Individuals who are disciplined for regular investing and looking for a good long term investment option backed with life cover and do not mind the 5-year lock in period should be investing in regular premium ULIPs.

There has been a recent spike in the sale of single premium ULIP plans as compared to regular premiums. In the single premium plan, an insurer gets coverage for full term by paying premium amount in a lumpsum. Whereas, in regular premium ULIP plan, an insurer needs to pay premiums in intervals such as monthly, quarterly, half-yearly or annually for the policy.

The private sector insurers registered a hike in the growth of 54.75% in the single premium segment in April-June 2018 at the same time the regular premium grew just 3.84% during the same period.

Investors have taken into account the Long Term Capital Gains (LTCG) tax on equity mutual funds, post the announcement in the Union Budget and hence there was an overall growth in ULIP sales. New plans have lower charges and are more transparent so it's gaining investors' confidence. Let's understand key differences between single premium and regular premium ULIP plans for investors to take informed decisions before opting for one.

Why investors are opting for single premium ULIP plans?While buying a single premium ULIP plan, a buyer of the policy needs to have a lumpsum amount to invest in existing or new schemes getting launched. Lumpsum investors have always been a key chunk of the market. This is mainly because a good proportion of the customers have a good amount of investible surplus right now, but they shy away from the commitment of recurring investments in regular premium ULIP plans.

We see a spike in sales as many companies are launching single premium insurance plans where product offering and pricing is better than the existing plans."

Who should be investing in single premium or regular premium ULIP plans?

Single premium ULIPs should be bought by individuals who can afford its expensive premium. Even individual with uneven cash flows can invest in such a mode as their future premiums might be uncertain.

Investors who have unexpected windfall gains like bonuses, profits, huge income from property sale, etc. also investing their gains in these single premium plans.

Lastly, individuals who want to avoid the hassle of regular payment of premium should be investing in the single premium plan.

Individuals who are disciplined enough for regular investing and looking for a good long term investment option backed with life cover and who do not mind the lock in period of 5 years should be investing in regular premium ULIPs

The positives and drawbacks of single and regular premium ULIP plans

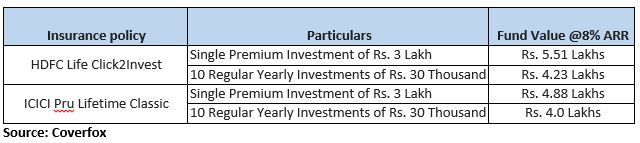

Illustration of fund value comparison in single premium vs regular premium ULIP plans

Tax benefits

In single premium ULIP plans, if the premium paid in a year is more than 10% of the sum assured of the plan, then the total premium is not eligible for tax exemption.

Example:

If the annual premium of a plan is Rs 35,000 and cover amount is Rs 1,75,000, therefore, only Rs 17,500 which is 10% of sum assured (Rs 35,000) will be tax-free and not the entire amount of Rs 35,000 will be exempted from tax.

Be careful while investing in single premium investment plans and check if the annual premium is less than 10% of the sum assured as this criteria is very often not met in such plans. The premiums are not fully tax exempted under Section 80C, also the maturity amount is also fully taxable.

On the other hand, regular premium ULIP policy will provide you tax deduction benefit continuously i.e. over the tenure of the policy under section 80C.

You can also avail tax benefits of up to Rs 1.5 lakh over a period of 15 years (tenure of the policy).

Hence, a single premium ULIP plan can be a shortcoming when compared with the regular premium ULIP plan.

Regular premium ULIP plans are value for money in uncertain demise of policy holder

When it comes to value for money, regular premium ULIP plans are more value for money. Suppose the policyholder meets an untimely death prior to the end of the policy term, the nominee need not pay the pending premiums once the sum assured is received. While in case of single premiums wherein you pay the entire premium in one go, if the policyholder dies during the term they would have unnecessarily paid for the future premiums

SIPs are Best Investments as Stock Market s are move up and down. Volatile is your best friend in making Money and creating enormous Wealth, If you have patience and long term Investing orientation. Invest in Best SIP Mutual Funds and get good returns over a period of time. Know which are the Top SIP Funds to Invest Save Tax Get Rich - Best ELSS Funds

For more information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com