In our previous articles, How Mutual Fund SIPs have created wealth over the last 15 years: Large Cap and Diversified Equity and Mutual Fund SIPs have created wealth over the last 10 years: Small and Midcap funds, we had discussed how Systematic Investment Plans (SIPs) in good large cap, diversified equity and small & midcap funds have created wealth for the investors. In this article, we will discuss how Equity Linked Savings Schemes have created wealth for the investors in the last 12 years. Equity Linked Savings Schemes (ELSS) offer twin benefits of wealth creation and tax savings under Section 80C of the Income Tax Act. Investment in ELSS of up to Rs 1 lakh each year is eligible for deduction from your taxable income when assessing your income tax obligation for the year. From a fund portfolio perspective, an ELSS is essentially a diversified equity scheme with a lock in period of three years from the date of the investment. Each SIP investment in an ELSS will be locked in for 3 years from their respective investment dates. Therefore, if you started a monthly SIP of Rs 5000 in an ELSS from May 2014, your first SIP of Rs 5000 made in May 2014 will be locked in till May 2017. Your second SIP of Rs 5000 made in June 2014, will be locked in till June 2017. You should note this when you redeem your units in ELSS SIPs and plan accordingly. The lock in period is somewhat of an advantage for ELSS fund managers, because they are free from redemption pressures in the first three years and therefore can focus on managing a portfolio that gives good returns in the long term. There are both growth and dividend options for ELSS. For tax purposes, dividends and capital gains from ELSS are tax free. Compared to other tax saving instruments under Section 80C like PPF, NSC and life insurance premiums, ELSS has a much lower lock-in period and has the potential of offering superior returns over the long term. However ELSS is subject to market risks, like other mutual funds.

In this article, we will discuss how SIPs in tax saving funds or ELSS, have created wealth for their investors. For our discussion, we have selected 5 tax saving (or ELSS) funds that have given good returns in the last 12 years. This is, by no means, a comprehensive list of all the ELSS funds that gave good returns in the last 12 years. We should also note here, some of these funds, based on their last 1 to 3 year performance, may not be the top performing ELSS. To review the top performing ELSS based on CRISIL's December 2013 ranking, please visit our article,Tax Planning: Review of Top 6 Mutual Fund ELSS Schemes. This article aims to illustrate of how long term investments in SIPs, have created wealth for investors in ELSS funds, by leveraging the power of compounding. Each of the funds in our selection has created wealth for investors by giving compounded annual SIP returns of nearly 20% over the last 12 years. Since SIP investments are made over a period of time, the method of calculating SIP returns is different from that of Lump Sum investments. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except XIRR can calculate returns on investments that are not necessarily strictly periodic.

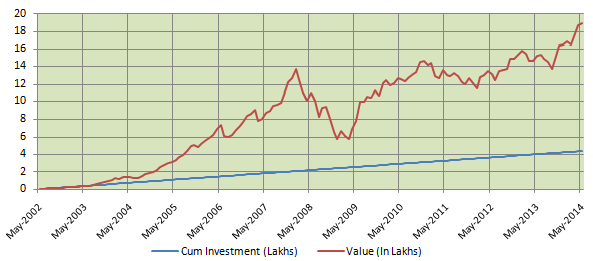

For our examples, we have assumed a monthly SIP of Rs 3000 only, made on first working day of every month in the ELSS funds that we will discuss. Let us assume the SIP start date was 12 years back in May 2002. Over this period, the investor would have invested Rs 4.4 lakhs in SIPs of the following mutual funds. Let us see how much wealth would they have accumulated, by investing in the following funds.

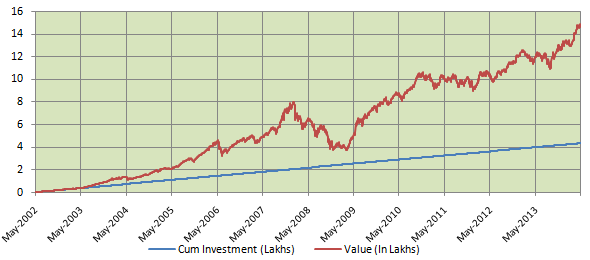

Franklin India Tax Shield:

The Franklin India Tax Shield fund, a tax saving scheme from the Franklin Templeton stable, one the oldest private Asset Management Companies in India, was launched in Apr 1999. The fund has just covered 15 years, and has given good returns during this period. The fund has an AUM base of over Rs 980 crores and is managed by Anand Radhakrishnan. The chart below shows the SIP returns of the Franklin India Tax Shield fund, growth option, over the last 12 years.HDFC Long Term Advantage Fund:

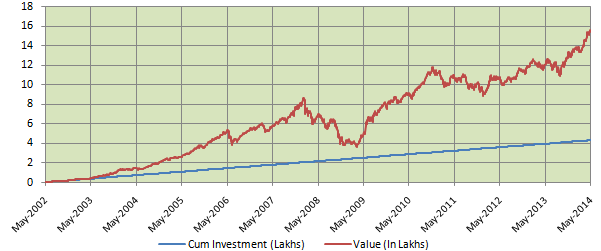

The HDFC Long Term Advantage Fund was launched in January 2001. This fund, from India's largest Asset Management Company, has an AUM base of over Rs 850 crores and is managed by Chirag Setalvad. The chart below shows the SIP returns of the HDFC Long Term Advantage Fund, growth option, over the last 12 years.HDFC Tax Saver Fund:

