Know your PF Balance and Status Online

You can now activate your UAN, know your PF balance and download your passbook via mobile app launched by the Employees' Provident Fund Organisation (EPFO).

Earlier, you could Check PF balance on Mobile via SMS only but to make things easier and convenient EPFO has come out with a mobile app enabling EPF members (employees), employer and pensioners to operate and view their EPF account on the move also.

In all, three services were launched by EPFO:

- PF Mobile App (M-Sewa)

- SMS based UAN Activation

- Missed Call Service

PF Mobile App

Getting abreast with the latest technology and in line with the PM Modi's dream of digital India, EPFO has launched the much anticipated mobile App integrating various facilities under one roof.

Downloading PF mobile App

You have to visit the link:http://search.epfoservices.org:81/EPFOMobileApp/mobileApp_en.php to download the application in .apk format.

Remember you will have to turn-on "Allow Installation of apps from unknown sources" under the security settings on your android phone.

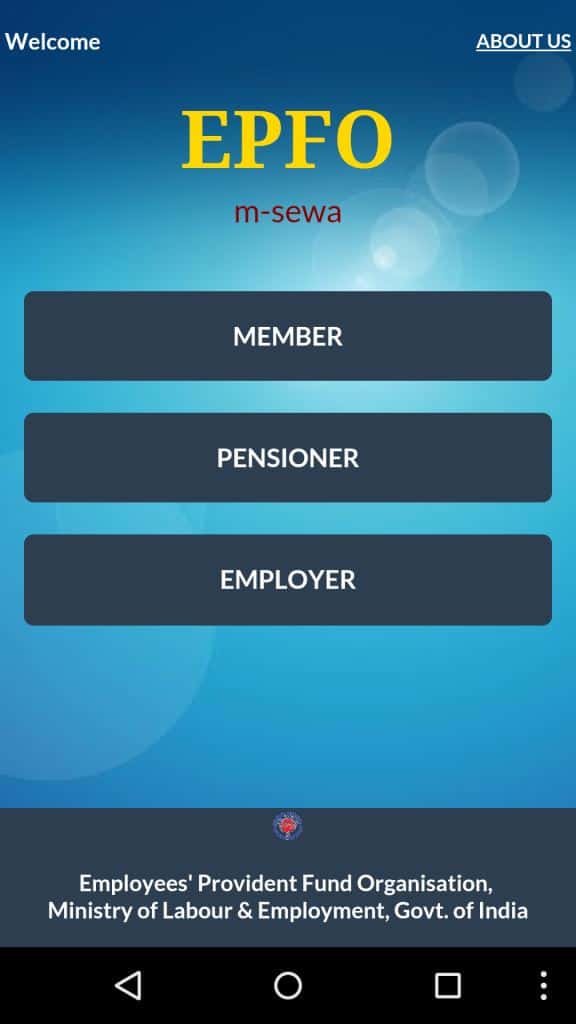

The mobile app user interface looks like this:

You will be given three options to choose your category viz. Member (employees), Pensioner and Employer.

For Members (Employees)

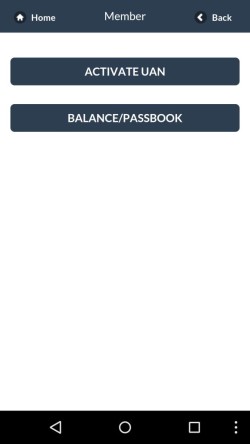

After clicking on MEMBER tab, two options will be shown on the screen:

- Activate UAN and

- Balance/Passbook

Activate UAN

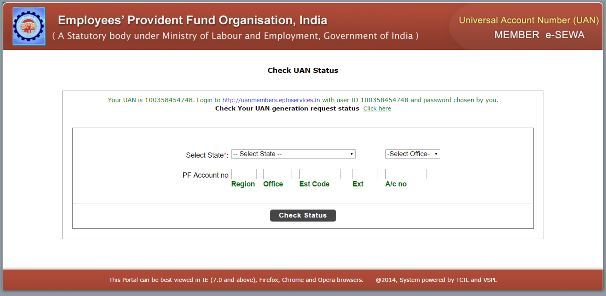

Before moving on with the UAN activation, you should first know your UAN and for this you have to visit http://uanmembers.epfoservices.in/ and click on the Know your UAN Status blinking on the top left corner as shown below:

You will have to fill-in the required details to receive your UAN number on your registered mobile number.

