For salaried employees, the deadline to submit the provisional tax saving investment proofs is fast approaching. Most of the employers collect the documents in January. During this period investors/employees who have not done their tax planning rush to buy life insurance policies or some other tax saving investments. There is one tax saving option which I believe is the best investment avenue both in terms of tax benefit and wealth creation. I am talking about ELSS (Equity Linked Savings Schemes) Mutual Funds. Let us analyze and identify the Best ELSS Tax saving Mutual funds.

Features / Benefits of Investing in ELSS Mutual Funds:

- ELSS Mutual Funds are one of the best tax saving options under Section 80c. Infact, ELSS MF scheme is the only pure investment option under Section 80C through which investors can take exposure to equity markets.

- ELSS Tax saving mutual funds come with a lock-in period of three years, the lowest among all the tax saving options that are available under Section 80C. (PPF's lock-in period is 15 years, Tax saving Bank Fixed Deposit's is 5 years, National Saving Certificate's is 5 years etc.,)

- ELSS falls under EEE tax rule (Exempt-Exempt-Exempt). No taxes are applicable during Contribution-Accumulation-Withdrawal phases. Investments get tax deduction under Section 80C, so you don't have to pay tax on the amount invested in the ELSS fund. The capital gains generated by the fund are also exempt from tax as the investments are not withdrawn. Finally, withdrawals are also tax-free because there is no tax payable on long-term capital gains from equity-oriented mutual funds. The Employee Provident Fund and the Public Provident Fund are the only other investment options that enjoy the EEE tax treatment.

- Dividends declared on these schemes are also tax free in the hands of unit-holders (investors)

- You can start a SIP in ELSS MF with a minimum investment (as low as Rs 500). Unlike an life insurance, you don't have to commit multi year investments.

- There is no upper limit for investment in ELSS but the maximum tax benefit is limited to Rs 1 lakh under Section 80C.

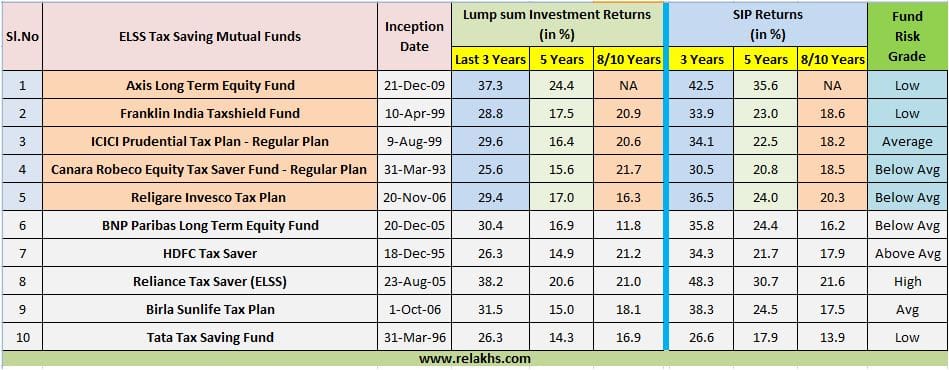

Top 10 ELSS Tax saving Mutual Funds

There are around 93 ELSS funds under Tax Saving/ELSS Fund category. In the last five years the average returns generated by ELSS fund category is around 11% to 13% .

Let me first list down the top performing Equity Linked Saving Schemes purely based on the investment returns (past performances). I have considered both lump sum as well as SIP returns for the past 3years to 10 years. I have considered only those funds which are atleast 5 years old.

- Axis Long Term Equity Fund

- Franklin India Tax Shield Fund

- ICICI Prudential Tax Plan – Regular Plan

- Reliance Tax Saver (ELSS)

- Birla Sunlife Tax Plan

- BNP Paribas Long Term Equity Fund

- Canara Robeco Equity Tax Saver Fund – Regular Plan

- Religare Invesco Tax Plan

- Tata Tax Saving Fund

- HDFC Tax Saver

Methodology to select Top 5 Equity Linked Saving Schemes for SIPs or Lump sum investments :

As with any fund investment, when narrowing down to identify the best funds, an error many investors are prone to make is opting for the most recent chart topper. We need to consider the funds' long term performances and other important factors too while shortlisting the best funds.

I have followed below points/methodology to shortlist best 5 ELSS funds out of the above ten funds.

