1. E-Filing Vault – Higher Security

Restricting the methods/options for Login and locking the reset password options will secure account from possible mis-use. This is for additional security or secured access.

Pre-requisites

- User should be registered in the e-Filing portal.

- A valid DSC is already registered in the e-Filing application.

- A valid Aadhaar should be linked with PAN in e-Filing (In Case of Individual Users)

2. Steps involved in E-Filing Vault-Higher Security Process

Step 1 – Login to e-Filing portal using user Credentials.

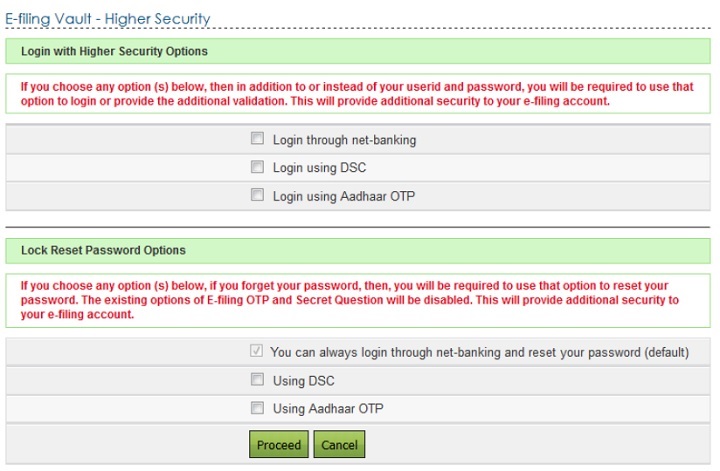

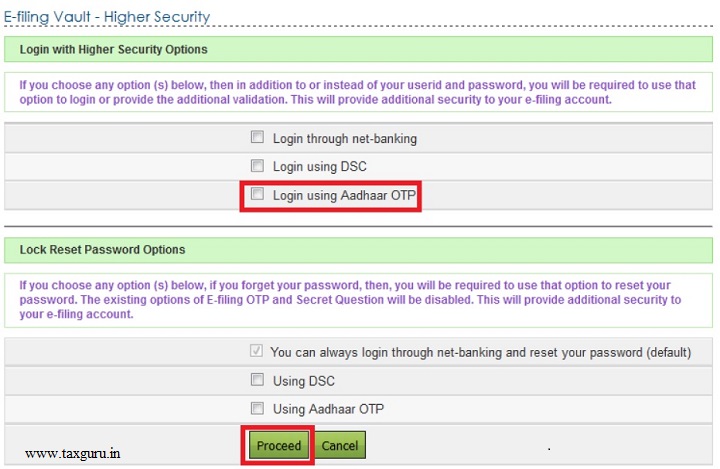

Step 2 – Navigate to Profile Settings ⇒ E-Filing Vault-Higher Security. The following screen is displayed.

Step 3 – User can select the required options to secure the account. On Success, user will be allowed to login and Reset Password only with the above selected option(s).

| Fields | Pre-requisite to avail the options | |

| Login through Net Banking | • | Users should have logged-in to e‑Filing portal through Net-banking atleast once to avail this option |

| Login Using DSC | • | Users need to register Digital Signature Certificate before opting for 'Login Using DSC'. To register DSC, Go to My Profile ⇒ Register Digital |

| Login Using Aadhaar OTP | • | Users need to Link Aadhaar to the PAN before opting for 'Login Using Aadhaar OTP'. To Link Aadhaar, Go to My Profile ⇒ Link Aadhaar. |

3. Login with Higher Security Options

Login through net-banking

If the user chooses Login through net-banking, along with e-Filing User ID and Password, user will be required to login through Net Banking. This ensures additional security to user's e-Filing account.

- User needs to select the option "Login through net-banking". Once the user selects the checkbox, below confirmation appears. Click "OK" and click the "Proceed" button.

- User will be redirected to a confirmation page.

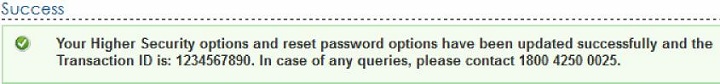

- Click on "Confirm" button. Success message is displayed on the screen.

- Next time the user logs in, the user is redirected to "e-Filing Login Through NetBanking" page where the user needs to select his / her bank and login to the

- User must select his/her bank from the list of the banks provided.

