With the CNX Midcap delivering 31% year-to-date thus far in 2014, against the CNX Nifty's relatively modest 19%, all eyes are on the mid-cap universe. What makes the mid-cap stock universe a superior returning option (albeit with higher downside, no doubt) than their large-cap peers? And should your portfolio have a mid-cap fund to participate in the upside that this market cap segment offers?

What makes them tick?

Less tracked: Broadly, the stocks beyond the top 100 in terms of market capitalization fall under the mid/small-cap category. These stocks, unlike their large peers, are not tracked as vastly and therefore provide enough scope to benefit from information gap – that is market's lack of knowledge of a particular company, thus leading to its prospects not factored into its price.

A couple of years ago, for instance, not many would have heard about Kaveri Seed Company or Jubilant Foodworks, until these stocks became multi baggers. Kaveri Seed For instance jumped 18 times in 5 years!

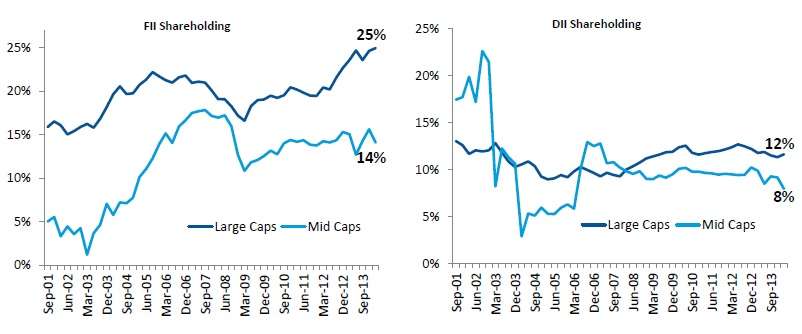

Under-owned nature of stocks: A number of mid-cap stocks are under-owned by broad markets either because they are highly illiquid (as a result o high promoter holding) or are not too known in the markets. As a result o low liquidity, even quality midcaps do not account for a large chunk of many institutional investors as the price impact of entering or exiting such stocks is high. Given below is the ownership pattern of the different market cap segment.

Such under ownership also means that there are enough opportunities to be tapped in this segment, with the right stocks that is.

Re-rating and wealth effect: The mid-sized nature of their business allows quality mid-cap companies to ramp up market share, grow their volumes and often times their profit margins, and achieve a critical mass that gets noticed in the market.

That is when the transition from being a midcap to a nascent large-cap or a large-cap begins to happen; thus leading to the stock suddenly receiving higher valuations, thus bringing the wealth effect.

Take the case of a stock like Lupin – from about Rs 3000 crore of market cap in mid-2005, the stock is now Rs 42,000 crore in market cap – 14 times or a compounded annual growth of over 35% in 9 years!

Unique opportunities

Besides the above, exposure to interesting and niche sectors can be had only through the mid-cap space. For instance, companies in the consumer retail space or internet-based businesses or other unique services would typically be mid-sized and growing. On the other hand, there could also be sectors whose market share is not large but have very dominant mid-cap players present in the segment.

Amara Raja Batteries in the auto ancillary sector or Jubilant Foodworks in the retail consumer segment are examples. Sectors such as logistics, select engineering segments, media and entertainment and retail consumption space would be industries that would have companies one would miss out in the large-cap space.

Having said that, mid-cap stocks are also highly vulnerable for some reasons: one, they often hold large debt in their books, as they typically grow through leverage. During slowdown or high interest rate regimes, therefore, they are the most hurt.

Two, many of them fail to regain market shares that they lost during a slowdown (as larger and more resilient players take over) and are unable to bounce back even when the economy recovers.

Three, exit of a large investor often leads to negative price impact and general pessimism affecting the stocks. Four, Regulatory issues, more often hit smaller companies more either because of the financial impact such regulation may have or other indirect cost of compliances.

How to participate

Hence, it is important to remember, a few rules to invest in the mid-cap space would help you participate adequately without burning your fingers.

One, for every mid-cap stock that is a multi-bagger there could be many that destroyed wealth. There are many stocks that destroyed as much as 90% of investors' wealth in the years following the 2008 downturn.

Hence, unless you are a knowledgeable investor and research your stocks, direct equities can be risky for you. Use mutual funds to participate in the mid-cap story.

Two, mid-cap funds can be part of your portfolio but cannot be the only segment in your portfolio. Why? One, picking the wrong mid-cap funds can impact your portfolio very badly. For instance, the worst performing midcap fund fell as much as 75% in 2008.

And there are those that still sport single digit or low double digit returns over a 5-year period. That means, unless the fund is able to bounce back with a good portfolio of stocks, it can pull down portfolio performance.

Three, from the above point, it follows that mid-cap funds need a longer time horizon. Over a three-year period ending June 20, 2014, for instance, the CNX Nifty (large-cap index) delivered 12.6% annually, as against 11% annual return in the CNX Midcap. That means, after long periods of underperformance, midcaps can take time to recover. That may leave you with a mediocre portfolio if you had a shorter time frame.

Four, avoid the temptation of going all out on mid-cap funds for the following reasons:

- the mid-cap universe that funds can participate is limited. Hence owning too many mid-cap funds will only duplicate your portfolio.

- Taking very large exposure to a midcap fund is also not advisable for reasons mentioned earlier. Besides, remember that diversified equity funds will always do the job of upping mid-cap exposure when they find opportunities in that segment.

That means, you have to factor in the mid-cap exposure you get through the diversified funds that you may hold as well. Ideally, we would prefer not more than a 30% of equity exposure to pure midcap funds for even a reasonably aggressive investor.

Mid-cap funds have also shown to have cycles of out performance after which some get left behind. For those of you familiar with the mid-cap fund universe, you will know that the star performers of 2005, 2006 or 2007 are no longer the top-quartile names in this market-cap segment today. Hence, even when you are building a portfolio with a mid-cap fund it is imperative to review its performance at least every couple of years.

Lastly, given how mid-cap as a universe can swing, SIPs are the optimal way to invest in this segment to ensure you do not burn your fingers. IDFC Premier Equity, HDFC Mid-Cap Opportunities and Franklin India Prima are among the mid-cap funds that we currently recommend as part of a core long-term equity portfolio.

For those looking for more aggressive options funds such as Franklin India Smaller Companies Fund is an option. If you wish to have a value tilt to your mid-cap holding then ICICI Pru Value Discovery has demonstrated a sound record of performance.

When used judiciously, mid-cap funds can be ideal tools to build your wealth, without hurting yourself in the process.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2016

1.ICICI Prudential Tax Plan

2.Reliance Tax Saver (ELSS) Fund

3.HDFC TaxSaver

4.DSP BlackRock Tax Saver Fund

5.Religare Tax Plan

6.Franklin India TaxShield

7.Canara Robeco Equity Tax Saver

8.IDFC Tax Advantage (ELSS) Fund

9.Axis Tax Saver Fund

10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online -

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

---------------------------------------------

Invest Mutual Funds Online

Download Mutual Fund Application Forms from all AMCs