Since long we were targeting agents commission as a reason for Endowment, Money Back, Traditional or Traditional Child Insurance plans low returns. It is true that these policies constitute a high commission for agents. However, the real culprit is neither agents nor insurance companies, but the expense limit rules insurance companies following.

Long back, when I wrote a post on the commission earned by Life Insurance agents, then I received mixed feedback. Some were supportive and a majority were rude. Agents' fraternity fully defended the commission structure. Even though the commission is a major part of expenses in Life Insurance policies, the truth is different and that I am going to share with you all.

Recently I got news that IRDA drafted the new guideline pertaining to the expenses of all Life and Health Insurance product (This includes Agent's commission too). This circular not yet published but sent for internal communication. This gave me a clear picture why the traditional or endowment plans unable to generate the return. Even they are failing to match the Bank FD rates. Below are some facts, which may surprise you.

Life Insurance companies follow the regulations, which formed in 1938 and 1939–

Yes, even after IRDA came into existence and the entry of private insurance companies, the expenses are still regulated by the rules of the years 1938 and 1939. These rules are called "section 17D of the Insurance Rules, 1939" and "section 40B of the Insurance Act, 1938". These old rules still followed by insurance companies for the purpose of managing expenses.

Expense depend on the age of Insurance Companies-

The cap on expenses is based on how old the insurance company. For example, it is high for new companies and low for old companies. Therefore, it is you to be a scapegoat if you bought an insurance product with the new company.

Expense depend on the product–

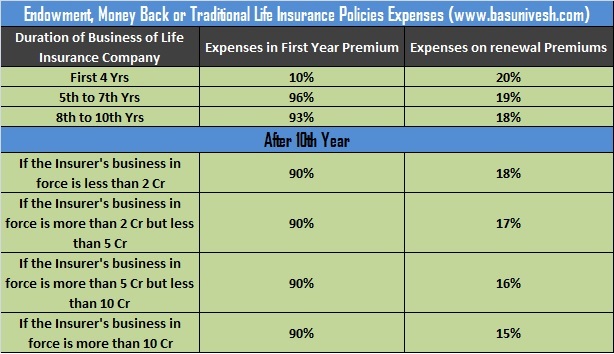

The cap on expenses differs for regular premium paying policies, annuity and for single premium policies. For example, the limit is set at 5% for an immediate annuity and single premium policies of an annuity. It is 10% for a deferred annuity with regular premium policies. For other products like the Endowment, Money Back or Traditional Plans the expenses are listed as below.

You notice that only 4 years of business the expenses are minimal (in first year premium) and later on it is almost 90% of your first year premium and later on it is around 15% to 16% of premium you pay.

Expense depend on the business in force of Insurance Company–

You notice from the above table that how the business volume of an insurance company also matters. First-year expenses are capped at 90% of premium collected. However, it decreases once the insurance company increases its volume.

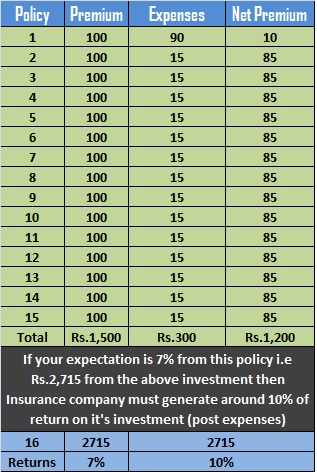

Below I explained why the traditional plans only giving you around 5% to 6%, even after investing successfully (especially LIC) in an equity markets. Let us assume that you took a traditional policy for a 15-year term and yearly you are paying Rs.100 as a premium. Then the cash flow looks like below.

Now being a buyer of this product, let us assume that your expectation is 7%. You assume that you invested yearly Rs.100 for 15 years and hence if we consider 7% return, then the maturity value must be around Rs.2, 715. However, for insurance companies the total invested amount during this policy is just Rs.1, 200 (excluding the expenses). Therefore, to give you the return of Rs.2, 715, the insurance company must generate around 10% return.

This is what all insurance companies providing you. They are giving you the DECENT 7% return by investing in equity or debt by smart ways There is a huge cry whenever news items appear that LIC profited from equity investment and how much % it is actually holding in a particular company. However, for me as a buyer of Insurance+Investment product this does notmatter. What matters to me is how much life risk covered and how much I get back on my investment. They are investing wisely and there is no doubt. Why? Because generating around 10%, is a proof. However, for an end investor what matters is 7%return, not the internal return of what insurance company generated (10%).

Now it is true that Endowment or Traditional Plans are most dangerous products than the ULIPs. Hope you understood why Endowment, Money Back, or Traditional Plans generate only around 6% to 7%, even after adapting wonderful investment strategies by insurance companies

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

------------------------------