- After login to NetBanking account, click on the link "Login to the IT e-Filing account".

- User will be redirected to e-Filing dashboard.

User can deactivate the Secured Login at any time.

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Login through NetBanking" and click Proceed button.

- User will be redirected to a confirmation page.

- Click on Disable button. Success message is displayed on the screen.

Login Using DSC

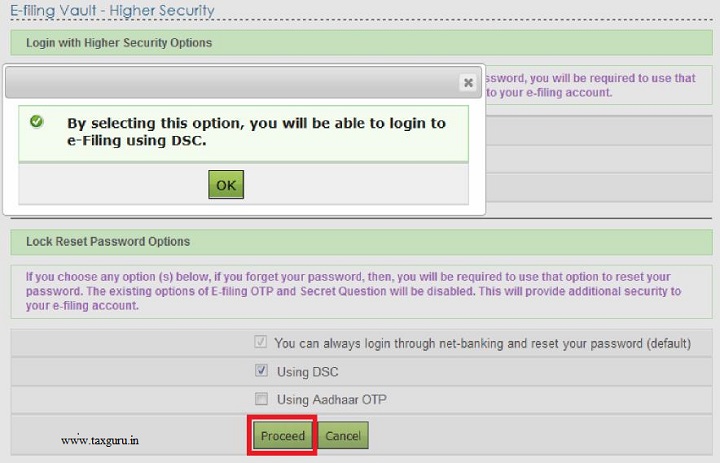

If the user chooses Login using DSC, along with e-Filing User ID and Password, user will be required to login using DSC. This ensures additional security to user's e-Filing account.

- User needs to select the option "Login using DSC". Once the user selects the checkbox, below confirmation appears. Click "OK" and click the "Proceed" button.

- User will be redirected to a confirmation page.

- Click on "Confirm" button. Success message is displayed on the screen.

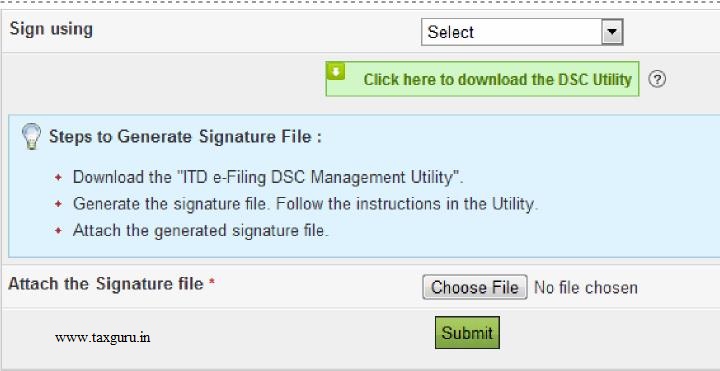

- Next time the user logs in, the user is redirected to Secured Login Option page where the user needs to select the either New or Registered DSC, and upload the signature file generated using DSC Management utility. Click Submit.

- User will be redirected to e-Filing dashboard.

User can deactivate the Secured Login at any time.

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Login using DSC" and click Proceed button.

- User will be redirected to a confirmation page.

- Click on Disable button. Success message is displayed on the screen.

Login Using Aadhaar OTP

If the user chooses Login using Aadhaar OTP, along with e-Filing User ID and Password, user will be required to login using Aadhaar OTP generated. If user has linked Aadhaar to the PAN a request is made to the Aadhaar Web service, OTP is generated and sent to the Mobile Number registered with UIDAI. This ensures additional security to user's e-Filing account.

