Investors often tend to ignore the impact of taxes on their investment planning. Taxes, however, have a significant impact on the returns earned by the investor and therefore investors should pay due attention to the tax treatment of their investment returns and plan their investments accordingly. In this article, we will discuss mutual fund taxation. We will also discuss several strategies that will help you minimize taxes in different situations.

Before we get into nuts and bolts of mutual fund taxation, let us discuss the two different kinds of income from mutual funds:-

Capital Gains:

Capital gain is the appreciation in the value of the units of the mutual fund at the time of the sale. From a tax standpoint, there are two types of capital gains.- Short term capital gain: If the units are sold within a year of their purchase, then it leads to an incidence of short term capital gain.

- Long term capital gain: If the units are sold at least after one year of their purchase, then it leads to an incidence of long term capital gain.

Dividends:

Dividends are profits returned by the mutual fund to the investor at regular intervals. However, the intervals are not certain and dividend amount is also not fixed.

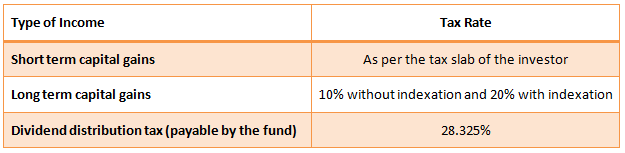

The tax treatment of capital gains and dividend incomes are different. Tax treatment is also for different types of mutual funds. We will discuss the taxation of different categories of mutual funds separately.

Equity Funds

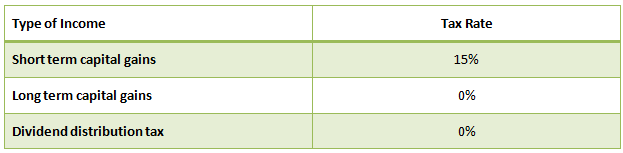

From a tax perspective, a fund in which at least 65% of the portfolio is allocated to equities is an equity fund. Therefore, other than the usual equity funds, like diversified equity funds, ELSS etc, balanced funds with more than 65% of its portfolio allocated to equities, is also categorized as equity funds from a tax standpoint. However, mutual funds like monthly income plans, which usually have a much smaller allocation to equities, are not categorized as equity funds. Short term capital gains (if the units are sold before one year) in equity funds are taxed at the rate of 15%. There is no tax on long term capital gains of equity fund. Dividends of mutual funds are tax free in the hands of the investors. However, depending on the type of mutual funds, mutual funds may have to pay dividend distribution tax, before giving dividends to the investors. For equity funds, the dividend distribution tax is zero. Here is a quick recap of tax treatment of equity funds.

Debt Funds (excluding money market and liquid funds)

From a tax perspective, a fund in which less than 65% of its portfolio allocated to equities is a debt fund. Short term capital gains (if the units are sold before one year) in debt funds are taxed as per the applicable tax slab of the investor.

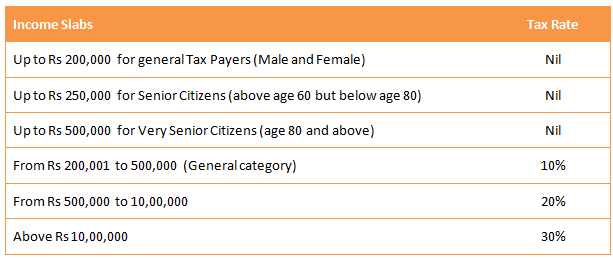

The income tax rates for individuals and Hindu Undivided Families are as follows:-

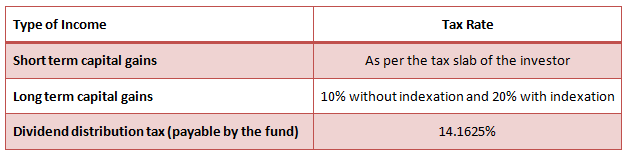

So if your taxable income is above Rs 10 lakhs then short term capital gains tax of a your debt fund is 30%. Long term capital gains of debt fund are taxed at 10% without indexation and 20% with indexation. To calculate capital gains with indexation, you should index your purchasing cost by multiplying the purchasing cost with the ratio of the cost of inflation index of the year of sale and cost of inflation index of the year of purchase, and then subtract the indexed purchasing cost from sales price. We have discussed in details the calculation of long term capital gain with indexation of debt funds with the help of an example in our article Top performing FMPs have given better returns than Bank FDs. Effective June 1 2013, dividend distribution tax (payable by the fund) on dividends given by debt funds (except money market and liquid funds) is 12.5% plus 10% surcharge plus 3% cess. The dividend distribution tax works out to be 14.1625%. The fund pays dividends to the investors, after deducting dividend distribution tax.

