In our article, Asset Allocation strategies for different age groups, we had discussed that asset allocation for investors depends on a number of factors. The different factors are:-

- Income and Expenses of the investor

- Liquid (cash savings) of the investor

- Short term financial goals

- Long term financial goals

- Insurance cover (both life insurance and health insurance) of the investor

As discussed in 6 Key steps of Financial Planning process, the next step in the financial planning process is to structure an investment portfolio that will meet the different short term and long term goals of the investor. In this article, we will discuss some broad guidelines to construct a mutual fund portfolio based on investment horizon, risk tolerance and liquidity considerations of the investor. It should be noted that, various other asset types, like shares, bonds, PPF, FDRs, real estate etc can also form part of the investment portfolio. However, we will restrict our discussion only to mutual funds in this article. Mutual funds are very versatile instruments and offer a variety of choices to the investors, depending on their investment objectives (capital appreciation versus income), investment horizon (short term versus long term) and risk tolerance. Therefore, portfolio construction guidelines for mutual funds can also be extended to other asset types, based on the nature of the asset.

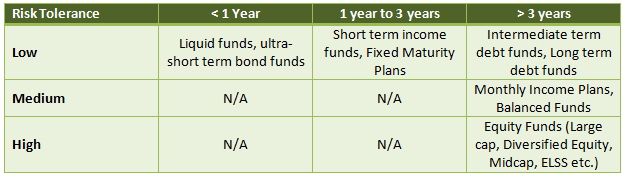

The portfolio construction guidelines are based on three factors, investment horizon, risk tolerance and liquidity considerations. Out of these three factors, investment horizon and risk tolerance are interlinked. In general, the shorter the investor's horizon, the less risk he/she should be willing to accept. However, within the same investment horizon, the degree of risk tolerance may be different for different investors (we will discuss in more details later in the article). The table below shows, the various investment options in mutual funds depending on the investment horizon and risk tolerance levels.

Let us now discuss these in more details, for each of these cases.

Investment Horizon less than one year:

If you need to park your cash for just a few months, then you should look at liquid funds or ultra-short term debt funds. If you need your funds within one to three months, then you should go for liquid funds. If you can wait for 6 to 12 months, then you should go for ultra-short term debt funds. Ultra-short term gives slightly higher returns than liquid funds, but they may be volatile in the very short term (1 to 3 months). Some ultra-short term debt funds charge a small exit load (around 25 bps) for redemption within a month. Liquid funds and ultra short term debt funds can give pre-tax returns of 9 – 10%, compared to the 4% interest paid by savings bank. Withdrawals from liquid funds are processed within 24 hours on business days. Therefore, other than the funds that you need for your day to day expenses and an amount for contingency that you keep in your savings bank, you should consider parking your surplus cash in liquid or ultra short term debt fund.Investment Horizon from 1 year to 3 years:

If you have a one to two three year time horizon, you should invest in short term income funds or fixed maturity plans. Fixed maturity plans (FMPs) are close ended schemes that aim to generate income for the investors in a fixed term. In the last one year, top performing FMPs have given better returns than bank fixed deposits even on a pre tax basis. On a post tax basis, FMP returns are even better compared to bank fixed deposits, because FMPs get indexation benefit on taxes. However, FMP investors should note that since FMP is a close ended scheme, there is virtually no liquidity before the fixed term. If liquidity is an important consideration, then investors should opt for open ended short term income funds. Between FMPs and short term income fund, the predictability of returns in higher in FMPs. Therefore, if you have a fixed time horizon, have a target minimum return on your short term investment and no liquidity concerns before the redemption of the fund, then you should go for FMP. On the other hand, if you are more flexible with regards to your investment horizon, then short term income fund is the better option. FMPs are particularly suitable, in a high interest regime environment, where you can lock in higher yields. On the other, if interest rates are falling, short term income funds are more suitable.Investment Horizon of more than 3 years:

