selection.

We can see that all these funds have given exceptionally good returns on a compounded annual basis over the last 3 year period. Let us review each of these funds briefly to see how these funds across market cycles and the returns investors would have received by investing through lump sum and SIP modes.

UTI MNC Fund

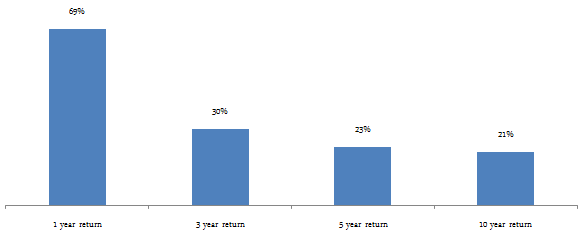

This is a well known fund from the UTI stable, with over र 1,000 crores of assets under management. The expense ratio of the fund is 2.8%. The volatility of the fund is on the lower side relative to diversified equity funds in general. The chart below shows the trailing returns of the UTI MNC fund over 1, 3, 5 and 10 year period.

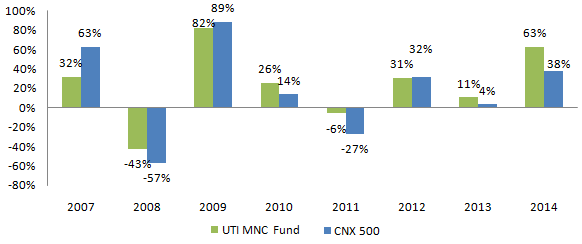

To get a sense of how this fund has performed across different market cycles, we have compared the annual returns of the fund with CNX 500 index from 2007 to 2014.

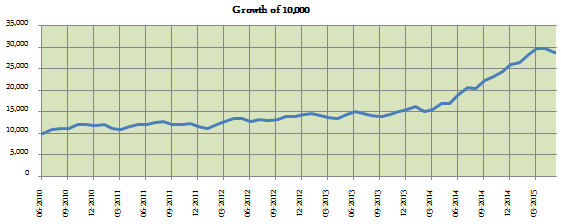

The chart below shows growth of र 10,000 lump sum investment in UTI MNC fund over the last 5 years. र 10,000 invested in the UTI MNC fund five years back would have grown to almost र 29,000 (as on 11/5/2015).

The chart below shows the returns of र 3,000 SIP in the UTI MNC fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.63 lacs while the investors would have invested only र 1.8 lacs.

Franklin India High Growth Companies Fund

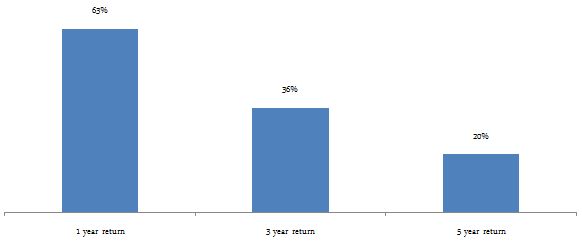

This is another well known fund from the Franklin Templeton stable, with over र 2,200 crores of assets under management. The expense ratio of the fund is 2.6%. The volatility of the fund is in line with the volatilities of diversified equity funds in general. However, the risk adjusted return is quite outstanding. The chart below shows the trailing returns of the fund over 1, 3 and 5 year periods.

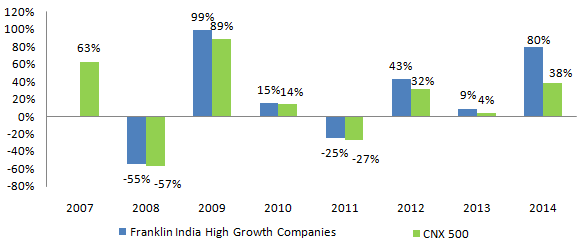

The chart below shows the annual returns of the Franklin India High Growth Companies fund over different market cycles from 2007 to 2014.

