A vast majority of risk averse investors prefer bank fixed deposits to debt mutual fund schemes. Perception of risk and lack of financial awareness are the contributing factors. For investors who are willing to sacrifice the comfort of guaranteed returns, long term income funds are better investment options than fixed deposits over a tenure of three years or more. While banks have offered around 8.5 – 9% interest rates for a 3 year term deposits, top long term income funds have given returns of 9.5 – 10.7% over the last 3 year period. Further over tenures of three years or more, debt funds enjoy tax advantage over fixed deposits due to the long term capital gains tax with indexation. If we add the difference in pre-tax returns and the tax benefit, the post tax returns of long term income funds has been substantially higher than the bank fixed deposits.

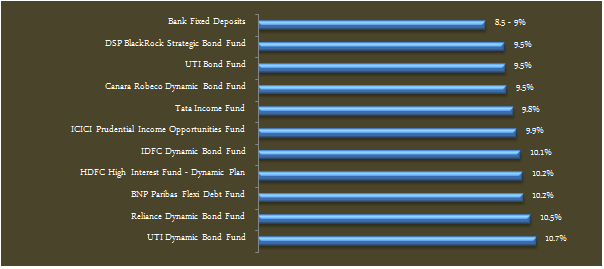

Returns of top long term income funds

Over a three year tenure top performing long term income funds have given 1.5 – 2% higher returns compared to fixed deposits. On र 1 lac investment the returns from income funds over a three year investment horizon would be र 2,000 to 6,000 higher compared to fixed deposits on a pre-tax basis. On a post tax basis the difference in returns will be even higher, as we will discuss later in the article. The chart below shows the trailing three year annualized returns of the top income funds.

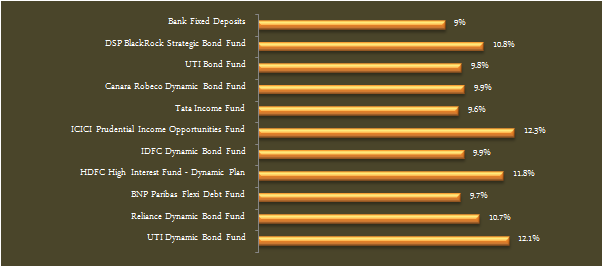

While the top long term income funds outperformed fixed deposits over three year tenure, these funds gave higher pre-tax returns than fixed deposits even in the last 12 months, despite prevailing high interest rates. The chart below shows trailing one year returns of the top income funds.

Outlook for Long Term Income Funds

We have been in the grip of high interest rates for a long time due to stubborn inflation. However inflation has been easing over the past four months. In September inflation was 6.7%. Some bond market operators are expecting the RBI to cut rates as early as December, but the majority of economists are of the view that RBI will start cutting rates in February 2015. The 10 year Government Bond yield has started inching down from historical high levels. It is now at 8.3% compared to 9% at the beginning of the year. That is why we have seen the long term income funds giving good returns in the last one year.

The 10 year Government Bond yield is expected to fall to 7% in FY 2015 – 2016. Bond prices have an inverse relationship with interest rates. As interest rate goes down bond prices increase, leading to higher potential returns from long term income funds over the next 2 to 3 years. When we move to benign interest rate environment, the returns of long term income funds can potentially be even higher than the recent short term returns.

Income Funds are not risk free

It is important that investors understand that income or debt funds are not risk free. It is equally important that investors understand the nature of the risk, so that they can make an objective investment decision, without being swayed by perceptions. There are three kinds of risk that income or debt funds are exposed to.

- Interest Rate risk: If interest rate goes down bond prices and returns will increase. Conversely, if interest rate goes up bond prices and returns will decrease. In the context of India's macro-economic outlook and the interest rate environment, the probability of interest rate going up is very low.

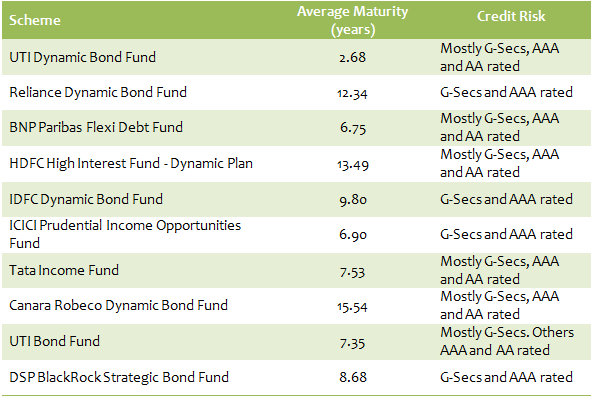

- Re-investment risk: If the bonds in the income fund portfolio mature and the proceeds are re-invested in lower yield bonds, then the returns will decrease. Re-investment risk is lower if the average maturity of the bonds in the portfolio is longer. Long term income funds typically have longer maturity bonds in their portfolio, as we will see in the table below.

- Credit risk: Credit risk relates to the risk of default. If the credit rating of the bond worsens the bond price will decline and the returns will be lower. As far as credit risk is concerned, the top long term income funds have high quality bonds in their portfolio, as we will see in the table below.

Tax Benefit

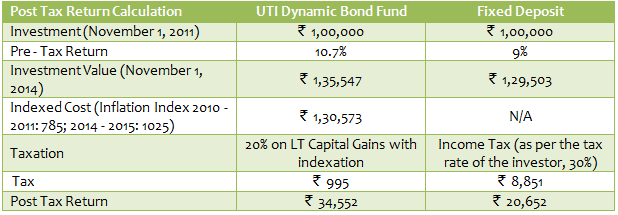

Some significant taxation changes were made for debt funds in the last Budget. The holding period of long term capital gains is now 3 years. If the holding period is less than 3 years, then the returns will be taxed as per the income tax rate of the investor. If the holding period is more than 3 years, long term capital gains tax of 20% will apply. However, indexation benefits are allowed for calculation of long term capital gains. Fixed Deposit interest, on the other hand, is taxed as per the income tax rate of the investor, irrespective of the holding period. Indexation benefit reduces long term capital gains tax significantly. Therefore for tenures of 3 years or more, income funds have a significant tax advantage over fixed deposits, especially for investors in the higher tax bracket.

Let us see the difference between post tax returns of a long term income fund and fixed deposit with the help of an example. Let us assume you invested र 1 lac in UTI Dynamic Bond Fund on November 1, 2011. Let us see how your post tax returns compare with a र 1 lac investment in fixed deposit at 9% interest over the same tenure.

Conclusion

In this article, we have seen how long term income funds are better investment option than fixed deposits over tenures of three years or more, for investors who are willing to sacrifice the comfort of guaranteed returns. Investors should consult with Prajna Capital if long term income funds are suitable for their investment portfolio.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------