"Mutual funds paying high dividends have their own appeal for a certain set of investors, especially those looking for regular income from their investments. Dividend plans distribute profits made by the fund at periodic intervals. These funds are suitable for investors with moderate risk tolerance levels as they receive regular cash payouts as well as capital appreciation over a long period of time. Retired investors can consider allocating a small portion of their investment to funds with high dividend yield to supplement their regular income from monthly income plans, and also to grow their capital. In this article, we will review some of the top mutual fund dividend plans in India over the last 5 years."

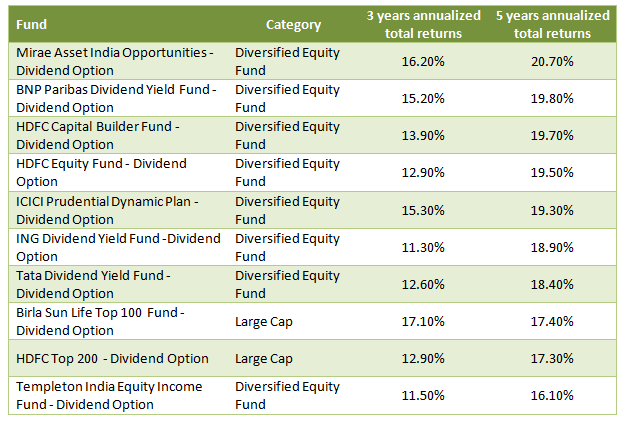

There are a number of "dividend yield" equity funds, like which aim to generate both regular income and capital appreciation, by investing in high dividend yield stocks. We have not restricted our selection to these funds only. Based on our analysis, in addition to dividend yield funds, the dividend plans of some diversified equity and large cap funds have generated excellent dividend income as well as capital appreciation. To indentify the top dividend plans, we have taken May 26, 2009 as the investment date and looked at total returns from May 2009 to May 2014. The total return of a fund is the sum of the capital appreciation and the dividend income from the fund. In addition to the total returns, we have also looked at the historical yield of the fund. To compute the historical dividend yield, we have taken the dividends declared from May 2009 to May 2014 and calculated the ratio of the average 5 year dividends and the original investment (made on May 26 2009). Since, the investment objective for the purpose of our analysis is both regular income and capital appreciation, dividend plans with higher total returns but low dividend income has been excluded from our selection. The table below lists the top dividend plans based on the considerations described above.

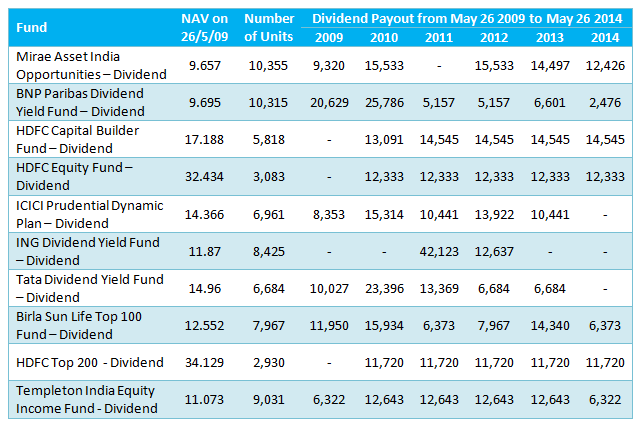

We can see in the table above that the five years total returns from the funds above were in the range of 16 – 21%. The three years total returns were in the range of 11 – 17%. We will now see how much dividends, these funds paid in the last 5 years. Let us assume the investor made an investment of Rs 1 lakh in the dividend plans of these funds on May 26, 2009. The table below shows a dividend pay-out from Rs 1 lakh investment in these plans, over the period from May 26 2009 to May 26 2014.

We can see from the table above that while some funds were regular about dividend payments (e.g. Templeton India Equity Income Fund, BNP Paribas Dividend Yield Fund, Birla Sun Life Top 100 Fund, Tata Dividend Yield Fund etc.), some funds were less regular (e.g. ING Dividend Yield Fund). Also, the dividend amounts each year, varies less for some funds (e.g. Templeton India Equity Income Fund, HDFC Top 200 Fund, HDFC Equity Fund etc.) and varies substantially for some funds (e.g. BNP Paribas Dividend Yield Fund, ING Dividend Yield Fund etc.). However, despite these variations, all the funds in our selection above have given good dividends to their investors. The average annual yield on the original investment for each of the fund's dividend plan exceeds 11%. The average annual dividend income from Rs 1 lakh investment in these funds is nearly Rs 12,500. Investors should note that dividends from equity funds are tax free in the hands of the investors. On the other hand, income from most debt investments is taxable, per the applicable income tax slab of the investors.

