The much maligned ULIPs have become more attractive as investment options under the revised IRDA guidelines. The cost and fees structure of ULIPs have been considerably rationalized. For the uninitiated, ULIPs are combined investment and insurance plans. The investors may choose between equity and debt allocations of their premiums, depending upon their financial planning considerations. ULIP also offers life cover, on the investor's annual premium. ULIPs have lock in period, usually ranging from 3 to 5 years. ULIP premiums are eligible for deduction from taxable income under Section 80C of the Income Tax Act. The maturity proceeds from ULIPs are also tax exempt under Section 10 (10D). In this two part series, we will discuss how ULIP funds have done in the last 5 years. Investors should note that their actual returns will be lower than the gross returns from the ULIP funds, depending on how they are impacted by various ULIP charges like Premium allocation charge, Policy administration charge and Mortality charge. To understand how these charges affect ULIP returns, please refer to our article, Demystifying Unit Linked Insurance Plan (ULIP) Charges and Returns. The top ULIP funds have given good gross returns in the last 5 years. Their performance in certain categories of investments is almost at par with mutual funds. In this article, we will discuss the performance of top ULIP equity funds in the last 5 years.

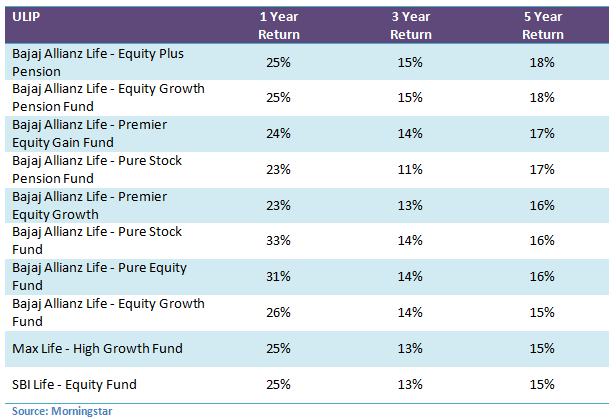

Large Cap Equity ULIP Fund

ULIP funds belonging to the large cap equity category have given average returns of 12.75% at the category level, almost at par with large cap equity funds. Like their mutual fund counterparts, the ULIP large cap funds category has outperformed the BSE – 100 Index during this period. Some of the top ULIP large cap funds have given compounded annual returns in excess of 18% over the last 5 years. The table below lists the top 10 large cap ULIP funds (individual policies only) based on 5 years annualized returns (3 and 5 year returns are annualized).

We can see that the top 10 large cap ULIP funds list is dominated by ULIPs from Bajaj Allianz. However large cap ULIP funds from Max Life, SBI Life, ICICI Prudential, IDBI Federal Life and Kotak Mahindra Life have also given nearly 15% returns. Given that ULIP fund portfolios are less actively managed compared to mutual funds, the performance has been quite good.

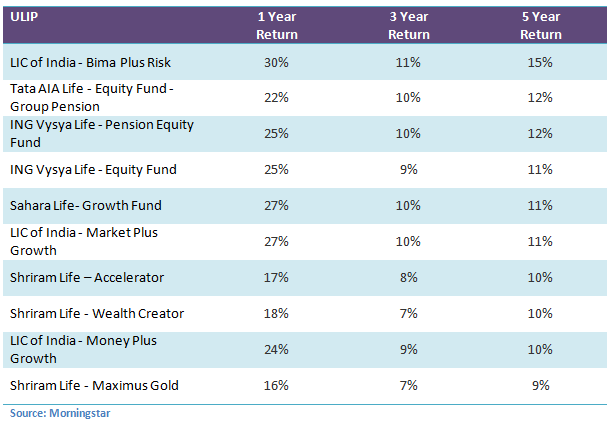

Flexi-cap Equity ULIP Fund

ULIP funds belonging to the flexi-cap equity category have given average returns of 11% at the category level, which is below par compared to diversified and other categories of equity funds. The table below lists the top 10 flexi-cap ULIP funds (individual policies only) based on 5 years annualized returns (3 and 5 year returns are annualized).