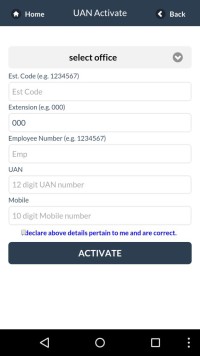

Once you get your UAN number, you are required to select office from the drop-down menu, enter establish code, extension (usually 000), your employee number, UAN (received on your mobile) and the registered mobile number in the PF mobile App to activate your UAN.

Remember you have to check on the "Declare above details pertain to me and are correct" situated below the UAN activation form.

PF Balance and View Passbook

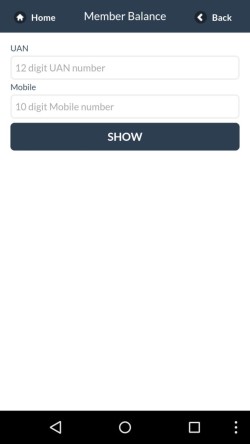

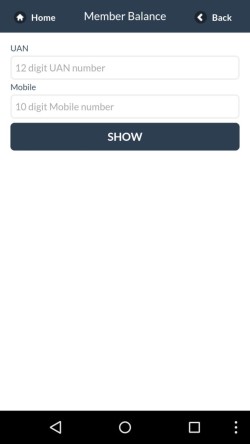

After activating UAN, you can check your EPF balance or download Passbook by clicking on the BALANCE/PASSBOOK tab from main menu. The screen looks like below

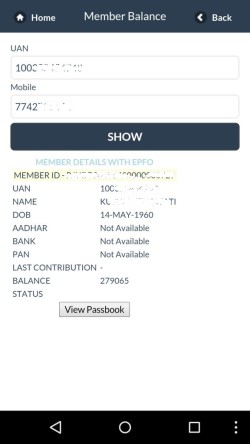

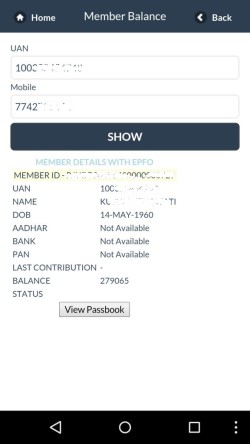

Simply enter you UAN number and registered mobile number and the balance will be displayed on your screen as shown below

