SBI Magnum Global - Invest Online

If you have been associated with the world of mutual funds for more than a decade, chances are that you would have had some tryst with SBI Magnum Global, the star performer of the early and mid 2000s. Like quite a few other funds launched in the 1990s, this fund too had its hey days, under the tutelage of then ace fund manager Sandip Sabharwal, but fell by the wayside in its success journey.

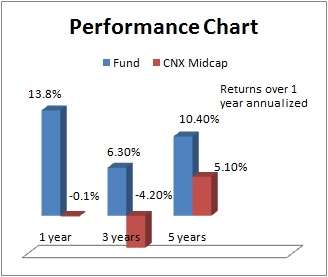

But the fund is now on a redeeming act, after R Srinivasan, the fund manager of the now popular Magnum Emerging Businesses fund, took over the helm in 2009. While its return of 6.3% annually in the last 3 years may not per se look good, that's comfortably higher than category average return of just 0.6% a year. It is also far superior to the -4.2 per cent return annually of its benchmark CNX Midcap.

SBI Magnum Global holds a portfolio of domestic stocks with a predominantly mid-cap bias. It cannot strictly be said that the fund has a mandate of investing in mid-cap stocks; as even up to 2003, the fund had a good dose of large caps. But since then, its consistently high exposure to the mid-cap market segment has led to the scheme being stamped as a mid-cap fund.

Suitability

If you are holding SBI Magnum Global, you can stay with it if you have reasonable risk appetite. If you wish to hold mid-cap funds in your core portfolio, then the likes of IDFC Premier Equity or HDFC Mid-Cap Opportunities should be your first choice, given their superior risk-adjusted returns. Funds such as Magnum Global can at best be good diversifiers.

You may also wonder how this fund is different from its sister from the same stable, SBI Emerging Businesses. The latter is a more aggressive mid and small-cap fund with more concentrated bets on stocks. That means it sports a higher risk-return profile when compared with Magnum Global.

Performance

SBI Magnum Global may not have delivered superior returns when paired with the likes of IDFC Premier Equity or HDFC Mid-Cap Opportunities on a point-to-point basis in the last 5 years. But its SIP returns outdo these funds marginally.

Over a 5-year SIP period, the fund delivered 8.6% annually, compared with 8% for HDFC Mid-Cap Opportunities and 8.4% for IDFC Premier Equity. This, of course, suggests that the fund's NAV provides enough opportunities to averages costs quite well. That happens only when its NAV is much more volatile than the peers. So Magnum Global can be good candidate for investing through SIP.

On a rolling one-year return basis between 2010 and 2013, the fund beat its benchmark 88% of the times, suggesting reasonable consistency.

More recently, in 2011 as well as on a year-to-date basis, the fund has stayed remarkably stable amidst heavy volatility in the mid-cap space. It fell 14% in 2011 as against category average of 25%. In 2013, thus far, it lost just 6.4% as against 13.4% by peers. Magnum Emerging Businesses lost 15% over the same period. Clearly, the latter is the more aggressive one, going by portfolio and performance.

Portfolio

SBI Magnum Global and SBI Emerging Businesses sport quite a few stocks in common; being managed by the same fund manager. Page Industries, Divi's Laboratories, Shriram City Union Finance and Redington India, to name a few, are some of the common stocks in their kitty.

But the concentrated holding in SBI Emerging Businesses Fund is the key differentiator. For example, Page Industries, which is the top fund held by SBI Magnum Global accounted for just 3.8% of its portfolio as of May 2013. But the same stock, which was the third top stock in the portfolio of SBI Emerging Businesses, was held to the tune of 5.9% of the assets.

It is because of its more diversified and less concentrated approach, that SBI Magnum Global may fall less in downturns compared with its sister fund. That said, this can also cap the kind of gains that the sister fund may enjoy.

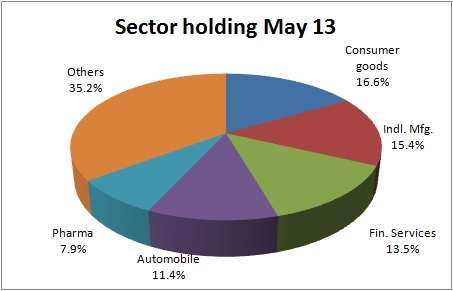

The sector choices between the 2 funds are also vastly different. Sectors such as industrial manufacturing are hardly present in SBI Emerging Businesses while it was among the top 3 sectors held by SBI Magnum Global as of May. Right now, Magnum Global holds a good number of 'growth stocks' but some of which look like 'value' in a down market.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan

2.Reliance Tax Saver (ELSS) Fund

3.HDFC TaxSaver

4.DSP BlackRock Tax Saver Fund

5.Religare Tax Plan

6.Franklin India TaxShield

7.Canara Robeco Equity Tax Saver

8.IDFC Tax Advantage (ELSS) Fund

9.Axis Tax Saver Fund

10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online -

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

---------------------------------------------

Invest Mutual Funds Online

Download Mutual Fund Application Forms from all AMCs