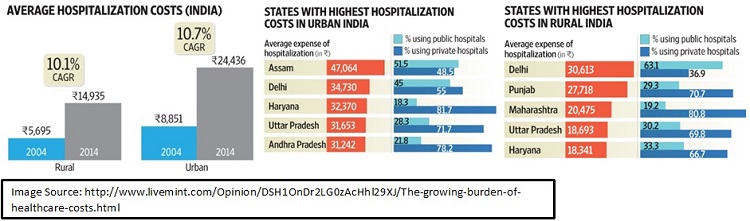

"He who has health, has hope; and he who has hope, has everything." –Thomas Carlyle Good Health seems hard to achieve and even harder to maintain. No matter how clichéd it sounds, health is wealth, and there's no denying this fact. The cost of healthcare treatments in Indian have been rising tremendously with approximately 10% annual growth from 2004 to 2014. With a scenario where an average expense of hospitalization is far from what an average citizen can afford in most of the states, health insurance becomes all the more imperative.

Most Indians who are covered by an insurance plan from their employer commit the mistake of perceiving their plan as an adequate one. However, these plans might be useful but not adequate. Such a mistake might cost you your entire life's savings at the time of crisis leaving you with nothing but bitterness and an empty pocket. Therefore, evaluating your needs and buying adequate cover is important to keep you and your family covered. Before you really get into it and choose a plan, there are certain things that you will need to consider. Needless to say, you don't want to fall into the trap of buying a plan that you do not need or cannot even use. Here are some pointers put together to help you find the perfect plan ultimately giving you the advantage you need when you're taking that fated trip to the doctor's office or even the emergency room (heaven forbid, though).

What's Your Health Telling You?

Buying health insurance that does not cover a health treatment you are most likely to need is useless, isn't it? So, if you are buying a plan, look for the day care procedures covered by your insurance provider. Interestingly, relying on a longer list of day care procedures can be misleading. Curious to know how? Suppose 'Provider A' enlists 20 day care procedures and 'Provider B' enlists 100. The list of 20 day care procedures mentions 'Dental Procedures' while the list of 100 mentions 10 specific dental procedures. Dental procedures is a broad term and might involve much more than those 10 specific procedures listed on the list of Provider B. That's how a short list of procedures might actually be wider instead of a longer list. Going through the entire list might help you decide which plan suits you better as there are plans that do not cover eye and dental treatments at all and you might want them in your plan.

Consider your Healthcare Provider

One of the biggest mistakes that people tend to make when trying to start a healthcare plan is not considering their health care provider. You may have a certain provider in mind, even if you have not started seeing them yet, and perhaps you are actually limited by your area. Whatever the case may be, you should always speak to your potential care provider first and make sure that they actually accept the insurance that you plan to obtain. Health Insurance Plans obtained from ICICI Lombard or other trusted insurance providers ensure that your insurance is acceptable in almost all the major hospitals. Double-check before you jump in. After all, is there any point buying an insurance plan that no one in your area accepts?

The Cost Sharing Issue

Over 80% of health insurance in India is private financing that includes a major fraction of out-of-pocket payments and ignoring the pre-payment schemes. If you have a surgery, for example, will the insurance company cover the entire thing, or will you be left standing with a portion of the bill? Even 10% of a bill can be rather costly, and it is not something that you want to be stuck with. Always speak with the insurance company to find out what kind of plan you need – if any from them. Even if you feel awkward doing so, always ask questions! It can save you untold amounts of trouble – more than you realize.

Are Your Dependents Covered?

Factor in the coverage you need for your kids, spouse or dependent parents and whether you have them covered in the insurance policy you looking to buy. The benefits of getting your family covered does not end at the level of security rather it offers great tax benefits as anyone paying premiums for parents, apart from themselves, spouse and children, they can claim deductions up to INR 55,000, according to Section 80D. While getting your family covered, evaluate predisposition towards ailments and your family's health history.

Think about Insurance Overcompensation

Some people tend to sign up for an insurance policy and take everything they can get 'just in case'. Do you really need your insurance plan to cover 90 percent of your policy? If you are a relatively healthy person, then there is a good chance that you can back off on the percentage and go with a plan that is a bit more suited to you. Also, a big cover is not necessary for combating your health care needs because a lot of top ups and add-on covers do the same job while costing you less.

Can You Customize?

The last thing to address is the failure to customize your plan. There is this inherent belief that one size fits all when it comes to insurance, and it simply isn't true. There are so many things to consider regarding your health, habits, age, area you live in etc. for example, if you are living in Delhi or Mumbai with a family of four young and healthy members, you can go for a cover of 5 lacs which has to be increased every 5 years considering inflation, health requirements and ageing. Figure out what type of coverage you need, and then make your purchase.

There are many more mistakes that can be made in the name of healthcare purchases, and these are merely a few of them. Figuring out most of them before you fall and commit them can save you loads of annoyance and stress. Start planning your future today. Talk to a healthcare provider, speak with an insurance expert, and live a happy, healthy life for the foreseeable future.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------