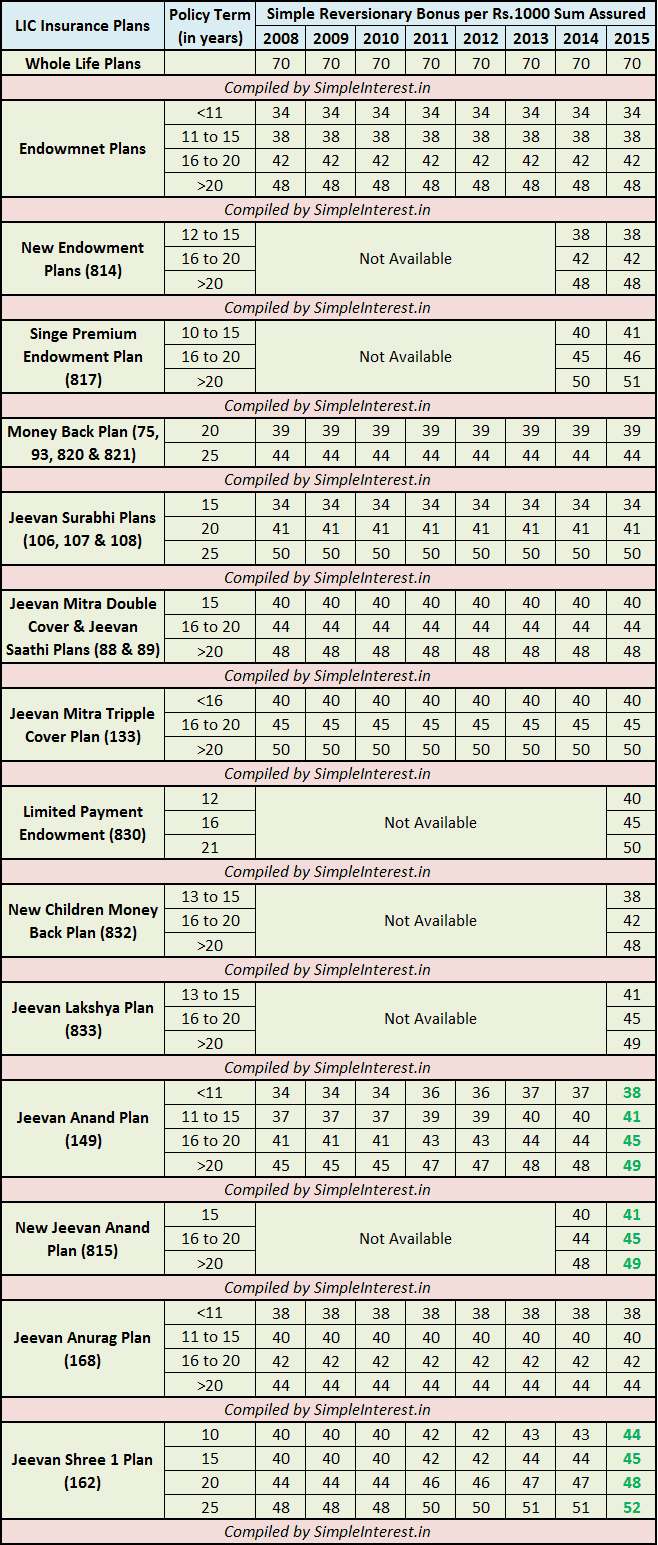

LIC has revealed the bonus rates for the year 2015-16 for all of its traditional plans. Since return from LIC Policy is majorly depending on the bonus declared, it becomes utmost necessary to know these rates.

But before knowing the bonus rates let us first understand the kinds of bonus declared by LIC and how the bonus is calculated based on these bonus rates.

Types of LIC Bonusand Additions

There are four types of bonuses declared by LIC. These are:

Simple Reversionary Bonus

What we simply meant when we say Bonus is this "Simple Reversionary Bonuses". This bonus is declared per thousand of the Sum Assured Amount in each financial year by LIC but will be paid at the end of maturity period or on the death of the policyholder, whichever is earlier. For instance if you are holding Jeevan Lakshya Policy with Sum Assure amount of Rs.10 lakhs and policy term exceeding 20 years and the bonus declared this year is Rs.49, then your bonus amount would be Rs.49,000 for current year, but as said earlier, you will get this amount only at maturity or on death.