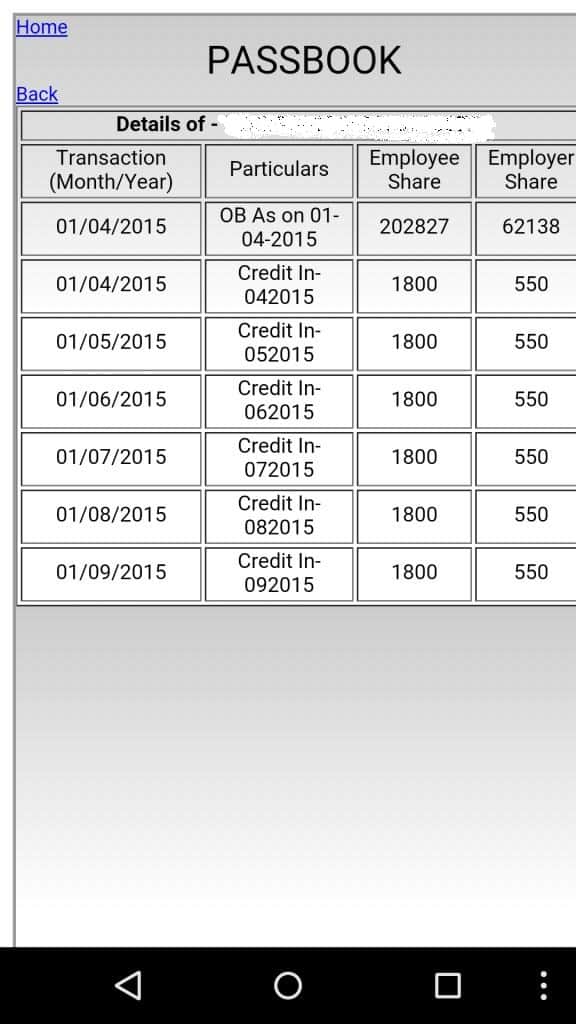

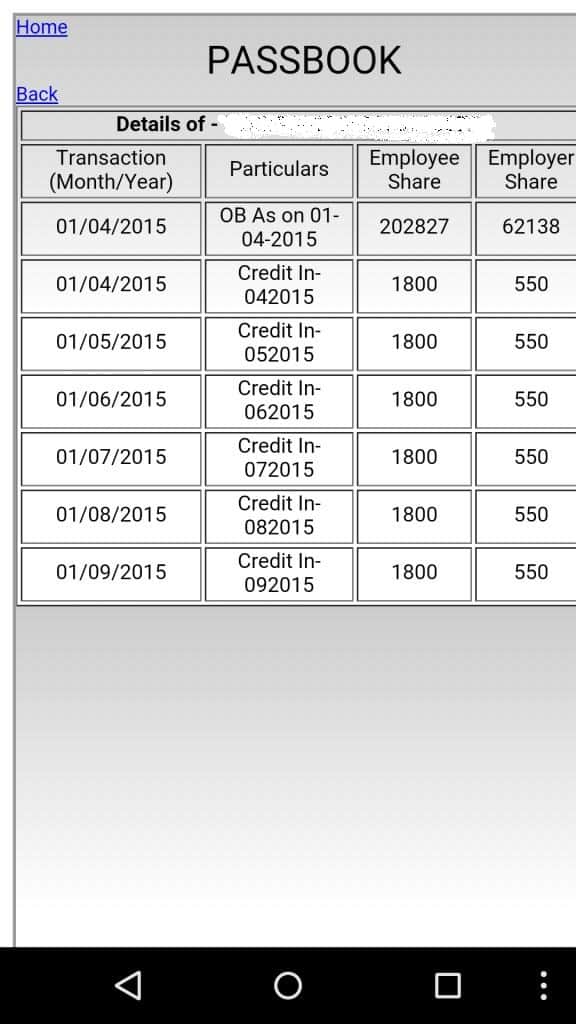

Further, you can also view your EPF passbook by click on the button "View Passbook" on the balance screen. The passbook will be shown on your mobile screen having carry forward balance from the last fiscal year and monthly contribution of the current fiscal year as shown below.

For Pensioners

Pensioners can check information about pension disbursement and payment by entering the 13 digit alpha-numeric PPO number and date of birth in ddmmyyyy format in the form shown below.

For Employers

Employer can check the status of EPF deposit/remittances by entering the 13 digits TRRN (Temporary Return Reference Number) number as shown below

SMS Based UAN Activation

This facility is useful for those who do not use smartphones. In order to activate UAN through SMS, you have to SMS your 12 digit UAN number to 7738299899 in the following format

EPFOHO UAN LAN

Where UAN would be your 12 digit number and LAN would be your desired language of information whose codes are English: ENG, Hindi: HIN, Telugu: TEL, Punjabi: PUN, Gujrathi: GUJ, Marathi: MAR, Kannada: KAN, Malyalam: MAL, Tamil: TAM, Bengali: BEN.

Members having their UAN activated can also use this service to know the details of their EPF account such as balance, contribution amount etc.

Missed Call Service

Last sort of getting PF related information is to give a miss call on 01122901406. You would get message containing your PF balance and other account details.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300