There has been a spate of closed end Mutual Fund launches in the last one year. There is much lesser awareness about closed end funds among retail investors for a number of reasons. Firstly, the closed end funds are far lesser in numbers compared to open end funds. Secondly, there is a perception that open end funds are "safer" than closed end funds. Thirdly, since the closed end funds are open for subscription only for a limited period of time, there is very limited discussion on closed end funds outside the subscription window. Investment experts are divided in their opinion whether closed end funds work for investors. In this blog, we will discuss the difference between open end and closed end funds. We will also objectively discuss the suitability of closed end funds for investors. At the very outset, we would like to state that we will not go into a discussion or debate on distributor commissions for closed end funds in this blog because it is not pertinent to our topic.

What is a closed end fund

A closed end fund is a mutual fund scheme where the investment is locked in for a specified period of time. Investors can subscribe to these schemes only during the offer period and can redeem their units only after the lock in period or the tenure of the scheme. Some closed end funds becomes open ended after the completion of the lock in period. Investment experts argue that the closed end funds are ideal for long term equity investors because the lock in period ensures that the investor stays invested in the fund at least for a specified length of time which enables them to good capital appreciation. The other argument in favour of closed end funds is that the lock in period ensures that the asset under management (AUM) of the fund is stable which enables the fund manager to invest in stocks where there is long term value and growth potential, without worrying about redemption pressures.

Is open end fund better than closed end funds or vice versa

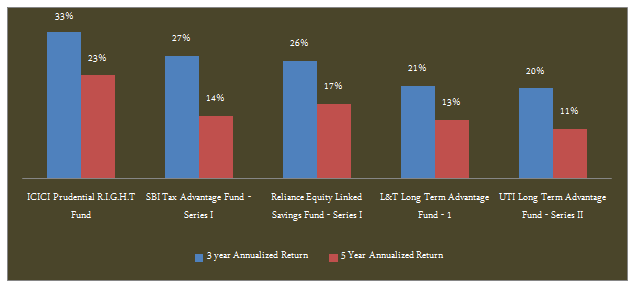

Investment experts are split in their opinion whether open end funds give higher returns than their closed end counterparts or vice versa. In our opinion it is difficult to generalize whether open end funds are better than closed end funds or vice versa. The performance of a fund, whether open ended or closed ended, depends on the fund management, investment style and the fund category. It also depends on the holding period and market conditions. It is not correct to compare the performance of closed end funds versus open end funds based on the short term returns. Some investment experts argue that because there is no redemption pressure in closed funds, there is no incentive for their fund managers to actively manage their portfolio. They cite last one year trailing returns to argue that open end funds are better than closed end funds. But such comparison is meaningless because the minimum investment horizon in closed end funds have a much longer horizon than a year. In fact, over a sufficiently long investment horizon, good closed end funds have done as well as their open end counterparts. Take the ICICI Prudential R.I.G.H.T a closed end ELSS fund. Over a three year time horizon the fund has given 33% annualized returns and done as well as the best performing open end ELSS funds

Some investment experts argue that one should invest in equities only with a long time horizon. What difference does it make to an investor with a long time horizon, whether he or she invests in closed end fund or an open end fund? There is merit in this logic. However, investor behaviour in certain cases makes closed end funds a better choice. Take small and midcap funds as example. Small and midcap stocks are more volatile than their large cap counterparts. These stocks are also less liquid. Small and midcap stock prices rise very quickly in bull markets. Some open end fund investors are quick to redeem their units after the NAV appreciates by 5 – 10% to book short term profits. This hurts the investors who remain invested in the funds. Closed end funds are better options in such situations because the lock – in period prevents early redemptions and protects the interest of long term investors.

Performance of closed end versus open end funds

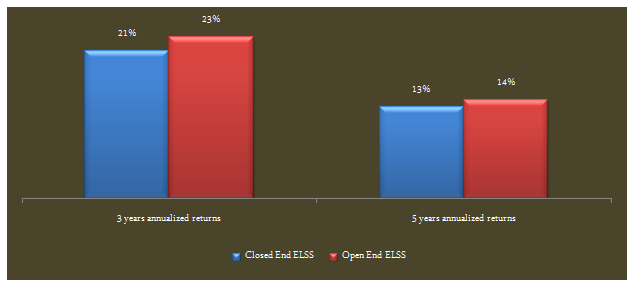

In terms of performance of closed end versus open end funds over a three year investment horizon the difference in returns is small. As discussed earlier, comparison of one year returns of closed end versus open end funds is not relevant because of the lock in period in closed end funds. As a category, open end ELSS funds gave slightly higher three year annualized returns compared to closed end ELSS funds. The chart below shows the comparison of annualized returns from closed end and open end ELSS funds over three years and five years investment horizon.

The top performers among closed end and open end ELSS funds are more or less evenly matched. While the returns of the top open end performers are slightly higher than the closed end performers in terms of three year annualized returns, the performance is closer over five years investment horizon. The chart below shows the annualized returns of top performing closed end ELSS funds over three years and five years investment horizon.

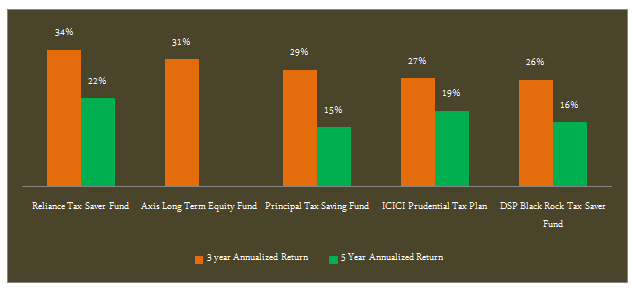

We can see that the top performing closed end ELSS funds gave good returns over three year investment horizon. The returns of top performing open end ELSS funds are slightly higher over a three year horizon and more or less similar over a five year horizon compared to closed end funds. The chart below shows the annualized returns of top performing open end funds over three years and five years investment horizon.

Disadvantages of closed end funds

Closed end funds have two main disadvantages. Firstly, investors cannot redeem their units before maturity or lock-in period. Asset Management Companies can list their closed end funds in stock exchange, which allows the investors to buy and sell units of closed end funds in the secondary market. The units may trade at a premium or discount to the NAV. However, this facility only offers limited liquidity to closed end fund investors since they are dependent on the demand and supply situation for the fund in the secondary market. The second disadvantage of closed end funds is that investors cannot use systematic investment plan (SIP) to invest in closed end funds because of limited offer period. However, if you prepared to invest in lump sum and wait till the end of the lock in period, closed end funds can be excellent investment options.

Conclusion

In this blog, we discussed the suitability of closed end funds as investment options. Like with all mutual fund investments you must ensure that you have selected the right fund that is suitable for your long term objectives. A number of closed end schemes are on offer now. You should discuss with your financial advisor, if you these schemes are suitable investment options for you.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------