Equity savings funds are a new variant in the equity mutual fund basket. Exposure to equity, a part of which is hedged, and then some debt, and you have this new fund category. Before going into this product's details, let's understand the reason for this new category coming into the mutual fund universe.

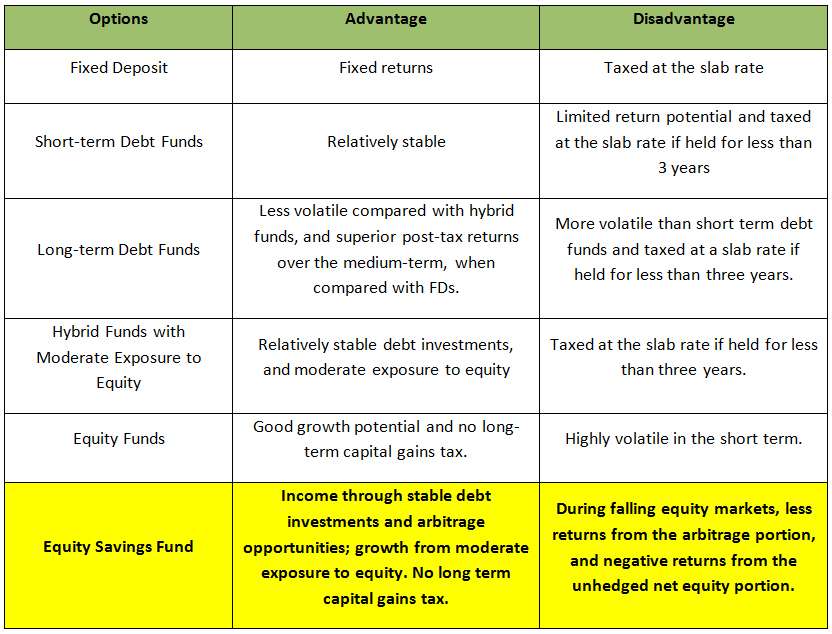

In the last Budget, the government increased the holding period for debt funds to three years in order to get indexation benefits. Else, you would be taxed at your slab rate. That means debt and debt-oriented funds such as Monthly Income Plans (MIPs) would have the same tax treatment as Fixed Deposits (FDs) for holdings up to three years.

Equity savings funds, as a category, came into being to provide MIP-like returns, while trying to address the concerns of this set of investors.

The Category

Equity savings funds aim to generate returns from equities, arbitrage trades, and fixed income securities. To retain equity taxation, funds will restrict the fixed income (debt) exposure to 35 per cent. Besides, to reduce volatility and hedge the portfolio, these funds actively use derivative strategies.

Still, some amount of equity is unhedged (pure equity cash market) to prop up the returns of the portfolio. The equity and the derivative exposure is considered as 'equity' allocation and hence, these categories of funds are treated as equity funds. The unhedged equity exposure typically ranges from 15 per cent to 40 per cent, and the rest of the portfolio is hedged to gain from arbitrage opportunities.

Before going into what these funds are, and when they will suit you, it is first important to know that these funds cannot build long-term wealth efficiently like pure equity funds. To this extent, one should not view these in the same light as equity for long-term portfolios. What equity savings funds offer is stability and tax efficiency; the latter when compared with debt.

These funds are suitable for those looking for some equity exposure but do not have a very long time frame. They suit those with limited risk appetite and looking for less uncertainty in returns. Many of these funds seek to provide regular dividend income although they are not mandated to do so.

They are certainly not substitutes for pure equity funds, especially for long-term portfolios, and fit those with a 2-3 year time frame who want tax benefits that are not available in debt-oriented funds for such a short time period.

