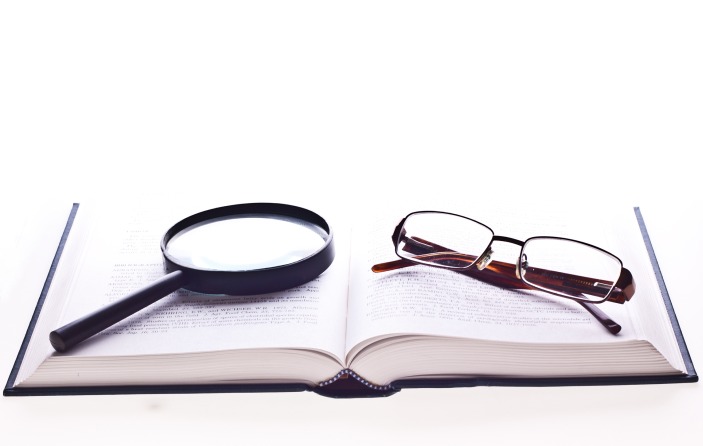

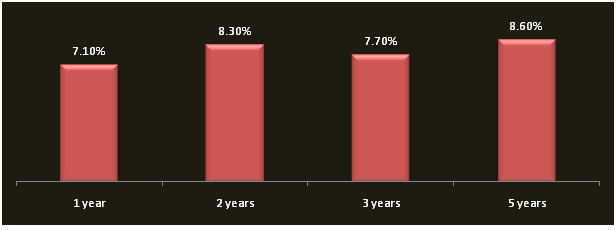

Post office Monthly Income Scheme has for long been a favourite with investors who want regular monthly income from their investments. They offer risk free 8.5% returns and are especially preferred by conservative investors, like retirees who need regular monthly income from their investments. However, top performing mutual fund monthly income plans (MIPs) have beaten Post Office Monthly Income Scheme (MIS), in terms of annualized returns over the last 5 years, by investing a small part of the corpus in equities which can give higher returns than fixed income investments. The value proposition of the mutual fund aggressive MIPs is that, the interest from debt investment is supplemented by an additional boost to equity returns. Please see the chart below for five year annualized returns from Post office MIS and top performing mutual fund MIPs, monthly dividend options.

It is clear from the chart above the top performing mutual fund MIPs have beaten Post Office MIS in terms of 5 years annualized returns on a pre tax basis. It is important to note the following points for mutual fund MIPs.

Guaranteed Returns:

Even though mutual MIPs though aim to pay each month, they do not guarantee monthly payments to investors. In equity market downturns, it is common for mutual fund MIPs to miss out on monthly dividends. Even if they pay monthly dividends to the investors, the amount of monthly dividends is not assured. Post Office Monthly Income Scheme (POMIS), on the other hand, offers guaranteed 8.5% annualized returns to investors.Liquidity:

Mutual fund MIPs are more liquid than POMIS. For premature withdrawals, POMIS are subject to a deduction of 2% of the amount invested if such a withdrawal happens within three years of investment. After three years, the amount of deduction is 1% of the amount invested. MIPs, on the other hand, charge 1% exit load for redemption of units within one year of allotment.Tax Consequence:

The interest income from POMIS is taxed as per the income tax slab of the investor. If the investor is in the highest tax bracket, their monthly income for Post Office MIPs will be taxed as 30.9%. On the other hand monthly dividends from the mutual funds MIPs are tax free in the hands of the investor, even though the AMC has to pay a dividend distribution tax of 13.5%. Therefore, mutual fund MIPs are more tax efficient than Post Office MIS. So over an investment of Rs 4.5 lakhs, with the same rate of return, you can save Rs 11,800 per year on taxes by investing in mutual fund MIPs versus post office MISMaximum Investment:

The maximum investment limit in Post Office MIS is only Rs 4.5 lakhs in one account or Rs 9 lakhs if the investor is investing in a joint account. There is no such limit on investments in MIPs. Therefore, it makes more sense for investors with higher investible corpus to invest in mutual fund MIP.

In conclusion, if you are looking for guaranteed monthly income from your investments, then you may opt for Post Office MIS. However, if you are willing to take small amounts of risks, and sacrifice guaranteed monthly income then mutual fund MIPs can provide greater returns in comparison to post office MIS. It is also important for investors to note, that in the monthly dividend option of the mutual fund MIPs, the dividends can be paid only out of the income and not out of the capital of the investor.

