Asset allocation is the most important aspect of financial planning. A lot of investors allocate a sub-optimal proportion of their portfolio to equities. This is because the risk appetite of investors in India is low. However, it is very important that investors and financial advisers understand the distinction between risk appetite and risk tolerance. Simply put, risk appetite is the investor's willingness to take risk, whereas risk tolerance is the investor's ability to take risk. We have discussed the difference between risk appetite and risk tolerance in our article, Measuring Risk Tolerance of Investors.

There are several important factors that determine the risk tolerance of an investor:-

- Income and Expenses of the investor

- Liquid (cash savings) of the investor

- Short term financial goals

- Long term financial goals

- Insurance cover (both life insurance and health insurance) of the investor

Even though risk tolerance is the most important logical foundation of asset allocation strategy for financial planning, from a practical standpoint, one cannot wish away the influence that risk appetite has on a person's investment style. In this article, we will discuss several asset allocation strategies that suit different investment styles. Ideally, investors should determine for themselves the asset allocation strategy that is most suitable for their short term and long term investment goals. They can also consult with their financial advisers, as to what strategy is most suitable for their investment considerations.

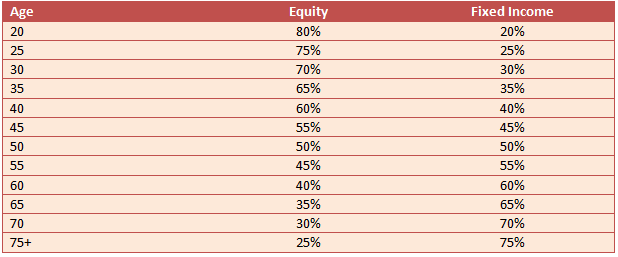

Rule of 100:

This is a very popular thumb rule for measuring risk tolerance. Simply put, you should subtract the investor's age from 100, and the result suggests the maximum percentage amount of the investor's portfolio that should be exposed to equities. So for a 25 year old investor, this rule suggests that 75% of his or her portfolio should be invested in equities, and for a 40 year old investor, this rule suggests that 60% of the portfolio should be invested in equities. This is the conventional asset allocation model, and is ideally suited for a passive investor. The table below shows the asset allocation guidance for different age groups.

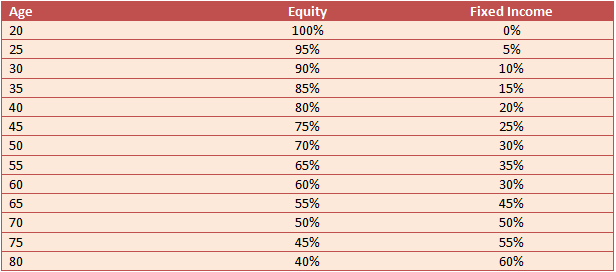

Rule of 120

This is a modification of the "Rule of 100". This strategy calls for a slightly more aggressive allocation to equities. We are living longer, thanks to better healthcare facilities available to us, more awareness about healthcare needs, and better dietary habits. If we are to live longer, then a logical consequence is that our post retirement life is also longer, which means that we need a greater allocation towards equities to take care of income requirements in our longer post retirement lives. How does it differ from the "Rule of 100"? You subtract your age from 120 to figure out how much of your portfolio should be allocated towards equities. The table below shows the asset allocation guidance for different age groups, as per this strategy.

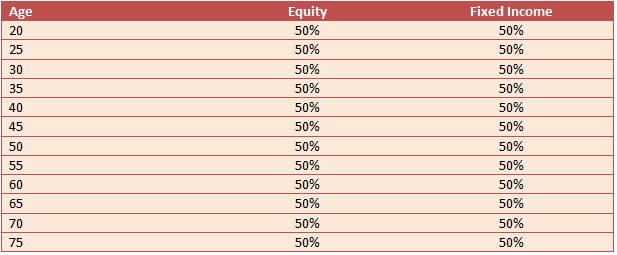

Risk Aversion investment model:

Naturally, we are all risk averse. Nobody wants to lose their hard earned money. However, the degree of risk aversion is different for different investors. Investors with a higher risk appetite will be more comfortable with short term volatility than investors with low risk appetite. If your risk appetite is zero, then you should avoid equities. But bear in mind, you will not be able to create wealth from your investment. You will have to rely on more savings from your current income to create wealth. On the other hand, if your risk appetite and risk tolerance is moderate, you should go for an appropriate mix of equity and fixed income in your portfolio, in line with their short term and long term cash flow requirements. This strategy, in some cases, is suitable for new entrepreneurs, who want a degree of safety, with regards to their investment portfolio, because they may need to deploy their investment at any stage to meet their business requirements. It may seem strange, that we are associating this asset allocation model with entrepreneurs, who by nature are high risk seeing individuals. However, these individuals may not always entirely rely on the growth of their investment funds to fund their business requirements, but rather depend on them to meet their liquidity requirements from time to time. The table below shows the asset allocation guidance for different age groups, as per this strategy.

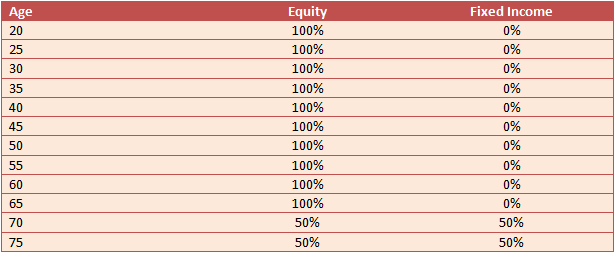

Risk Loving investment model:

While nobody wants to lose their money, investors who can rely on income from sources other than their own investments for their living and other expenses, can afford to take higher risks. As per the fundamental rule of Finance, higher risk also translates into higher returns. Investors with a higher risk appetite will be more comfortable with short term volatility than investors with low risk appetite, and will be comfortable with a longer investment horizon. Typically, there will be two kinds of investors, who fall in this category. (1) Investors with high net worth, with a very long time horizon for equity investments. (2) Investors with low net worth and who are willing to risk, because the capital at risk is smaller. The table below shows the asset allocation guidance for different age groups, as per this strategy.

Conclusion

There are no hard and fast asset allocation rules for investors. Asset allocation for investors depends on a number of factors. These are, as stated above, Income and Expenses of the investor, Liquid (cash savings) of the investor, Short term financial goals, Long term financial goals and Insurance cover (both life insurance and health insurance) of the investor. Financial advisers should advise and educate the investors, with regards to their asset allocation strategies. Investors should also educate themselves about different asset allocation methodologies and decide for themselves, which one is suitable for the long term growth of their wealth.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------