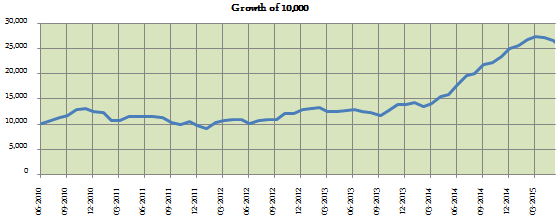

The chart below shows growth of र 10,000 lump sum investment in Franklin India High Growth Companies fund over the last 5 years. र 10,000 invested in the Franklin India High Growth Companies fund five years back would have grown to over र 26,000 (as on 11/5/2015).

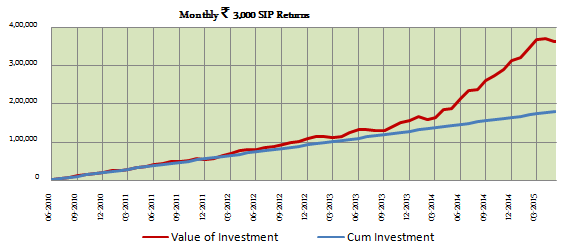

The chart below shows the returns of र 3,000 monthly SIP in the Franklin India High Growth Companies Fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.6 lacs while the investors would have invested only र 1.8 lacs.

Reliance Equity Opportunities

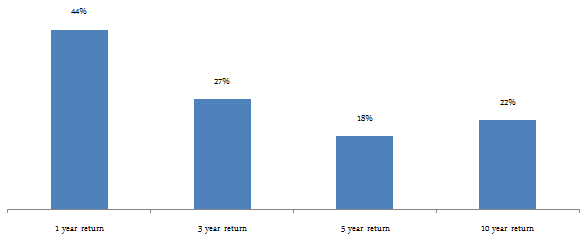

This is another old favourite with investors from the Reliance stable, with over र 11,000 crores of assets under management. You can read our review of Reliance opportunities fund by going to Strong SIP performance over the last 10 years from this consistent diversified fund. The expense ratio of the fund is 2.3%. The volatility of the fund is in line with the volatilities diversified equity funds in general. However, the risk adjusted return is quite outstanding. The chart below shows the trailing returns of the fund over 1, 3, 5 and 10 year periods.

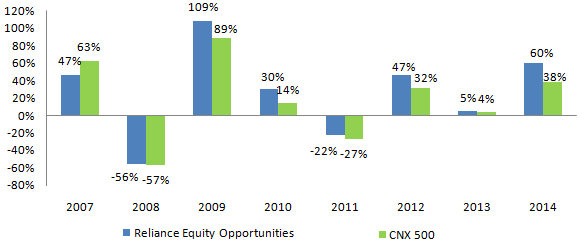

The chart below shows the annual returns of the Reliance Equity Opportunities fund over different market cycles from 2007 to 2014.

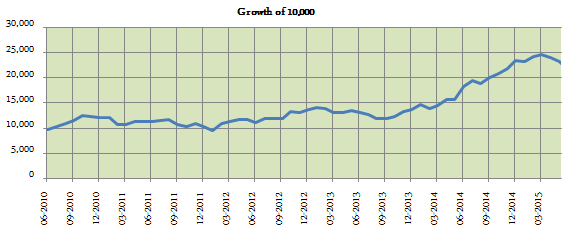

The chart below shows growth of र 10,000 lump sum investment in Reliance Equity Opportunities fund over the last 5 years. र 10,000 invested in the Reliance Equity Opportunities Fund five years back would have grown to almost र 23,000 (as on 11/5/2015).

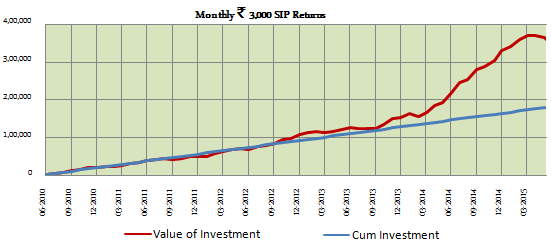

The chart below shows the returns of र 3,000 monthly SIP in the Reliance Equity Opportunities Fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.1 lacs while the investors would have invested only र 1.8 lacs.

Conclusion

In this blog we reviewed some of the best flexi cap funds. In our next blog we will review the remaining top flexi cap funds from our selection.