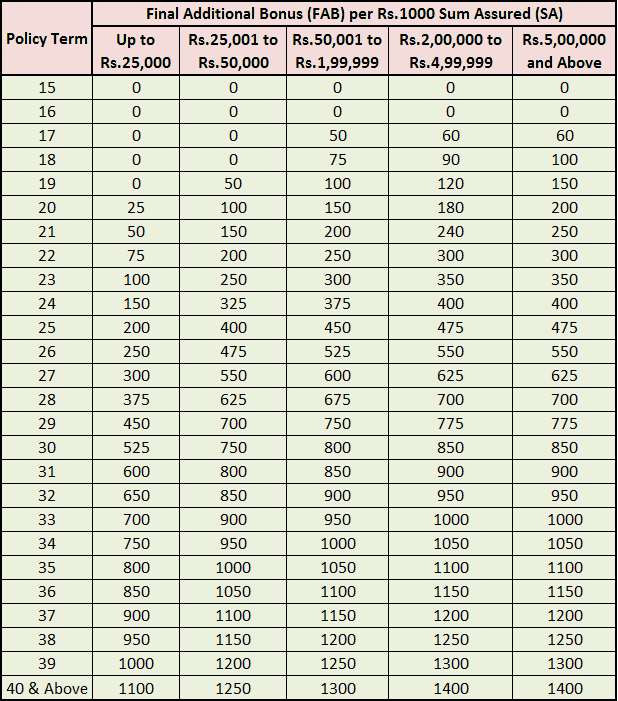

Final Additional Bonus (FAB) or Terminal Bonus

This is the second type of bonus declared by LIC termed as Final Additional Bonus (FAB). FAB is a onetime payment and paid only to those policyholders who have policy of longer duration, say 15 years and more, and has paid premium for all 15 years. Usually, policies having Guaranteed Additions are not eligible for FAB. Given below is indicative list Final Additional Bonus.

Loyalty Additions

Loyalty Addition is a non-guaranteed bonus which is given as an appreciation of being a long-term loyal customer of LIC. Usually this is also declared per thousand of sum depending and at the end of the policy term but for some policies it gets declared after completion of certain policy period such as in Jeevan Saral Policy, loyalty additions will be awarded to the policyholders after completing minimum of 10 years. But likewise FAB, loyal addition is also paid at the end of maturity period or on death whichever is earlier subject to completion of minimum policy period.

Guaranteed Additions (GA)

Some of the LIC Policies offers a "Guaranteed Additions" which means that policyholder will get an assured amount of sum for a specified period. For instance, Jeeva Shree-1 policy provides a Guaranteed Additions of Rs.50 per year per thousand sum assured for first five years of the policy. Another such policy is Komal Jeevan. Guaranteed Additions are added with the Basic Sum Assured and paid at the time of claim.

LIC Simple Reversionary Bonus Rates for 2015-16

I have highlighted the increase of Bonus Rates from past year but no major revisions can be seen in Bonus Rates.

LIC Final Additional Bonus (FAB) Rates for 2015-16

Will Update Soon

LIC Loyalty Additions for 2015-16

Will Update Soon

LIC Bonus Calculation Formula

Formula of Calculating Bonus amount according to the bonus rate is pretty easy. Since bonus are declare per thousand basis, you have to divide your sum assured amount by thousand and then multiply it by given bonus rate for the year.

Bonus Amount = Bonus Rate X Sum Assured/1000

For instance, Bonus declared for New Children's Money Back Plan (832) is Rs.48 for current year, so policyholder having Rs.10 lakhs sum assured and policy term exceeding 20 years would get Rs.48,000 (Rs.48 X 10,00,000/1,000) as bonus which will be paid at the time of making claim.

Best Tax Saver Mutual Funds 2016 or ELSS Mutual Funds for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300