Even though the real estate market has been somewhat subdued in the last one to two years, over the past ten years, real estate in India has given good returns. Enticed with the idea of owning a house and seeing their assets rapidly appreciate in value, countless Indians have invested a large part of their savings in real estate. Buying and selling residential or commercial real estate is part of the portfolio of many investors. Many cities and suburbs have seen a veritable real estate boom in the last decade. While real estate investments of many investors have appreciated in value, real estate investors cannot escape tax consequences when they book profits. To escape tax consequences, it is a fact that some real estate investors transact in cash. However, it is illegal to deal in cash and the consequences are severe, if investigated by the Income Tax authorities. It is possible to save taxes on your real estate investment, without having to resort to illegal means. In this article, we will discuss how you can save capital gains tax on your real estate investment.

What is capital gains tax on Real Estate?

Capital gain in the real estate context means the profit earned from sale of your real estate investment, residential or commercial. The tax consequence arising out of capital gains is called the capital gains tax. From a real estate perspective there are two kinds of capital gains.

Short term capital gains:

If the capital gain is on sale of property which is owned by the seller for less than three years period then it is short term capital gain. Short term capital gain is taxed as per the income tax bracket of the seller.Long term capital gains:

If the capital gain is on sale of property asset which is owned by the seller for more than three years period then it is long term capital gain. Long term capital gain is taxed at 20% with indexation (we will discuss, how to calculate long term capital gains, in the next section of the article).

How to calculate capital gains tax on Real Estate sale?

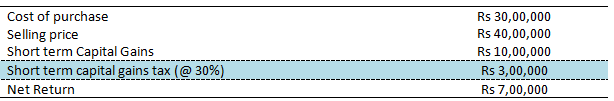

Let us understand with the help of an example. Let us assume that, you are an investor in the highest tax bracket (i.e. 30% tax bracket) and you bought a property on July 1, 2011 at a cost of Rs 30 lacs. Let us further assume that the property value appreciates at a rate 15% per annum. If you sold the property in July 1, 2013 at a price of Rs 40 lacs, what is your capital gains tax?

In this case, the short term capital gains tax is Rs 3 lacs and the net return is Rs 7 lacs.

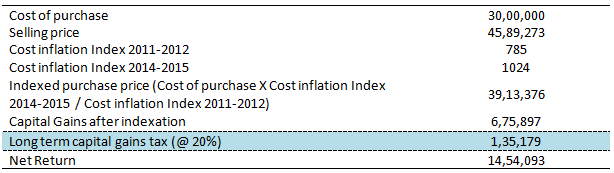

But what if you sold the property on July 15, 2014 instead of July 1, 2013? Since the holding period is more 3 years, long term capital gains will apply. Let us assume at the same rate of appreciation, the value of property as on July 15, 2014 is Rs 46 lacs. What is your capital gains tax?

Therefore, we can see that it is advantageous to hold on to your property for more than 3 years, because the long term capital gains tax rate with indexation is much lower than short term capital gains tax rate. Also, investors should note that, if they have invested funds for repair of their property, such repairs can also be indexed and included in the calculation of capital gains from a tax perspective.

How is the holding period defined?

The holding period is defined as the period till date, from which you were granted the "Right to own the Property". The Bombay High Court has clarified the definition of capital asset as defined in Section 2(14) of the Income Tax Act. From an Income Tax perspective, the right to obtain conveyance of immovable property was clearly "property" as contemplated by Section 2(14) of the I.T. Act, 1961. The issue of allotment letter gives the right to obtain conveyance. Therefore the holding period from an income tax perspective applies from the date the allotment letter was issued to you.

How can you save Long Term Capital Gains Tax?

Under Section 54 of the Income Tax Act, the seller of a real estate asset can claim for long term capital gains tax exemption, through these two methods.

- The seller must use the capital gain, arising out of the sale of his or her real estate investment, to buy or build another house

- The seller must use the capital gain, arising out of the sale of his or her real estate investment, to invest in specified capital gains bonds.

Therefore, continuing with our above example, if you have made a profit of Rs 15 lacs on the sale of your property, and you re-invest the entire capital gain amount (e.g. Rs 15 lacs) in a new property in the same financial year when the sale was made, then you will be exempt from long term capital gains tax on the sale of your property.

What if you have not been able to identify a property to avail benefits under Section 54?

If you are not able to identify a property in same financial year after selling property, you can still avail the tax benefits under Section 54 of the Income Tax Act, provided you buy another house in 2 years or build another house in 3 years. To avail of long term capital gains tax benefit, you have to open a special account called capital gain accounting scheme and deposit the amount of capital gains in the capital gains account before the due date of filing of income tax returns for the assessment year in which the asset sale was. All withdrawals from the capital gains account should be made only for purchase of property. Continuing with our above example, if you deposit the entire capital gain amount (e.g. Rs 15 lacs) in a capital gains account before the date of filing of IT returns for the assessment year 2014 - 2015, which will be sometime in end of July 2014, you will be able exempt from long term gains. You will be able draw funds from your capital gains account to buy another house in 2 years (i.e. by 2016) or build another house in 3 years (i.e. 2017). However if you fail to purchase a property within three years after selling your property, the entire sales proceeds will be exposed to Long Term Capital Gains and the tax consequences thereof.

How to open a Capital Gains Account?

You can open a capital gains account in an authorized bank. The Government has notified 28 banks which can open the Capital Gains Account on behalf of the Government. You have to apply for opening the account by filling out the required application form (Form A) and submit proof of address, PAN card and photograph. You cannot withdraw funds from a capital gains account using a cheque book or ATM, like you do in your normal savings bank account. There are procedures to be followed to withdraw funds from the capital gains account.

Investment in Specified Bonds

Section 54EC of Income Act provide that if the seller invests whole or part of capital gains arising from the sale of asset in specified Capital Gains, within a period of six months of the sale, the proportionate capital gains so invested in the long-term specified asset, out of the whole of the capital gain, shall not be charged to tax. The proviso to the said sub-section provides that the investment made in the long-term specified asset during any financial year shall not exceed Rs 50 lacs. There was an ambiguity in the language of the specific provision in Section 54C. As a result, if you made a profit of Rs 1 crore on the sale of your house transferred in December, you could invest Rs 50 lacs in March of that financial year and further Rs 50 lacs in April of the next financial year. However the 2014 Budget presented in the Parliament a few days back has clearly specified that, the maximum deduction which can be availed is Rs 50 lacs in one financial year in which the sale was made and separate deduction cannot be claimed in the subsequent financial year. Therefore the maximum tax benefit you can get under the provisions of the new Budget is Rs 50 lacs.

Conclusion

Real estate is an attractive and popular investment option for many investors in India. With careful planning you can save a substantial part of your long term capital gains tax, without having to resort to illegal means.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------