In this two part series, we selected top 7 Flexi Cap Funds based on CRISIL's mutual fund ranking and Morningstar ratings. Each of these funds has delivered outstanding performance both in the short term and also over a longer time horizon. Each of the 7 Flexi Cap or Multi Cap funds in our selection has been ranked either 1 or 2 by CRISIL and rated either a 5 star or 4 star by Morningstar. In our previous part of this series, The table below shows the top 7 flexi cap funds from our selection.

Franklin India Flexi Cap Fund

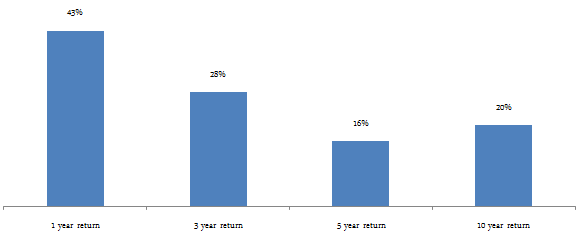

Franklin India Flexi Cap Fund is another very well known fund from the Franklin Templeton stable, with over र 2,500 crores of assets under management. The expense ratio of the fund is 2.3%. The volatility of the fund is on the lower side relative to diversified equity funds in general. The chart below shows the trailing returns of the Franklin India Flexi Cap Fund over 1, 3, 5 and 10 year period.

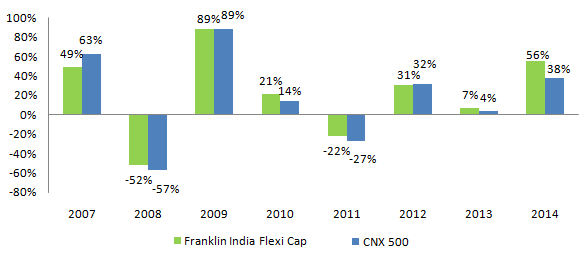

To get a sense of how this fund has performed across different market cycles, we have compared the annual returns of the fund with CNX 500 index from 2007 to 2014.

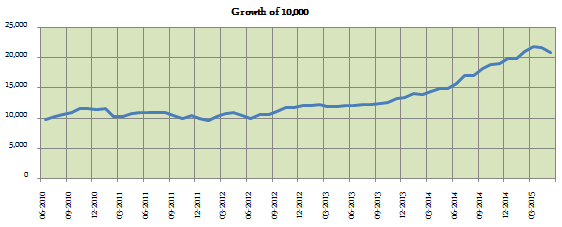

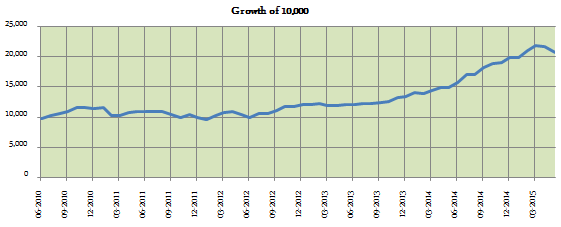

The chart below shows growth of र 10,000 lump sum investment in Franklin India Flexi Cap fund over the last 5 years. र 10,000 invested in the fund five years back would have grown to over र 21,000 (as on 11/5/2015).

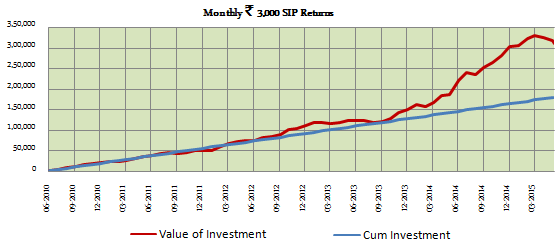

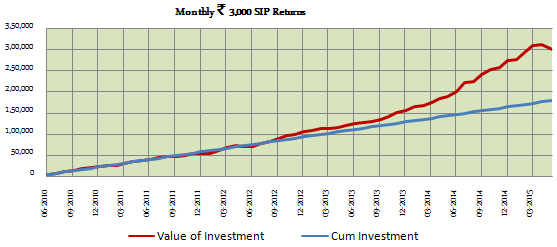

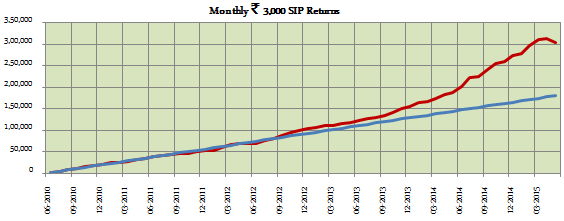

The chart below shows the returns of र 3,000 SIP in Franklin India Flexi Cap fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.1 lacs while the investors would have invested only र 1.8 lacs.

