Invest Balanced MFs Online

While equity mutual funds are expected to beat other class of funds in the long term, short-term volatility is unbearable for some investors. For them, balanced funds are a better option because their equity exposure is usually restricted to 65-75%, and the debt portion of 25- 35% lends stability to the fund. Though the returns from balanced funds will be lower than that of equity funds in the long term, their volatility will also be lower. So, on a risk-adjusted basis, it should give better return on a 5-7 year holding period

Both equity and debt are expected to do well in the coming years, because the expected decline in interest rate will be good for both asset classes. Balanced funds make immense sense in periods like this, when both equity and debt are expected to do well

Some experts believe that balanced funds can also beat the returns from equity funds in absolute terms, during the next three years. The equity market performance in the near future will depend on the interest rates movement. Since the debt (or the debt portion in balanced fund) will be the first beneficiary of a rate reduction, balanced fund may do better than the equity funds on absolute basis in the next three years

Debt portion is also tax free Another advantage of the balanced funds is its tax treatment. Since these equity-oriented schemes invest more than 65% of their assets in equities, they get the same tax treatment as equity funds. While the gains from debt funds are treated as long-term capital gains only after three years, in the case of balanced funds, the minimum holding period is just one year. So, while you have to pay 20% capital gains tax after indexation on the gains from debt funds, long-term capital gains from balanced funds are tax free. Balanced funds make the debt part also tax free after a year's holding

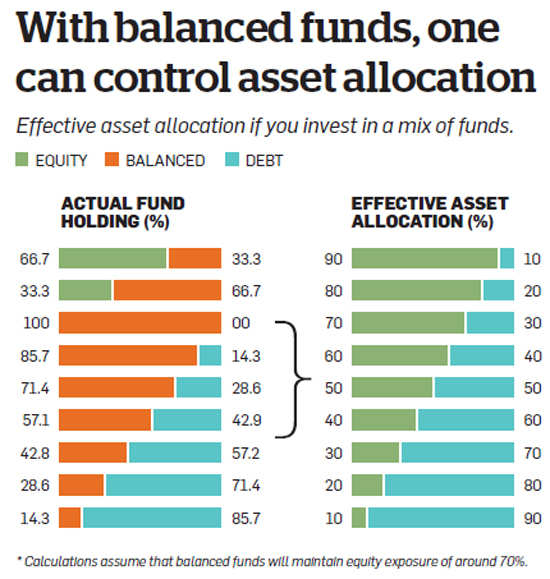

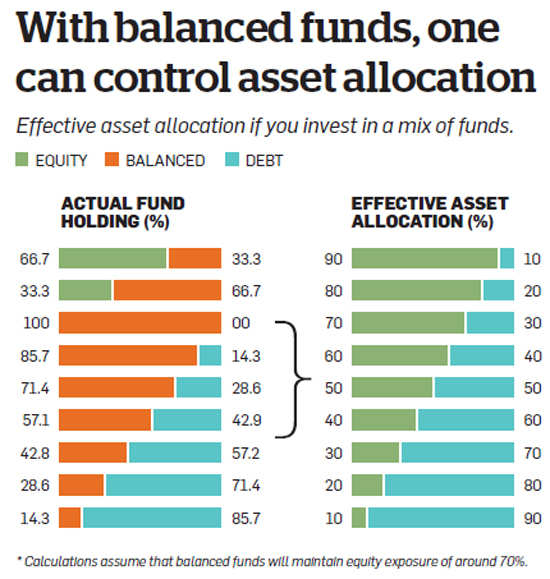

Balanced funds do reduce your tax liability. But, for that, investors must treat a balanced fund not as one scheme, but as a combination of two schemes. You are effectively investing 70% of your money in an equity fund and the remaining 30% in a debt fund.

Once this demarcation is clear, it is easy to create various equity allocations using balanced funds and debt funds (see table). Let's take the example of an investor who has a high-risk appetite and wants to put 80% in equities. If he puts 80% in equity funds and 20% in debt funds, the gains from the debt funds will be taxed at 20% while gains from the equity funds will be tax free. Instead, he can put 33.3% in equity funds and the remaining 66.7% in balanced funds to achieve the same asset allocation. But in this case, the entire portfolio will be treated as equity and become tax free after one year.

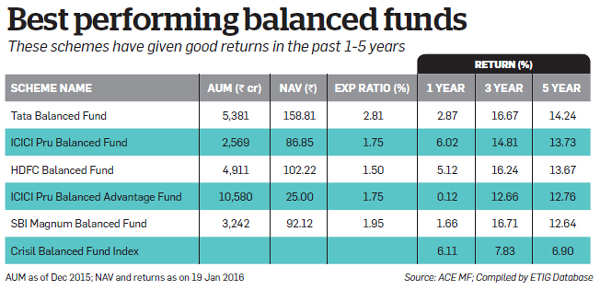

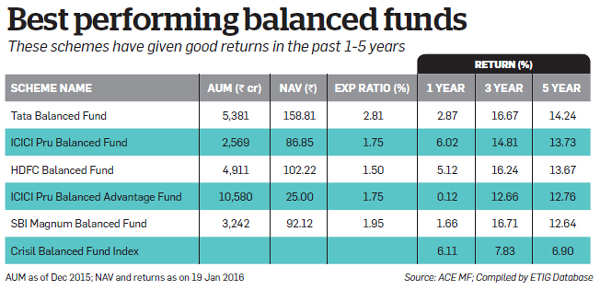

Now, consider another investor who is risk-averse and wants to put only 10% in stocks. Instead of investing in an MIP where the all the gains (including those from the equity portion) are taxed at 20%, he can invest 85.7% in a debt fund and the remaining 14.3% in a balanced fund. In this case, 14.3% of the investment will be taxed as equity.Some investors don't want to invest in multiple funds and prefer a single product solution. Such investors should consider algorithmbased products such as the ICICI Prudential Balanced Advantage Fund—among the best performing balanced funds—or the Edelweiss Absolute Return Fund. Such funds will do better when the market is in a downward spiral

-----------------------------------------------

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

Invest Online

Download Application Forms

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------