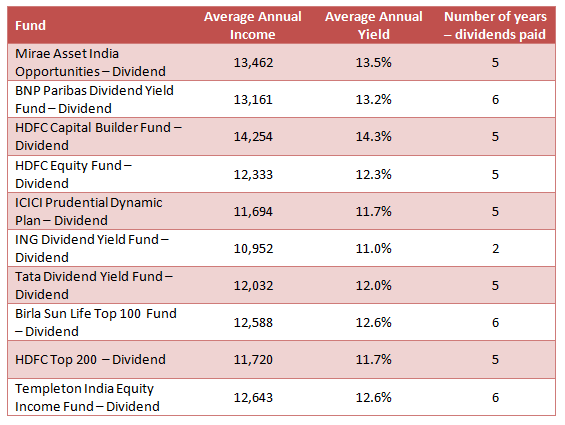

The table below shows the average annual income, average annual yield and the number of years during this period when these funds paid dividends, over the five year period from May 2009 to May 2014.

We can see that each of these funds have given good tax free yields. Almost all the funds, with the exception of ING Dividend Yield Fund and Mirae Asset India Opportunities Fund, have paid dividends every year during this five year period. ING Dividend Yield Fund paid dividends only twice, during this 5 year period, but it paid high dividends in those two years. As a consequence, despite missing dividend payments for 3 years the historical yield of the fund in the 5 year period is 11%. However, if investors prefer funds with regular dividends, they can consider two other funds, not included in the selection above.

- Birla Sun Life Dividend Yield Plus – Dividend Option: This dividend yield fund from the Birla Sun Life stable paid dividends every year, during this 5 year period. The historical yield from this fund, during this five year period was 10%

- UTI Dividend Yield Fund – Dividend Option: This dividend yield fund from the Unit Trust of India stable paid dividends every year, during this 5 year period. The historical yield from this fund, during this five year period was also 10%

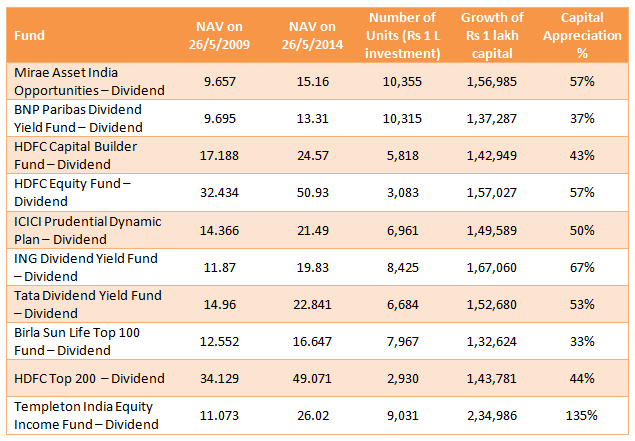

We have seen the funds in our selection have given good annual income over the period from May 26 2009 to May 26 2014. In addition to generating income these funds also have given capital appreciation over this five year period. This is really the icing on the cake of high dividend yielding mutual funds. The table shows the growth of the original Rs 1 lakh investment in these funds and the percentage capital appreciation over these five years.

Conclusion

In this article, we have seen that high dividend yielding mutual fund schemes are excellent investment options for investors with moderate risk tolerance levels, looking for regular income as well as capital appreciation. These funds are typically less volatile than the other equity funds and therefore the downside risk is limited to an extent. Retired investors can also consider allocating a portion of their investments to these plans, to supplement their income from monthly income plans. Dividends from these plans are tax free in the hands of the investors. If the investors need higher cash payout, they can opt for systematic withdrawal program from these funds. However, it is important to note that mutual funds are subject to market risks. Investors should consult with their financial advisers if these funds are suitable for them.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------