Positioning

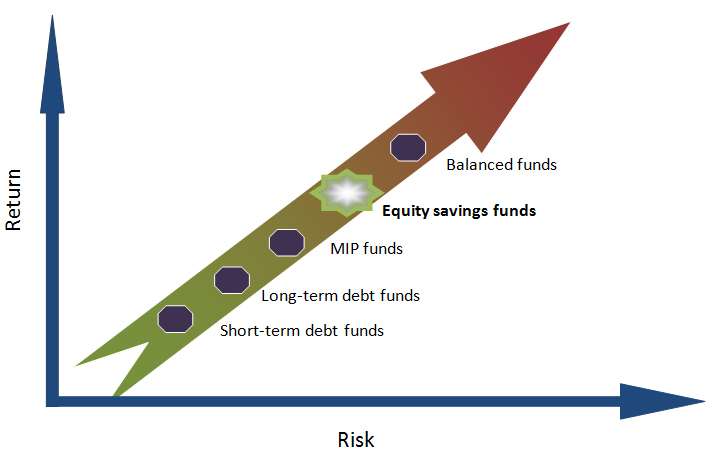

If you plot the fund categories on a risk-return axis, equity savings funds are positioned between MIP funds and balanced funds. They stand a notch higher than MIP / debt-oriented funds, and one notch lower than balanced funds in their risk-return proposition.

How does arbitrage generate returns?

Arbitrage funds look to exploit arbitrage opportunities (the price difference in securities) in different segments of markets. Fund managers opine that there are significantly higher arbitrage opportunities in a bull market, but lesser during falling or flat markets.

Let us assume that ABC Ltd. trades in the National Stock Exchange (NSE) cash market for Rs. 100, and Rs. 101 (same month futures price) in the futures market. By the end of the month, the future price converges with the cash price. Buying in the cash market and selling in the futures market will entitle a gain of 1 per cent. If we assume a 0.2 per cent brokerage for these transactions, then the net gain is 0.8 per cent, or an annualised return of 9.6 per cent.

Pure arbitrage funds hedge their cash positions entirely and hence, the return from a market movement (from unhedged equity) is ruled out. In equity savings funds, there is a good chunk of unhedged equity that can generate returns higher than arbitrage funds. To this extent, equity savings funds carry far higher risk and higher return potential than arbitrage funds.

Category Performance

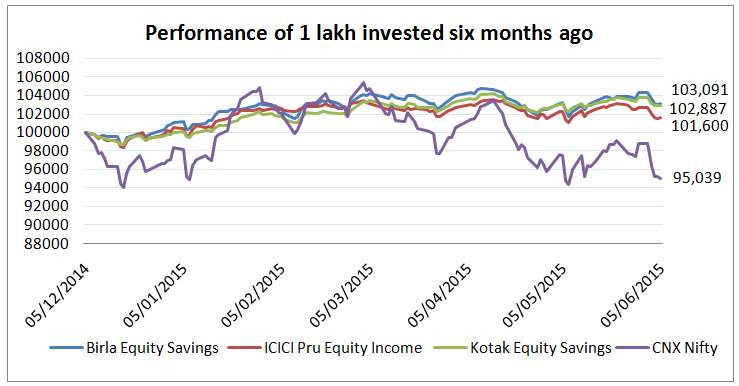

Given that many of the funds in this category are of recent origin, they do not have much of a track record. But when reviewing their performance thus far, it appears that they have performed well in relation to the CNX Nifty. In the below chart, the Nifty has fallen by around 5 per cent, while equity savings funds delivered positive returns that range from 1.6 per cent to 3 per cent in the last six months. Their arbitrage component and debt allocation clearly helps these funds in down markets.

The unhedged equity portion differs from fund to fund, and also varies in different time periods. Higher the unhedged portion (net equity exposure), higher the volatility. Hence, you need to check this information before investing in these schemes. For instance, Edelweiss Absolute Returns also follows a similar strategy, but can take a much higher unhedged equity exposure (we have therefore, not brought the fund under this category).

| Scheme | Unhedged portion |

| Birla Sun Life Equity Savings Fund – Reg. – Growth | 20% – 45% |

| ICICI Prudential Equity Income Fund – Reg. – Growth | 20% – 40% |

| Kotak Equity Savings Fund – Reg. – Growth | 15% – 25% |

Equity savings funds – How they stack up

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2016

1.ICICI Prudential Tax Plan

2.Reliance Tax Saver (ELSS) Fund

3.HDFC TaxSaver

4.DSP BlackRock Tax Saver Fund

5.Religare Tax Plan

6.Franklin India TaxShield

7.Canara Robeco Equity Tax Saver

8.IDFC Tax Advantage (ELSS) Fund

9.Axis Tax Saver Fund

10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online -

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

---------------------------------------------

Invest Mutual Funds Online

Download Mutual Fund Application Forms from all AMCs