Sushant has one term insurance plan of र 50 lacs sum assured. Mukul has two term plans of र 25 lacs each from two different life insurance companies. Which is more advantageous? Sushant pays an annual premium of around of र 5,500, while Mukul pays a total premium of around र 6,500 per annum for his two policies. For the same sum assured Sushant pays र 1,000 less than Mukul per annum. Surely, Sushant is better off? Not necessarily. We will discuss in more details in this blog.

At the very outset, please note that we will restrict our discussion only to term plans. In a term plan, the nominee of the insured gets the sum assured in the event of an untimely death. There is no maturity benefit if the insured outlives the term of the insurance policy. On the other hand, in a traditional insurance cum savings plan (e.g. endowment plans) the insured gets the sum assured and the bonus amount on maturity. Term plan is the best form of life insurance because it provides the necessary cover at the lowest cost. Please read our article, Taking term plan can be a smart insurance choice.

Rejection of death claims

One of the nightmare scenarios of the family of the insured is the claim getting rejected after an unfortunate death. Why do claims get rejected? There can be a number of reasons why claims can get rejected.

- Incorrect information in the proposal form

- Failure to disclose medical history correctly

- Policy lapsing

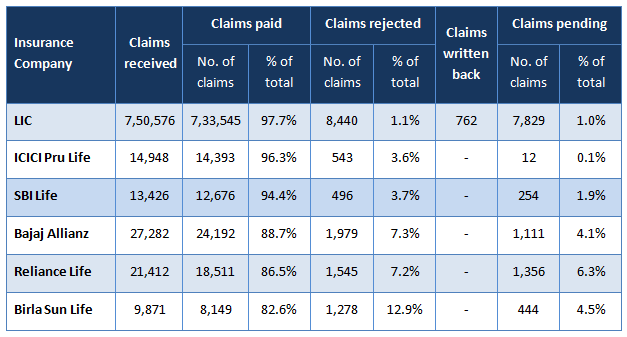

While a majority of the death claims do get paid, it is also true that some death claims get rejected. Some insurers have a better claims settlement track record than others. The table below shows the claims settlement ratios for the some of the biggest life insurers in FY 2012 – 2013 (you can find the same information for all insurers in the death claims table in the IRDA annual report, available for download on the IRDA website)

One should always select a life insurer with an excellent claims settlement track record. Having said that, rejection of a death claim, however small the probability might be, can cause severe financial distress for the family of the insured. Since there is no maturity benefit in a term plan, if a death claim gets rejected the nominee of the insured gets nothing. Some insurance agents argue that in an endowment plan the insured at least gets the surrender value. This is no reason why one should buy endowment plans. On the other hand buying multiple term plans from different insurers, reduce the overall probability of non-fulfilment of death claims. If the death claim is rejected by one insurer and paid by another, the family of the insured can get at least the sum assured of one term plan. The other benefit of multiple term plans is that in the event one insurer pays the death claim while another rejects it, the family of the insured can follow up with the insurer who has rejected the death claim with the evidence that they have received the claim from another insurer. This can force the insurer which rejected the death claim to review the claim again. However, when buying multiple term plans from different insurers, the insured should always select insurers with good claims settlement record, even if it means paying a little higher premium. A cheaper policy is no good, if the insurer cannot fulfil the claim in the event of an untimely death.

Cost Benefit Analysis

The cost of multiple term plans is definitely more than that of a single term plan of the same sum assured. Does the benefit outweigh the cost? Let us look at it objectively by referring to the example with which we began this blog. Sushant and Mukul have bought the same life cover of र 50 lacs. While Sushant has a single 20 year term plan, for which he pays a premium of र 5,500 per annum, Mukul has two 20 year term plans for which he pay a total premium of र 6,500 per annum. Mukul pays र 1,000 extra for the same sum assured. The र 1,000 cost saving made by Sushant compared to Mukul, could be invested at an interest rate of 9% over a 20 year period resulting in a future value of र 51,160. This is the opportunity cost for Mukul. However, if Sushant's death claim is rejected, his family will not get anything. On the other hand, if the death claim on one of Mukul's term plans is rejected but the other one is paid, Mukul's family will get र 25 lacs of sum assured. The benefit of र 25 lacs surely outweigh the additional र 51,160 opportunity cost.

Conclusion

The objective of life insurance is to buy financial protection for your family in the event of an untimely death. Buying multiple term plans strengthens the protection at a relatively small additional cost. When buying additional term plans, it is important that you declare your existing sum assured in the proposal form. You should always remember to compare different term plans before buying your policy.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------