Review of Top 5 Mutual Fund Monthly Income Plans

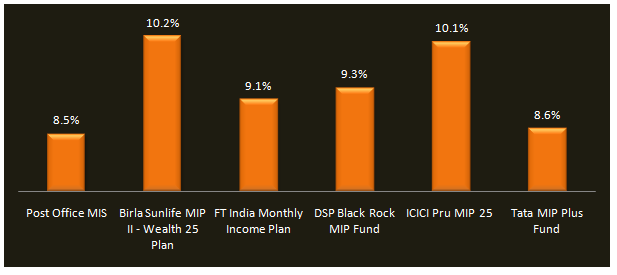

Birla Sunlife MIP II - Wealth 25 Plan:

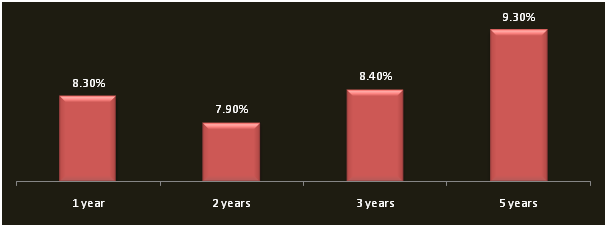

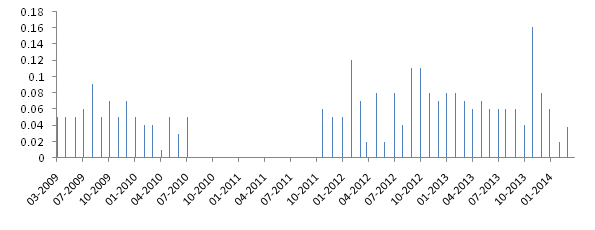

This scheme was launched in Apr 2004. The monthly dividend plan gave a 5 year annualized return of 10.2%. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

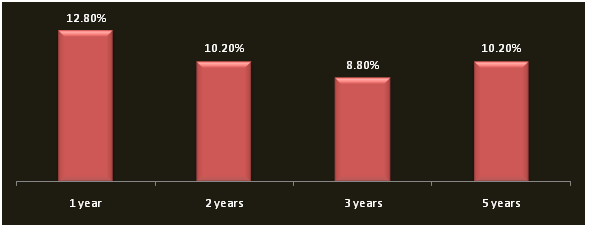

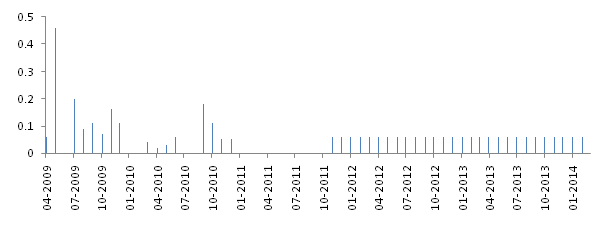

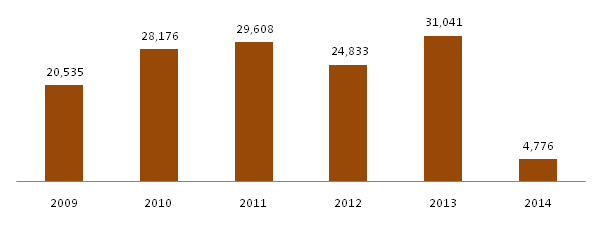

The minimum investment in the scheme is Rs 5,000. The asset allocation of the portfolio is 30% equity, 64% debt, 3% money market and 4% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

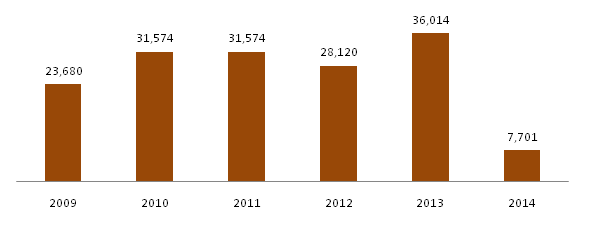

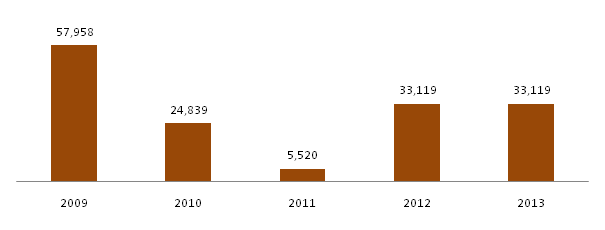

As one can see from the chart above, the fund paid monthly dividends to the investors regularly over the last 5 years, except for brief periods in 2010 and 2012. Please see the chart below, for annual dividend income from the fund over the last 5 years, for an investment of Rs 500,000 in the fund 5 years back. Compare these returns with the Rs 26,400 post tax income from POMIS.

FT India Monthly Income Plan:

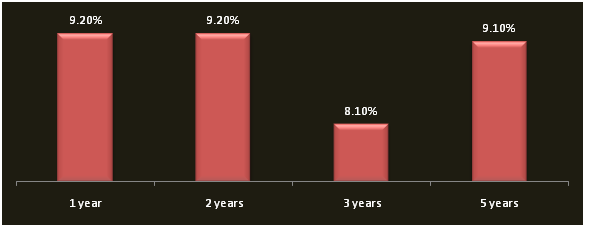

This scheme was launched Sep 2000. The monthly dividend plan gave a 5 year annualized return of 9.1%. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