- Returns : I have shortlisted these top performing ELSS MFs based on monthly SIP returns and Lump sum Investment Returns.

- Another factor is 'the age of the fund'. How long has the mutual fund been in existence? That gives us a chance to look at its performance over long periods of time. Funds with a good track record for the last 5 to 10 years have been preferred.

- Risk Vs Return : Some funds may generate very good returns but at the cost of very HIGH RISK. We need to look at risk-return trade off also. I have analyzed some of the important ratios to measure risks of mutual funds. These are like Standard Deviation, Alpha, Beta, Sharpe Ratio and overall Risk grades of the funds.

- I have considered Upside capture ratios and Downside capture ratios. (These ratios show us whether a given fund has outperformed–gained more or lost less than–a broad market benchmark during periods of market strength and weakness, and if so, by how much)

- I have considered Expense ratio as one of the criteria

- I have not considered the STAR ratings of funds provided by Ranking agencies. Usually these star ratings reflect the short term (1 or 2 year's) performance of the funds.

- I have also given importance to "Fund's Risk Grade."

- The primary sources of information are moneycontrol, valueresearchonline and morningstar.

Top 5 ELSS Tax Saving Mutual Funds for 2016

(Click on the image to enlarge or to open it in a new browser window)

- Axis Long Term Fund has very high Alpha and Low Fund Risk Grade. This fund has been performing really well for the last 5 years or so. This fund has given 5 year SIP returns of around 35%, one of the highest in ELSS fund category.

- Franklin India Taxshield Fund is one of my favorite funds. This fund has consistently performed well for the last many years. The standard deviation of this fund is also low. Franklin Taxshield is suitable both for lump sum and SIP investments.

- ICICI Prudential Tax Plan has 'average' fund risk grade. You may have to stomach little bit of volatility to get good returns from this fund. This fund has been performing well for the last 10 years.

- Canara Robeco Equity Tax Saver Fund has given returns of 21.7% during last 10 years ( on lump sum investment). This is the highest among all the above ten funds. The standard deviation of this fund is also low.

- Religare Tax Saver Fund has given good SIP returns for the last 8 years.

- HDFC Tax saver was the darling of many mutual fund investors for a long time. Off-late the volatility has been on the higher side for this fund. It also has very low Alpha ratio. Investors who can afford to take high levels of risk can still prefer HDFC Tax Saver.

- If you consider Returns as the only criteria to shortlist a fund then Reliance Tax Saver Fund can surely be rated as a top ELSS fund. But when you consider other factors like high Standard Deviation, High Fund Risk Grade, high Beta ratio etc., then your decision might change.

- TATA Tax Saving Fund's standard deviation is the lowest of all. It has 'low fund risk grade.' But you can not expect abnormal returns from this fund.

Important points to ponder on ELSS

- Though the lock-in period of ELSS is three years only, it is advisable to invest in them with a long-term view. ELSS mutual funds are just like normal diversified equity mutual funds. So, the risk profile associated with them is high. So, you will be better off if you invest in them for long term wealth creation.

- SIP Vs lump sum in ELSS? Remember that ELSS funds have a lock-in period of 3 years. So, each and every SIP installment will be locked for 3 years. It may be cumbersome when you start redeeming the mutual fund units. If you are not comfortable investing a lump sum amount at one shot, consider investing once a quarter.

- It is better to opt for the GROWTH option of a ELSS fund. Don't make the mistake of opting for the dividend reinvestment plan, under which the dividend payout is reinvested to buy more units of the scheme. Every time this happens, the new units get locked in for another three years. (Recently SEBI & AMFI had discussed this matter and asked Mutual Fund houses not to re-invest dividend amount under ELSS category)

- While diversification is good, over-diversification may not be very good. In the name of diversification do not invest in multiple funds from the same fund category.

Since ELSS is an equity fund, kindly note that there is no guarantee of return on investment. But looking at the historical performance, ELSS has outperformed traditional options such as PPF (Public Provident Fund), EPF (Employees Provident Fund) and tax-saving FDs (Bank Fixed Deposits) over a long period of time.

Have you invested in a ELSS mutual fund? Do you also think Mutual Fund ELSS is a damn good tax saving instrument? Did you find your fund in the above 'Best ELSS Tax saving Mutual funds?' Please share your views and comments. Cheers!