Universal Account Number (UAN) for Provident Fund

Retirement Fund body Employees Provident Fund Organization (EPFO) has been very quick in assigning Universal Account Number (UAN) to the members who are currently contributing to the Provident Fund.

What is Universal Account Number (UAN)?

Universal Account Number is a unique 12 digit portable number assigned to a member of EPFO i.e. person registered with EPFO and currently contributing to it. This UAN will become the identity of the member till his retirement.

Features and Benefits of UAN

- UAN will make hassle free transfer of PF balance while switching jobs.

- Employee can view PF Balance, File and View Transfer Claim Status, Download UAN Card, Update KYC norms etc.

Since UAN is to be allotted to only contributing members, all the dormant/inactive account is going to get closed.

Have you got your UAN? If not, then before reaching to your employer, first check whether you have been allotted UAN or not by EPFO.

How to Check Universal Account Number Status of Provident Fund?

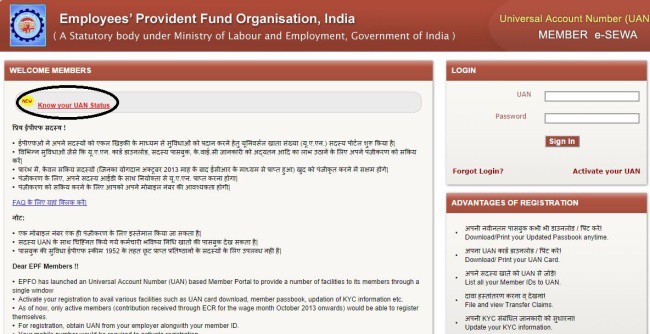

Step 1: Start with clicking on the link: – http://uanmembers.epfoservices.in/

The above link is for employees, there is a separate link for employers: –https://employerclaims.epfoservices.in/

Step 2: On the upper left side, click on the blinking text "Know your UAN Status"

Universal Account Number (UAN) Portal

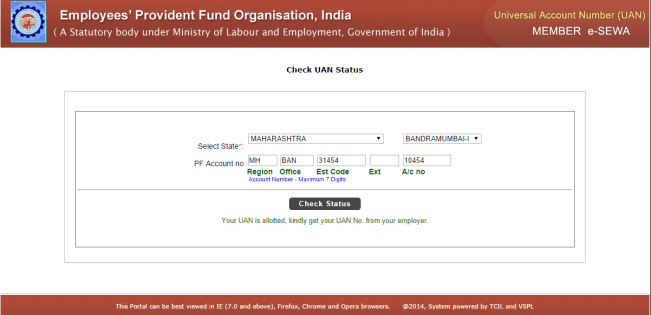

Step 3: Fill out the required details in the next page "Check UAN Status"

Universal Account Number (UAN) Status

- Select the state where your office s registered. It may be different from the state in which you work. The best way to know it is to check the first 2 letters of your PF number. The first two letters denotes the state for example RJ for Rajasthan, HR for Haryana, MP for Madhya Pradesh and UP for Uttar Pradesh.

- Second box is for selecting the PF office region. Once again this can be confirmed by the next 3 letters of your PF number.

- As soon as you hit enter the first two column of the next row will be filled automatically.

- Third box should be filled with the organization number. First set of digits of your PF number denotes the organization number. You can check it with your colleagues as they should have the same the organization number.

- In the EXT box you need to fill the extension, it may be 000 or any word letter. You can better leave it empty if it's not in your PF number.

- The last box of A/C no. is the box where you need to put your unique PF number.

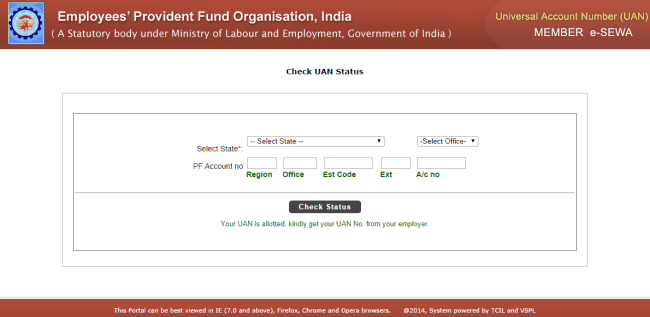

Step 4: As soon as you hit Check Status button, a message will appear that UAN is allotted or not.

Universal Account Number (UAN) Status

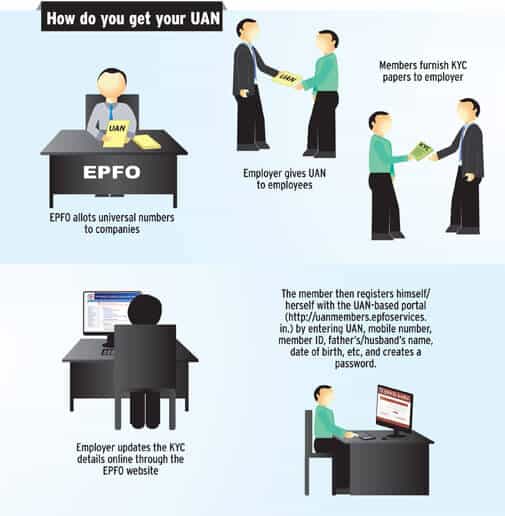

How to Get UAN from your Employer?

In case the above status shows that you have been allotted UAN number by the EPFO, than you should approach your HR asking about it.

how to get UAN from your employer

How to activate your UAN?

Once you have got your UAN, the next step is to activate it.

- Login into http://uanmembers.epfoservices.in/

- Click on the "Activate UAN Based Registration" and check the read and understood the instructions box.

- Enter your UAN Number, Mobile number, member id and select state and office.

- Click on the GET PIN button after entering the case sensitive words.

- You will then receive an authorization PIN code on your mobile.

- Put the PIN received in the box and hit submit button to activate your UAN.

At this phase your UAN is verified and activated. On the next screen you will have to create your login credentials i.e. user name and password.

How to Download your UAN Card?

1 Login to http://uanmembers.epfoservices.in/ with the username and password you have created in the above step.

- Hover on the download menu and click the option "Download UAN Card".

- Again Click on the "Download" button present on the screen. You can either take print out or save it on your computer.

In case you need any help or have any query, you may contact:

Helpdesk Number: 1800 118 005

Helpdesk Email Id: uanepf@epfindia.gov.in

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300