Step-up SIP, also popularly known as top-up SIP, is an automated facility through which SIP contribution can be increased by a predetermined fixed amount, or a fixed percentage, at periodic intervals in line with your financial goals and level of income.

The investor has to opt for this facility - increasing amount/percentage and intervals - right at the time of enrolling for the SIP.

The periodic intervals can be quarterly, half-yearly, or annual.

Few AMCs still don't have an option of automatically increasing the SIP amount, so you have to manually make a transaction of increasing the SIP amount.

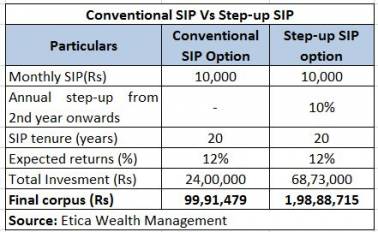

Difference between Conventional SIP and Step-up SIP

Conventional SIPs do not allow investors to increase their contribution during their SIP tenure. The only alternative is to start a fresh SIP or make lump-sum investments.

As a result, those lacking financial discipline often fail to increase their SIP contribution in sync with their rising income. That is where step-up SIPs come into the picture.

Step-up SIPs allows investors to automate their SIP contribution and increases in sync with their expected growth of income. With automated incremental investing, SIP investors can derive greater benefit from the power of compounding and thereby reach their financial goals sooner.

Illustration

An investor named Raman starts a conventional SIP of Rs 10,000 and another one named Mohan starts a step-up SIP with the same amount, increasing investment by 10 percent a year from the second year onward for 20 years.

At the end of an investment term, the total corpus built by Raman will be Rs 99.91 lakh, which is barely half of the Rs 1.98 crore accumulated by Mohan (refer to table).

Who should opt for step-up SIPs?

Step-up SIP is especially beneficial for those who lack sufficient surplus to invest for their financial goals. With this option, they can start SIPs with lower contribution and then gradually increase their investments along with their increasing income

It is also beneficial for those who lack the financial discipline to increase their investments with growing income.

Benefit of step-up SIP: Built-up corpus takes care of rising inflation

An investor needs to step up any investment on the fact that the value of money is eroding with time due to rising inflation

In the last 20 years, the average rate of inflation has been 6.54 percent. The value of currency erodes with time.

If you invest Rs 3,000 a month, it would be the same as investing Rs 10,500 in 20 years. So, an investment target that seems worthwhile today, say Rs 1 crore by 2037, might actually become Rs 3.5 crore by the time you get there, assuming the same inflation rate of 6.54 percent per annum

So, stepping up your investment every year can help you create more wealth.

Challenges in step-up SIP:- Income should increase year-on-year

The basis of a step-up SIP is the assumption that an investor's income would keep increasing in a linear fashion year-on-year. There can be instances where income may not increase as much in some particular years or expenses may increase too much, leaving little surplus. In such cases, continuing with step-up SIP will be stimulating task for an investor. - Changes in lifestyle and expenses

Life and things around keep changing at a fanatic pace. So, arrival of a new born child or a job loss or any unfortunate circumstances in a family can make the whole cash flow go for a toss. If this happens after starting a step-up SIP, then it may be difficult to continue with rising investments. Keep in mind while stepping up your investment is to not overshoot and commit yourself to more than what you can afford to set aside

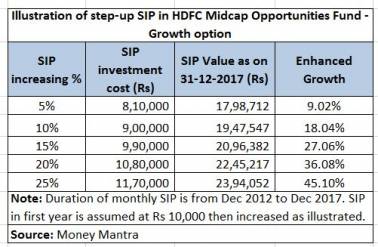

Illustration of step-up SIP with a mutual fund scheme

The illustration in the table below should persuade you to increase monthly SIP investments every year into mutual fund schemes you are holding, as per your goals and rise in income.

SIPs are Best Investments when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich - Best ELSS Funds

For more information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com