We can see that the Bima Plus Risk ULIP from LIC has given 15% returns, but the other funds in the top 10 list have given returns less than 13%. Based on 5 year annualized returns, this category of ULIP funds has underperformed to other equity categories, but the 3 years and 1 year performance has been good.

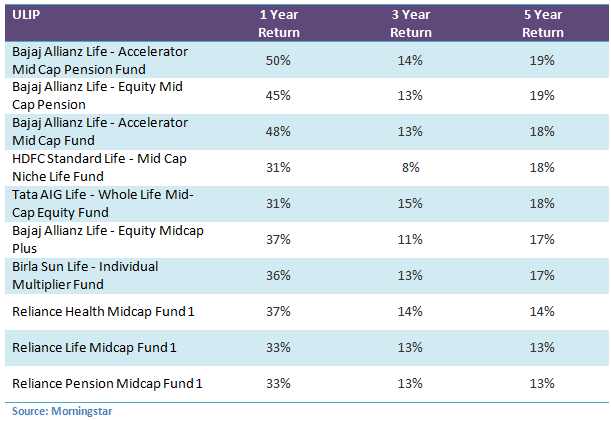

Small and Midcap Equity ULIP Fund

ULIP funds belonging to the Small and Midcap categories have also given good gross return. The average category return of small and midcap ULIP funds is 16%, which is only slightly lower compared to their mutual fund counterparts. The table below lists the top 10 small and midcap ULIP funds (individual policies only) based on 5 years annualized returns (3 and 5 year returns are annualized).

We can see that the top 10 midcap ULIP funds list is dominated by ULIPs from Bajaj Allianz, giving 17 – 19% returns. ULIP funds from HDFC Standard Life, Tata AIG and Birla Sun Life have also given 17 – 18%. There are also a number of Reliance Life ULIPs in the Top 10 list. The returns from the Reliance midcap ULIP funds are relatively on the lower side at 13 – 14%.

Sector Equity ULIP Fund

Apart from large cap, flexi cap and midcap equities, there are certain ULIP sector funds. However, these have been rank underperformers over the last 3 years and 5 years with average returns only 1 – 2%. However, in the last one year infrastructure and energy sector ULIP funds have done well. Sector funds are more risky than diversified funds.

Actual Returns for the investors

In this article, we have seen how top ULIP equity funds have performed. The actual returns for the investors will be much lower, especially investors those who are at an early stage of their policy terms. Many ULIPs allocate a substantial part of the premium in the first year of the policy, and even beyond, to premium allocation charges. A portion of the premium also goes to policy administration charges and mortality charges. Mortality charge, which is the fee for insurance cover, increases with age. Some of these charges like premium allocation charges are deducted upfront from the premium. The balance premium of deduction of upfront charges is invested to buy units of the fund. Other charges are deducted on a monthly basis, by cancelling units at applicable net asset values.

Switching from or surrendering under performing ULIPs

If the performance of your ULIP equity fund is not satisfactory compared to the top ULIP equity funds discussed above, then you can consider switching to better performing funds from the same life insurance company. Most ULIP policies allow some free switches every year. Some life insurance companies allow unlimited free switches. You may also consider surrendering your policy and invest in a top performing ULIP from a different life insurance company. Investors should note that surrender charges may apply. But if your ULIP is under performing significantly, then you should do a cost benefit analysis of the surrender charges you will have to pay versus the benefit you get by moving to a plan giving much higher returns. However, investors should remember that return on investment is not the sole objective of ULIPs. Life insurance is also an important objective, especially if the ULIP is your only life insurance policy. Please refer to our article, Avoid 6 common Life Insurance mistakes, for some important life insurance considerations.

Conclusion

In this article, we have seen how the top equity oriented ULIP funds have performed in the last 5 years. ULIPs are complex investment products. Investors should fully understand all the charges before investing in ULIPs. Investors should consult with the financial advisers if ULIPs are suitable investments for them. If you are already invested in ULIPs you should monitor your ULIP investment on a regular basis to see, if they are helping you meet your insurance and investment objectives. In our next article, we will see how top balanced and debt oriented ULIP funds have performed in the last 5 years.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------