SBI Magnum Multiplier Fund

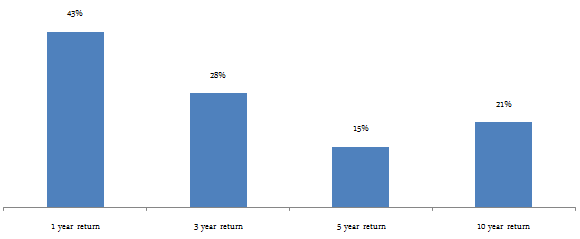

This is one of the oldest mutual fund schemes in the country outside the Unit Trust stable. The fund was launched in 1993 and has over र 1,450 crores of assets under management. The expense ratio of the fund is 2.6%. The volatility of the fund is on the lower side relative to diversified equity funds in general. The chart below shows the trailing returns of the SBI Magnum Multiplier fund over 1, 3, 5 and 10 year period.

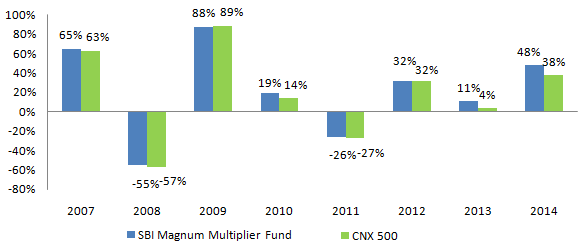

To get a sense of how this fund has performed across different market cycles, we have compared the annual returns of the fund with CNX 500 index from 2007 to 2014.

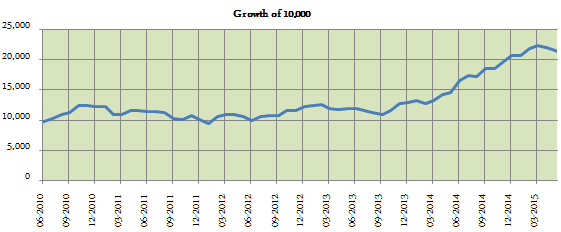

The chart below shows growth of र 10,000 lump sum investment in SBI Magnum Multiplier Fund over the last 5 years. र 10,000 invested in the fund five years back would have doubled in value to almost र 20,000 (as on 11/5/2015).

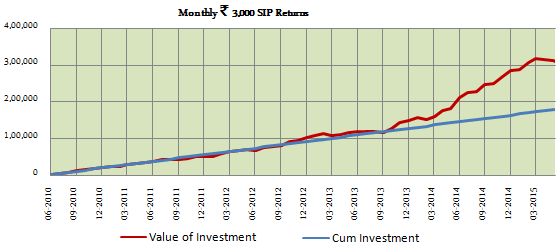

The chart below shows the returns of र 3,000 SIP in the SBI Magnum Multiplier fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.1 lacs while the investors would have invested only र 1.8 lacs.

Tata Ethical Fund

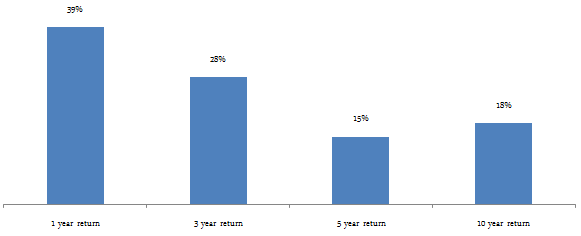

In our article, Some of the best smaller sized equity funds, we had discussed that despite its small AUM base (र 291 crores), Tata Ethical Fund is one of the best performing equity funds, relative to its peer set. The expense ratio of the fund is 3%. The investment mandate of the fund has ensured that the volatility of the fund, over the last 3 years, is significantly lower than the volatilities of diversified equity funds in general. The chart below shows the trailing returns of the fund over 1, 3, 5 and 10 year periods.