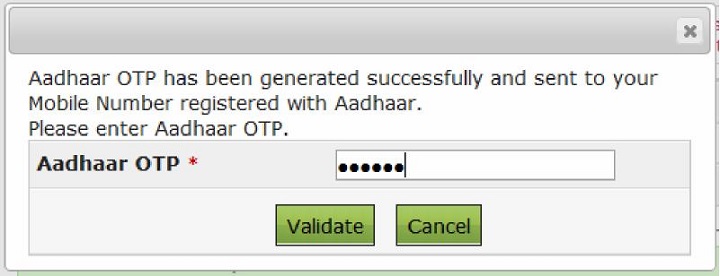

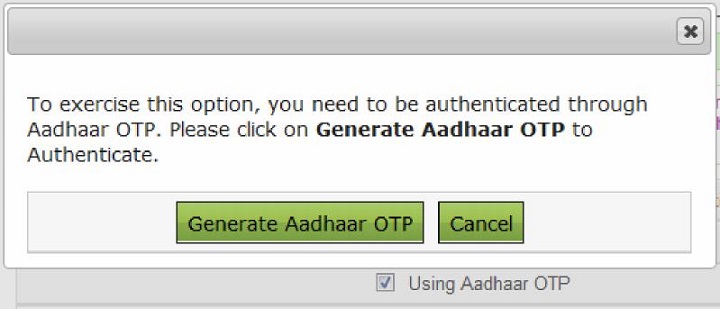

- User needs to select the option "Login using Aadhaar OTP". Once the user selects the checkbox, below confirmation appears. Click "Generate Aadhaar OTP" button.

- Aadhaar OTP is successfully generated and will be sent to the Mobile Number registered with Aadhaar.

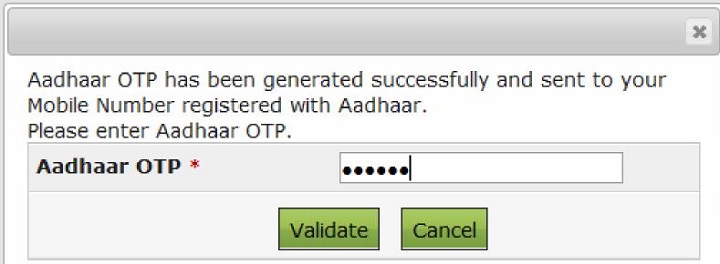

- Enter the Aadhaar OTP and click Validate.

- Success message is displayed on the screen. Click on "OK" and click "Proceed"

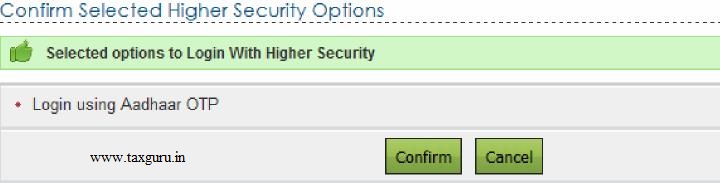

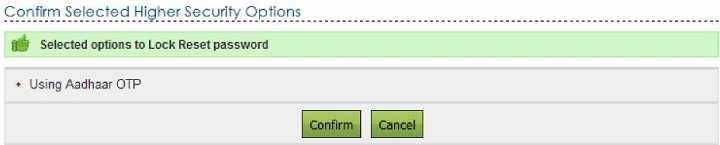

- User will be redirected to a confirmation page.

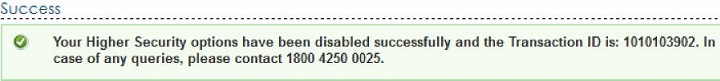

- Click on "Confirm" button. Success message is displayed on the screen.

- Next time the user logs in, the user is redirected to Aadhaar OTP Login page where the user needs to generate Aadhaar OTP. Click Generate Aadhaar OTP button.

- Aadhaar OTP is successfully generated and will be sent to the Mobile Number registered with Aadhaar.

- Aadhaar OTP will be validated and the User will be redirected to e-Filing dashboard.

User can deactivate the Secured Login at any time.

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Login using Aadhaar OTP" and click Proceed button.

- User will be redirected to a confirmation page.

- Click on Disable button. Success message is displayed on the screen.

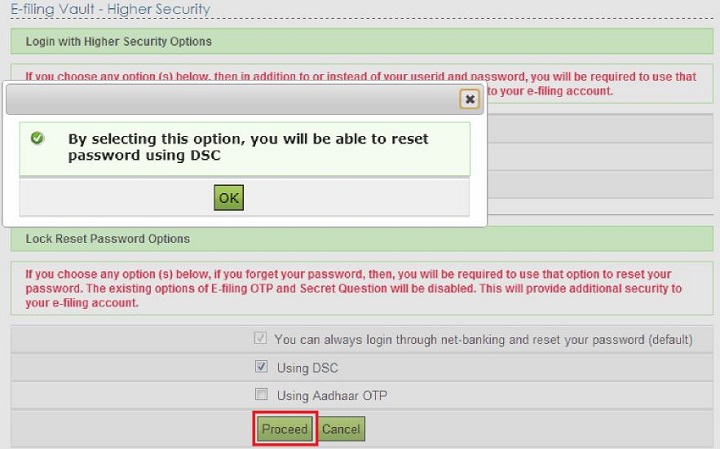

4. Lock Reset Password Options

If the user forgets his/her password, then the user will be required to use the option selected using this process to reset password. The existing options of e-Filing OTP and Secret Question will be disabled. This will provide additional security to e-Filing account.