If your investment horizon is more than 3 years and you have low risk tolerance levels then, you should invest in intermediate term debt funds or long term debt funds. If you have slightly higher risk tolerance then, you should go for monthly income plans. Monthly income plans invest primarily in debt instruments, while maintaining a small allocation in equity instruments. They are suitable for retirees, looking for regular income from their investments as well as a bit of capital appreciation. Balanced funds on the other hand are suitable for investors, with a moderate risk tolerance level and a longer time horizon (5 to 10 years). These funds typically have 60 – 70% of the portfolio invested in equities and the rest in fixed income securities. These funds are suitable for investors, looking for capital appreciation, without assuming substantial risks on the capital invested. These funds are suitable for investors, who are 5 years or so away from retirement or other long term financial objectives. On a risk adjusted basis top performing balanced funds have delivered excellent returns compared to diversified equity funds. If you have longer time horizon, say 5 to 10 years or more, and if you are willing to take more risks, then equity funds is the way to go. Investors should note that, equity as an asset class provides the highest returns in the long term. However, investors in equity funds do have to contend with volatility, which means that they cannot have a short time horizon. Top performing equity funds have given more than 20% returns. Equity funds are suitable for long term financial planning objectives like, retirement planning, children's education, children's marriage, house purchase etc. There are a large number of investment options within equity funds like,large cap funds,diversified equity funds, Equity Linked Savings Schemes (ELSS), small & midcap funds, thematic funds etc which may cause the investor to be confused, as to which is the best investment option. What option is suitable for you depends on your personal situation, however, we will discuss several considerations which may help you make the appropriate choice:-- Many investment experts believe that diversified equity funds, which comprise of both large cap and midcap stocks, are the best long term investment options for financial objectives like, retirement planning, children's education, children's marriage, house purchase etc. Diversified equity funds carry slightly more risk than large cap funds, but also give higher returns, compared to large cap funds. At the same time, they are not as volatile as small and midcap funds.

- If tax saving is a consideration, then you should choose ELSS. Under Section 80C of Income Tax Act, investment in ELSS of up to Rs 1 lakh (subject to the overall limit within Section 80C) is eligible for deduction from your taxable income and therefore will qualify as tax saving investment for you. ELSS funds have a lock in period of 3 years from the date of investment, and therefore will have an impact on your liquidity considerations. However, tax saving should not be the only consideration to invest in ELSS. ELSS are essentially diversified equity funds and have given excellent returns, over various long term investment horizons.

- Large cap funds, which comprise mainly of large cap stocks, have the lowest risk among equity funds categories. Large cap funds, to some extent, limit downside risks in bear market conditions. However, based on historical performance, large cap funds have given 2 – 3% lower returns than diversified equity funds. The performance differential with respect to small & midcap funds is even more, at nearly 6 – 7%, if not more.

- Small and midcap funds are inherently more risky than large cap and diversified equity funds. But these funds have the potential to give higher returns. As discussed earlier, compared to a large cap fund, a small & midcap fund can give 6 – 7% higher returns. What does it mean in terms of actual numbers? For a lump sum investment of just Rs 5 lakhs, the difference in returns over a 10 year timeframe can be as high as Rs 20 lakhs. When should you invest in small and midcap funds? If you have an aggressive return on investment target. For example, if your annualized return on investment target on a portion of your equity portfolio is more than 25%, you should invest in small & midcap funds. However, small and midcap funds should constitute, only a portion of your equity funds portfolio. Though there are no hard and fast rules for allocations to midcap funds, there are some broad guidelines (subject to the personal financial situation and the risk tolerance level of the individual investor):-

- Very aggressive risk tolerance: 80% large cap / diversified equity and 20% small & midcap

- Aggressive risk tolerance: 85 – 90% large cap / diversified equity and 10 – 15% small & midcap

- Less aggressive risk tolerance: 95% large cap / diversified equity and 5% small & midcap

Conclusion

In this article, we have discussed how you can construct your mutual fund portfolio, based on the investment horizon of your various short term and long term investment objectives. A thoughtfully constructed investment portfolio will ensure success in meeting your financial objectives. You should discuss with Prajna Capital, what investment options are suitable to meet the objectives in your financial plan.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------