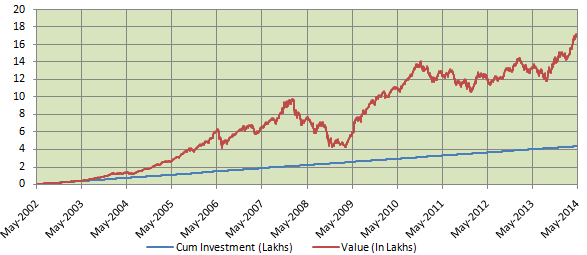

The HDFC Tax Saver Fund was launched in December 1995. This fund, from India's largest Asset Management Company, has a large AUM base of nearly Rs 3500 crores and is managed by Vinay Kulkarni. The chart below shows the SIP returns of the HDFC Tax Saver Fund, growth option, over the last 12 year.ICICI Prudential Tax Saving Plan:

The ICICI Prudential Tax Saving Plan, widely renowned as one of the best ever tax saving plans, was launched in August 1999. This fund from the ICICI stable has an AUM base of nearly Rs 1550 crores and is managed by Chintan Haria. The fund has been ranked, a good performer by CRISIL, in their latest mutual fund rankings. The chart below shows the SIP returns of the ICICI Prudential Tax Saving Plan, growth option, over the last 12 years.SBI Magnum Tax Gain 93 Scheme:

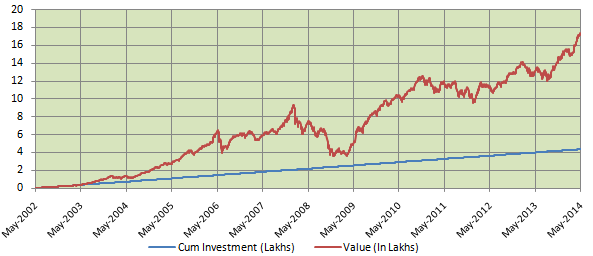

The SBI Magnum Tax Gain 93 scheme has given the highest compounded annual returns over the last 10 years, among all tax saving schemes. This fund was launched in March 1993 and has a large AUM base of over Rs 4100 crores. The fund is managed by Jayesh Shroff. The chart below shows the SIP returns of the SBI Magnum Tax Gain 93 scheme, growth option, over the last 12 years.

If you had started a monthly SIP of Rs 3000 in Franklin India Tax Shield fund back in May 2002, by now you would have accumulated nearly Rs 14.7 lakhs corpus, with an investment of only Rs 4.4 lakhs. You would have accumulated a corpus of Rs 5 lakhs by the end of 2007 and despite the severe financial crisis in 2008, a corpus of Rs 10 lakhs by the end of 2011. Over the 12 year period the compounded annual tax free returns on your SIP investment in this fund would be nearly 19%.

If you had started a monthly SIP of Rs 3000 only HDFC Long Term Advantage Fund back in May 2002, by now you would have accumulated a corpus of nearly Rs 15.5 lakhs, with an investment of only Rs 4.4 lakhs. You would have accumulated corpus of Rs 5 lakhs by the end of 2006 and beginning of 2007 and despite the severe financial crisis in 2008 / 2011, a corpus of Rs 10 lakhs by the end of 2011. Over the 12 year period from 2002 to 2014, the compounded annual tax free returns on your SIP investment in this fund would be close to 20%.

If you had started a monthly SIP of Rs 3000 only in HDFC Tax Saver Fund back in May 2002, by now you would have accumulated a corpus of nearly Rs 17 lakhs, with an investment of only Rs 4.4 lakhs. You would have accumulated corpus of Rs 5 lakhs by the end of 2006 and despite the severe financial crisis in 2008, a corpus of Rs 10 lakhs by the middle of 2010. You would have crossed the 15 lakhs mark by the end of last year. Over the 12 year period from 2002 to 2014, the compounded annual tax free returns on your SIP investment in this fund would be nearly 21%.

If you had started a monthly SIP of Rs 3000 only in the ICICI Prudential Tax Saving Plan back in May 2002, by now you would have accumulated a corpus of over Rs 17 lakhs, with an investment of only Rs 4.4 lakhs. You would have accumulated corpus of Rs 5 lakhs by the end of 2006 and despite the severe financial crisis in 2008, a corpus of Rs 10 lakhs by the middle of 2010. You would have crossed the 15 lakhs mark by the end of last year. Over the 12 year period from 2002 to 2014, the compounded annual tax free returns on your SIP investment in this fund would be well over 21%.

If you had started a monthly SIP of Rs 3000 only in the SBI Magnum Tax Gain 93 scheme back in May 2002, by now you would have accumulated a corpus of nearly Rs 19 lakhs, with an investment of only Rs 4.4 lakhs. You would have accumulated corpus of Rs 5 lakhs by the middle of 2006 and a corpus of Rs 10 lakhs by the end of 2007 and beginning of 2008. Despite a sharp fall in NAV due to the severe financial crisis in 2008, the fund recovered by 2009 – 2010. Your corpus in the fund would have crossed the Rs 15 lakhs mark by the middle of 2013 and by now you would be in touching distance of the Rs 20 lakhs mark. Over the 12 year period the compounded annual returns on your SIP investment in this fund would be nearly 23%. Surely, no tax saving investment would have been able to give such returns, in the last 12 years.

Conclusion

In this article, we have seen how SIPs in ELSS funds over the long term have created wealth for the investors. SIPs benefit from the power of compounding, and therefore the earlier we start our SIPs in ELSS, the greater is the potential for wealth creation. In addition, you can save taxes by investing in ELSS. However, tax saving should not be the only criteria for investing in ELSS. As discussed in this article, systematic investment plans in ELSS can create long term wealth for you. It is important, however, to select a good ELSS fund for your SIPs. Your financial advisers can help you select good ELSS funds that are suitable for your risk profile. As your risk profile changes over time, you should re-balance your portfolio to align with your risk profile. Tomorrow, we will discuss about SIPs in another category of mutual funds, balanced funds, which are inherently less risky than the equity oriented funds discussed so far.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------