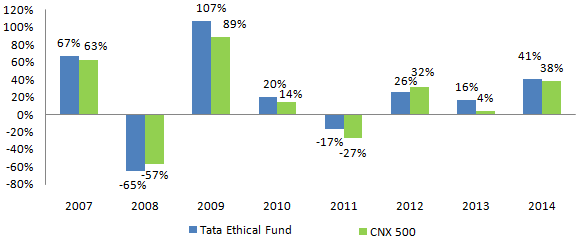

The chart below shows the annual returns of the Tata Ethical Fund over different market cycles from 2007 to 2014.

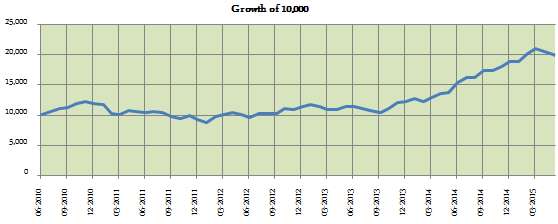

The chart below shows growth of र 10,000 lump sum investment in Tata Ethical fund over the last 5 years. र 10,000 invested in the Tata Ethical fund five years back would have grown to nearly र 21,000 (as on 11/5/2015).

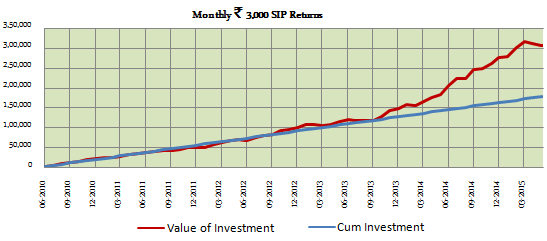

The chart below shows the returns of र 3,000 monthly SIP in the Tata Ethical Fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.1 lacs while the investors would have invested only र 1.8 lacs.

Birla Sun Life India GenNext Fund

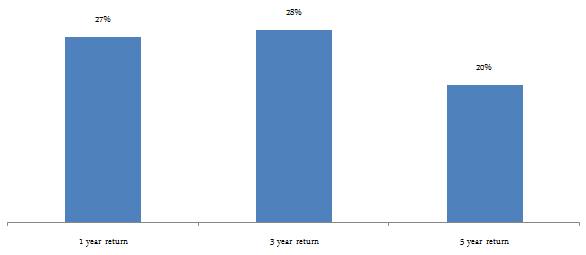

In our article, Some of the best smaller sized equity funds, we had also noted that Birla Sun Life India GenNext Fund is one of the best performing diversified equity fund, despite its small AUM base of र 250 crores. The expense ratio of the fund is 2.8%. The volatility of the fund is lower than the volatilities of diversified equity funds in general. The chart below shows the trailing returns of the fund over 1, 3, and 5 year periods.

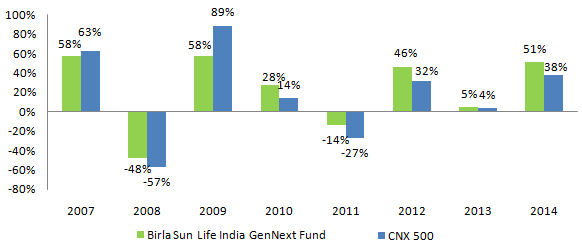

The chart below shows the annual returns of the Birla Sun Life India GenNext fund over different market cycles from 2007 to 2014.

The chart below shows growth of र 10,000 lump sum investment in Birla Sun Life India GenNext Fund over the last 5 years. र 10,000 invested in the fund five years back would have grown to over र 25,000 (as on 11/5/2015).

The chart below shows the returns of र 3,000 monthly SIP in the Birla Sun Life India GenNext Fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.2 lacs while the investors would have invested only र 1.8 lacs.

Conclusion

We had discussed number of times on our blog that diversified Flexi Cap or Multi Cap funds are one of the best investment options for retail investors over a long time horizon. In this 2 part series, we reviewed some of the best flexi cap funds. Investors should consult with their financial advisors if these Flexi Cap funds are suitable for the investment portfolios.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------