Filing Belated Return or Income Tax Return after the Due Date

Every assessee whose total income before claiming deductions exceeds the basic exemption limit is required to file income tax return irrespective of the quantum of tax liability. But People tends to miss due date of filing tax return due to lack of time or no planning.

Due dates of Filing Tax Return prescribed under section 139(1)

Section 139(1) of the Income Tax Act, 1961 specifies the time limit of filing the income tax return for every assessee whose total income exceeds a specified income threshold.

Tax returns filed after the specified due date are considered as belated tax returns which could be filed within two years from the end of the relevant financial year under section 139(4) of the Act. After that it becomes time-barred, that is, cannot be filed.

Further, penalty is not levied if the tax return is filed within one year from the end of the relevant Financial Year. For example Belated Return for the financial year ended 31st March, 2015 can be filed up to 31st March, 2017 but to avoid penalty the same should be filed by 31st March, 2016.

But before hoping to file belated return you must decide under which of the following conditions you fall in:

Belated Return conditions

Case 1: No Tax Liability Pending

Where assessee has already paid the tax in form of TDS, Advance Tax and self-assessment tax, then the tax return can be filed up to the end of assessment year without any penalty but if filed after the end of assessment year then penalty of Rs.5,000 u/s 271F, will be levied.

For example tax return of assessment year 2015-16 must be filed up to 7th September, 2015 (due date revised twice for individual assessee) but if no tax liability is pending then ITR can be filed up to the end the assessment year i.e. 31st March, 2016.

In case assessee also failed to file ITR up to this date then by paying penalty of Rs.5,000, assessee can file ITR up to one year from the end of assessment year i.e. 31st March, 2017. Penalty in this case is on discretion of Assessing Officer.

Case 2: Tax Liability Exists

Sometimes assessee forgets to consider few incomes such as income from second house property lying vacant or if he had worked under couple of employers but forget to disclose the salary from past employers, thus owes taxes to the Government. The return filing date without penalty of Rs.5,000 remains same i.e. till the end of assessment year but interest of 1% shall be levied on the amount of unpaid tax u/s 234.

For Example: Mr. Sanyam is a salaried individual and his net tax liability for the Assessment Year 2015-16 comes to Rs.40,000 and break-up of his tax payment is:

- TDS deducted by employer: Rs.25,000

- Self-Assessment or Advance tax paid: Rs.5,000

- Balance Tax payable by Mr. Sanyam: Rs.10,000 (40,000 – 25,000 – 5,000)

Suppose Mr. Sanyam files the tax return on 15th, December 2015 i.e. before the end of assessment year but after the due date, he would be liable to pay simple interest on tax unpaid for 4 months (from September to December) but no penalty.

- Tax Payable would be Rs.10,400 [10,000 + 4%(10,000)]

Suppose Mr. Sanyam files the tax return after the end of the assessment year on 10th August, 2016 (i.e. after 31st March, 2016). In this case, he will liable to a penalty of Rs. 5,000 u/s 271F along with the penalty of 1% on balance tax payable for 12 months (September, 2015 to August, 2016).

- Tax Payable would be Rs.16,200 [10,000+5,000+(12%(10,000)]

Case 3: Tax Refund instead of Tax Liability

In case you have paid excess tax and have tax refundable then you can file the return even after 31st July of the assessment year without any issue. The only disadvantage will be that your refund will be processed late and you will get your money late.

Procedure of Filing Belated Return

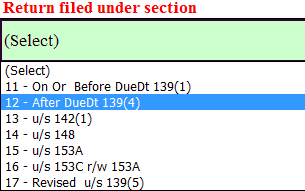

The procedure of filing belated return u/s 139(4) is similar to filing original return u/s 139(1). However, assessee should clearly state that the return is belated return by selecting Belated Return in ITR Form as shown below. This is applicable for both online as well as for offline ITR forms.

Limitations of Belated Return or Penalties of late filing of I-T returns

Revision of ITR is Not Possible:

A belated return cannot be revised. Unlike a return filed within the original time limit, which can be revised n number of times within a specified period.

For example, you have spent Rs.10,000 on the preventive health check-up for yourself but did not claim it while filing ITR as you were not aware about the deduction up to Rs.5,000 under CGHS (Central Government Health Scheme) for the amount spent on preventive health check-ups or you discover any omission or misstatement in the original tax return filed. Had you filed your original tax return within due date you could have filed the revised return to claim the deduction of Rs.5,000 within two years from the end of the relevant financial year or before completion of your assessment by the tax officer, whichever is earlier.

Carry Forward of Losses:

Another loss of not filing the tax return within the due date is that your eligibility of carrying forward the losses of the current financial year to next financial year gets lapsed as per section 80 of the Income Tax Act. For example you have made losses in share market which could be set-off from the gains of next financial year but since you have filed belated return us/ 139(4) instead of filing the original tax return within time, you cannot carry forward this loss and thus loses the benefit of set off of these losses against the income of next year.

However, there are few exceptions to this rule i.e. this rule is not applicable on the losses from house property and business loss on account of unabsorbed depreciation and capital expenditure on scientific research. That means losses from house property and business loss due to unabsorbed depreciation and capital expenditure on scientific research can be carried forward even if the tax return is filed after due date.

Interest on Outstanding Taxes:

After deducting advance taxes, TDS and self-assessment tax if any tax remains unpaid than the interest u/s 234A will be applicable @ 1% per month and part thereof up to the date of filing of the return on the amount of outstanding tax. This interest is in addition to the interest u/s 234B or 234C and will be levied only if there is any tax payable in your return.

This is in addition to the 1% per month interest for non-payment of advance tax, that is, tax due after tax deduction at source exceeding Rs.10,000. Thus, late returns can result in an additional interest burden.

Penalty on Filing Return after due date:

Section 271F gives power to tax officer to levy a penalty of Rs.5,000 on the assessee for filing tax return after one year from the end of the relevant financial year. For example, there will be no penalty if the ITR for financial year ended 31 March 2015 is filed by 31 March 2016. If it is filed after that, the tax officer can levy this penalty. However, this provision is discretionary and rarely exercised by the assessing officer.

Delay in Refund or Loss of Interest on Refund:

You are eligible to get tax refunds irrespective of the date of filing the tax return. Usually, the earlier you file the return, the earlier you receive the refund. Late filing of return delays refund. Further, interest on refund u/s 244, wherever applicable, is also reduced to an extent if the return is filed late.

Persons who can afford to file late return

Only assessee who

- Already deposited all the taxes via advance tax or self-assessment tax or

- All the taxes have been deducted by his employer and deposited with the Government or

- Do not have any considerable amount of tax refundable to claim or

- Do not any losses to be carried forward to next year

Persons who should file return on time

Assessee who has

- Not paid all the due taxes to the Government or

- Huge amount of tax refundable

- Considerable amount of losses to be carried forward

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300