The Public Provident Fund (PPF) is often described as perhaps the only social security measure available to Indian investors. This might not remain so in the current form, if the government adopts the recommendations in The Economic Survey 2015-16.

PPF is one of the small savings schemes that have fixed deposit rates and compete with bank deposits. This Survey classifies such schemes, as 'actually small', not so small' and 'not so small at all'. And, PPF is categorised as 'not so small'. The effective returns to PPF deposits are very high, creating a large implicit subsidy which accrues mostly to taxpayers in the top income brackets. The magnitude of this implicit subsidy is about six percentage points - approximately Rs 12,000 crore in fiscal cost terms

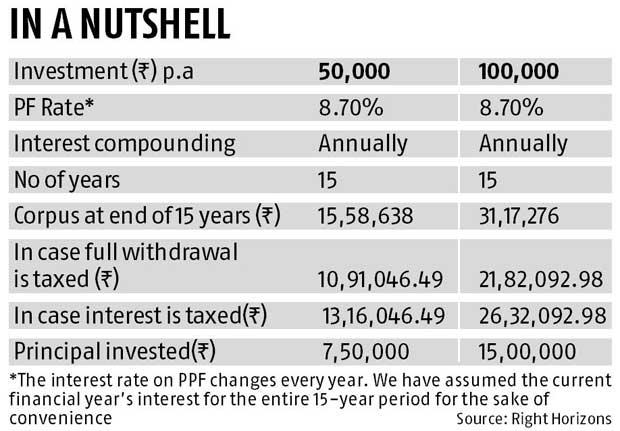

The Survey recommends India move in a phased manner to the EET method of taxation of savings. Wherein, the first E stands for tax exemption of the contribution, the second one for exemption of the interest income, and T for taxation of the principal (and interest) when it is withdrawn.

"Interestingly, the New Pension System (NPS) is already being subjected to the EET method of taxation. Therefore, deductions under Section 80C and 80CCD should be re-assessed to move toward a common EET principle for tax savings," the Survey says.

PPF is a universally used instrument for savings, especially for the non-salaried class, since they are able to lock-in money for the long term. If you take away the tax benefits, it will lose its shine

If PPF is taxed with retrospective effect, it will be a big negative for those who have been regularly saving in it. It could also drive investors towards NPS, says Anil Rego, founder of Right Horizons, a financial advisory and management entity.

It is true that PPF is a HNI (High Net worth Investor) product. We advise our clients to invest in PPF because on a post tax basis, the returns are significant. But, if it taxed with prospective effect, investors can take an informed decision. They will compare the returns of PPF and NPS and then decide where to invest. NPS is low cost and could give better returns because it has some equity exposure

For several salaried taxpayers, their employee provident fund takes care of the Rs 1.5 lakh exemption limit under Section 80C. Yet, they continue to invest in PPF because the after-tax returns are entirely tax-free. If taxed, it will not make sense for such taxpayers to invest in PPF.

Faced with an uncertain economic situation and a falling interest rate scenario, small savers have very few options other than the voluntary contribution to PPF. Even those salaried taxpayers who are covered by their employers' superannuation schemes end up paying tax on the latter's contribution if it exceeds Rs 1 lakh a year. While the interest is not taxed, if the employee withdraws the money before retirement, it is taxed. This, too amounts to double taxation,

India has a large working population but not the kind of social security that is available in developed countries. While it is true that the small savings interest rates are a burden for the government, it should take more steps to increase the tax base. It should ensure that those who don't pay taxes do so, instead of taxing middle income taxpayers

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------