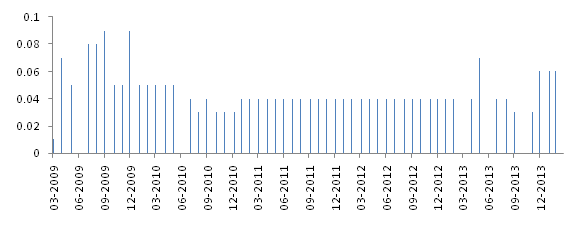

The minimum investment in the scheme is Rs 10,000. The asset allocation of the portfolio is 19% equity, 63% debt, 13% money market and 5% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

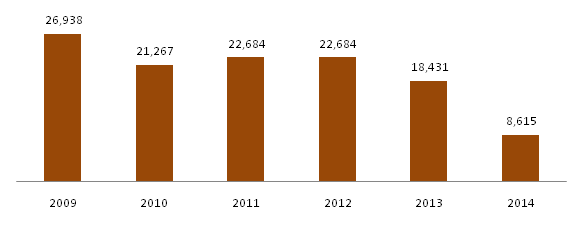

As one can see from the chart above, the fund paid monthly dividends to the investors regularly over the last 5 years, except for very brief periods in 2009, 2010 and 2013. Please see the chart below, for annual dividend income from the fund over the last 5 years, for an investment of Rs 500,000 in the fund 5 years back. Compare these returns with the Rs 26,400 post tax income from POMIS.

DSP Black Rock MIP Fund:

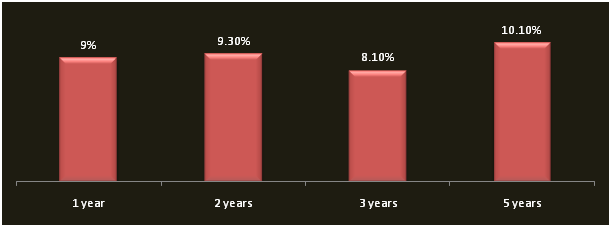

This scheme was launched in May 2004. The monthly dividend plan gave a 5 year annualized return of 9.3%. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

The minimum investment in the scheme is Rs 5,000. The asset allocation of the portfolio is 25% equity, 72% debt, 1% money market and 5% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

As one can see from the chart above, the fund was not able to pay monthly dividends regularly in 2010 and 2011. Please see the chart below, for annual dividend income from the fund over the last 5 years, for an investment of Rs 500,000 in the fund 5 years back. Compare these returns with the Rs 26,400 post tax income from PO MIS.

ICICI Prudential MIP 25:

This scheme was launched in March 2004. The monthly dividend plan gave a 5 year annualized return of 10.1%. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

The minimum investment in the scheme is Rs 5,000. The asset allocation of the portfolio is 24% equity, 74% debt and 2% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

As one can see from the chart above, the fund was not able to pay monthly dividends regularly in 2010 and 2011. Please see the chart below, for annual dividend income from the fund over the last 5 years, for an investment of Rs 500,000 in the fund 5 years back. Compare these returns with the Rs 26,400 post tax income from PO MIS.

Tata MIP Plus Fund:

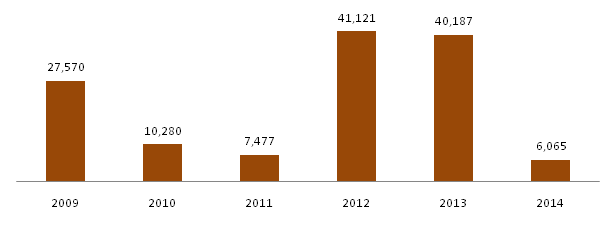

This scheme was launched February 2004. The monthly dividend plan gave a 5 year annualized return of 8.6%. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

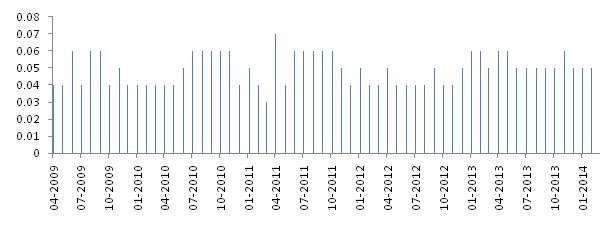

The minimum investment in the scheme is Rs 25,000. The asset allocation of the portfolio is 20% equity, 71% debt, 1% money market and 8% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

As one can see from the chart above, the fund paid regular monthly dividends during this 5 year period. Please see the chart below, for annual dividend income from the fund over the last 5 years, for an investment of Rs 500,000 in the fund 5 years back. Compare these returns with the Rs 26,400 post tax income from PO MIS.

Conclusion

Top performing monthly income plans from reputed fund houses, have provided good monthly income especially compared to post office MIS. It is important to note that, investors who prefer guaranteed monthly income should opt for post office MIS. However, investors who are willing to take a bit of risk, can opt for mutual fund MIPs for getting higher returns associated with the equity portion of the portfolio mix and the greater tax efficiency associated with MIPs in comparison with post office MIS. Consult with Prajna Capital, it mutual fund MIPs are suitable for their income needs.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------