Choosing between growth and dividend option?

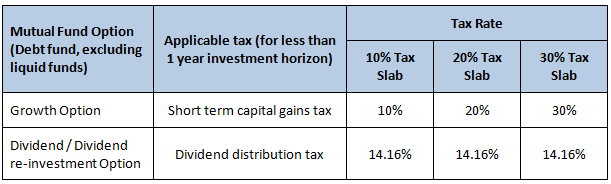

If your investment horizon in a debt fund is less than a year, you should let your tax status determine the choice between the growth option and dividend or dividend re-investment option. If you fall in the 10% tax slab, then you should opt for the growth option. If you are in the 20% or 30% tax slab, you should opt for the dividend or dividend re-investment option (please see the table below).

Here is a quick recap of tax treatment of debt funds, excluding money market and liquid funds.

Liquid Funds

From a tax perspective, liquid funds and ultra short term debt funds constitute money market and liquid funds. Short term capital gains (if the units are sold before one year) in liquid funds are taxed as per the applicable tax slab of the investor. Long term capital gains of debt fund are taxed at 10% without indexation and 20% with indexation. Effective June 1 2013, dividend distribution tax (payable by the fund) on dividends given by money market and liquid funds, is 12.5% plus 10% surcharge plus 3% cess. The dividend distribution tax works out to be 28.325%. The fund pays dividends to the investors, after deducting dividend distribution tax.

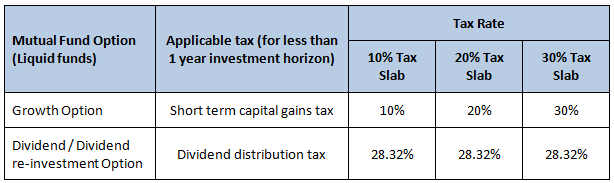

Choosing between growth and dividend option?

Like other debt funds, you should let your tax status determine the choice between the growth option and dividend or dividend re-investment option, if your investment horizon is less than a year. If you fall in the 30% tax slab, then you should opt for the dividend or dividend re-investment option. If you are in the 10% or 20% tax slab, you should opt for the growth option. We have discussed the tax consequence of growth and dividend options in liquid funds with the help of an example in our article Liquid Funds: A good option to park your surplus cash Part 1. The table below summarizes the tax consequence of growth and dividend options in liquid funds, for various tax slabs.

Here is a quick recap of tax treatment of money market and liquid funds.

Gold Funds

Tax treatment of Gold ETFs and Gold fund of funds is the same as debt funds excluding money market and liquid funds

Arbitrage Funds

Arbitrage funds aim to give risk free returns to the investors. Since arbitrage funds are risk free by definition, they are often compared to liquid funds. Over the past one year or so, arbitrage funds have given as much returns as liquid funds. However, the tax treatment of arbitrage funds is same as equity funds. If you opt for the dividend option in an arbitrage fund, then the fund does not have to pay dividend distribution tax, unlike debt and liquid funds. If you hold your arbitrage fund for over a year, the long term capital gains tax is nil. Debt and liquid funds, on the other hand, are subject to long term capital gains tax of 10% without indexation and 20% with indexation. Even though arbitrage funds are more tax friendly compared to debt and liquid funds, one should note that returns of arbitrage funds are contingent upon the availability of arbitrage opportunities in the market. We will discuss arbitrage funds, in a subsequent article.

Conclusion

In this article, we have discussed the effect of taxes on your mutual fund investment. Tax saving or tax reduction should never be your ultimate investment objective. Your investment objective should be determined by your personal financial goal. However, you should pay due attention to the impact of taxes on your investments and plan your investments accordingly, so that you achieve your investment objectives by maximizing the post tax returns on your investment. You should discuss the most tax efficient investment options for you with your financial adviser.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------