Reset Password through net-banking

This is a default option available. At any time the user can reset his/her password using NetBanking option.

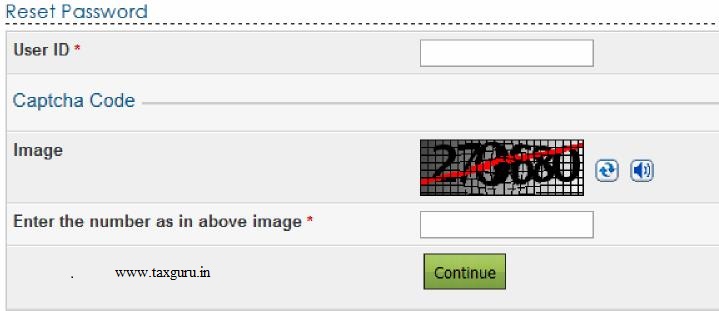

- In the Login Page, click "Forgot Password?" link.

- User will be redirected to a Reset Password page. Enter the User ID and Captcha Code and click Continue.

- Click on "e-Filing Login Through NetBanking" link.

- User must select the bank from the list of the banks provided.

- After login to NetBanking account, click on the link "Login to the IT e-Filing account".

- User will be redirected to e-Filing dashboard.

- User can change the password under Profile Settings ⇒ Reset Password.

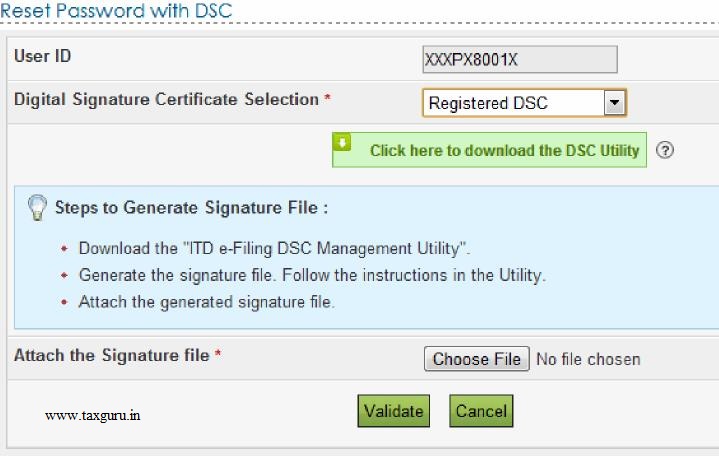

Reset Password Using DSC

If the user chooses to reset the password using DSC, all the other options to reset the password will be disabled and the user can reset the password only using DSC. This ensures additional security to user's e-Filing account.

- User needs to select the option "Using DSC". Once the user selects the checkbox, below confirmation appears. Click "OK" and click the "Proceed" button.

- User will be redirected to a confirmation page.

- Click on "Confirm" button. Success message is displayed on the screen.

- Next time the user wishes to reset password, click on "Forgot Password link?" in the Login Page.

- User will be redirected to a Reset Password page. Enter the User ID and Captcha Code and click Continue.

- User can reset his password only using DSC.

- Select the option "Using DSC" and click Continue. User is redirected to a page where he can select the type of DSC and upload the signature file generated using DSC Management Utility.

- Click on "Validate" button. User is redirected to a page where he can Change the

- Enter the New Password and re-enter the Password and click "Submit" button. Success message is displayed on the screen.

User can deactivate the Secured Reset Password at any time.

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Using DSC" and click Proceed button.

- User will be redirected to a confirmation page.

- Click on Disable button. Success message is displayed on the screen.

Reset Password Using Aadhaar OTP

Success message is displayed on the screen. Click on "OK" and click "Proceed"

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Using Aadhaar OTP" and click Proceed button.

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300