The income tax department's e-filing website has undergone many changes over the past one year. It is important that you are aware of these changes to avoid making any kind of mistakes at the time of filing your income tax return. This is time it becomes all the more important because late filing of ITR will cost you.

Here are six changes you will see on the e-filing website of the income tax department:

1. No need to mention date of birth while logging-in to your e-filing account

Earlier you had to mention your date of birth when logging into your account on the e-filing website but this is not required anymore.

2. ITR related documents are now password free

Abhishek Soni, CEO, tax2win.in, a tax-filing company says, "Various documents related to ITR filing such as Form 26AS and ITR-V have also undergone some changes. It has come to our observation that these documents, which were password protected earlier, can now be opened directly."

3. Change in method to download Form 26AS

The procedure to download your Form 26AS from the TRACES website has changed. Earlier, the TRACES website asked you the option using which you want to view your Form 26AS, i.e., in PDF, HTML or Text format. Using the PDF version, you could easily download Form 26AS.

From this year, to download your tax passbook in PDF format, you are first required to view the same in HTML view and then click on 'Export as PDF'.

4. Choose verification of ITR option at the time of providing details

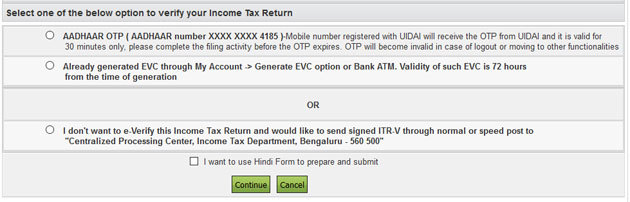

Another change is regarding the verification option. Earlier, the e-filing website did not ask for the verification option until the return was submitted. Soni says, "Even though this year the e-filing portal asks you to choose the verification method using which you will be verifying your ITR, it will allow you to change the method at the later stage after submission of your ITR."

Let us say you have selecting the offline method for verification of your ITR, i.e., mailing ITR-V to Central Processing Centre (CPC), Bangalore. However, once you have finished filing your tax return, you can use the alternative method, i.e., the electronic mode using your Aadhaar OTP or EVC generated from Net banking and so on to verify your ITR.

However, one of the verification methods available earlier cannot be seen now on the e-filing portal. Earlier, the income tax department allowed taxpayers to verify their ITR (subject to certain conditions) using a one-time password sent on their registered email ID and mobile number but now this option cannot be seen on the portal. This option was earlier available for returns where gross total income was below Rs 5 lakh and the mobile number registered for the relevant PAN was not registered for any other PAN.

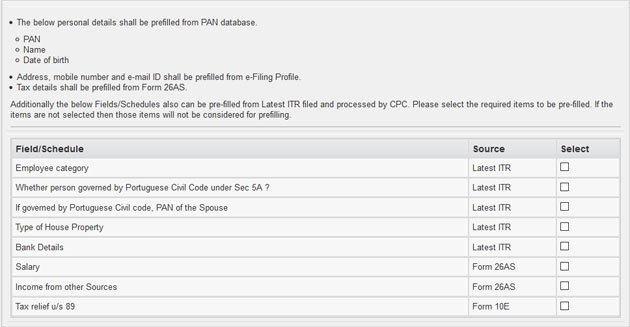

5. Pre-select certain details while filing ITR using online method

If you are eligible to file ITR-1 for the FY 2017-18 and you are filing it using 'Prepare and Submit Online', you now have to the option to get certain fields auto-populated (this is a new feature). You can choose to auto-populate the fields selecting last year's ITR or Form 26AS.

If you select the 'auto-populate' check boxes then these details will be auto-populated and you will not be required to fill /select them again while filing your ITR using the ITR method.

Some of these details include employee category, bank details, salary, and so on

6. Check TDS details and match it with Form 26AS when auto-populated

One of the biggest advantages of filing ITR-1 online is that it auto-populates most of the details in the form like your name, address, PAN details and tax details. However, it is seen that at times the TDS details auto-populated in the ITR-1 online is not correctly reflecting the details from the Form26AS.

Soni adds, "If you do not match the TDS details (which are auto-populated) with the Form 26AS, then you may miss out on the tax-credit available to you."

Therefore, while filing your ITR you must not rely solely on the automatic import of data and must check all the details from Form 26AS. In case of mis-match, take the TDS figures from the Form 26AS as downloaded from the TRACES website.

SIPs are Best Investments as Stock Market s are move up and down. Volatile is your best friend in making Money and creating enormous Wealth, If you have patience and long term Investing orientation. Invest in Best SIP Mutual Funds and get good returns over a period of time. Know which are the Top SIP Funds to Invest Save Tax Get Rich - Best ELSS Funds

For more information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com