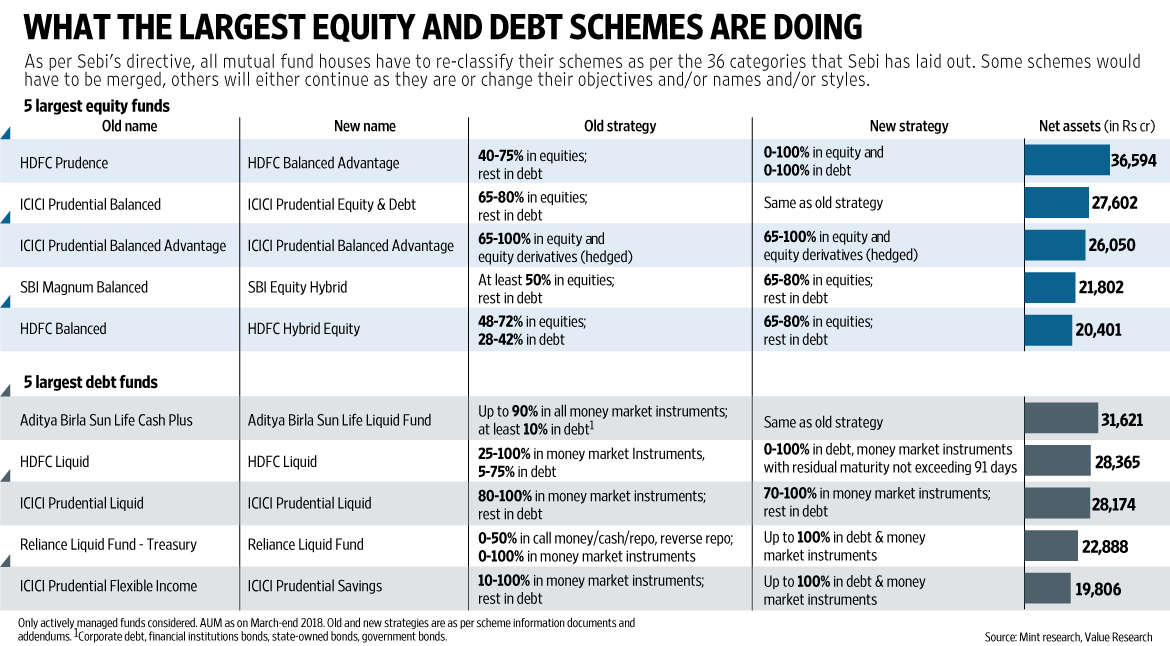

HDFC Prudence Fund (HPF), the country's largest equity-oriented mutual fund scheme with assets close to Rs 37,000 crore, will now be known as HDFC Balanced Advantage Fund and can switch entirely between equities and debt. Until now, it could invest only 40-75% in equities. On 25 April, HDFC Asset Management Co. Ltd announced plans for many of its schemes, as part of the ongoing merger and re-categorisation exercise.

Most other fund houses, too, have announced their plans to re-categorise their schemes. If you don't agree with your schemes' new form, you have a chance to exit without paying an exit load.

Here's how you should decide what to do.

Your scheme could change...

If there is no change to your scheme, you have nothing to worry about. But if your scheme is about to change, check how big or small it is. For instance, if you own a large-cap fund that is set to become a large- and mid-cap fund or a multi-cap fund, it won't matter much. In fact, this particular move is good. Going ahead, it will get difficult for large-cap funds to outperform their benchmark indices. The definition of large-cap fund has narrowed down and benchmarking performances against total returns index would make things tougher for large-cap funds

If your scheme undergoes a big change, evaluate. For instance, SBI Treasury Advantage Fund, which will be known as SBI Banking and PSU Fund, was meant for short-term investments. Now, its strategy would be to invest in debt scrips of state-owned companies and banks. If the risk profile of a scheme changes, look at it again. If it no longer meets your purpose, leave it

...but do not jump the gun

Don't blindly go by the change in your fund category. Mirae Asset Emerging Bluechip Fund (MEBF)—an erstwhile mid-cap fund—has become a large- and mid-cap fund. The name remains the same, and, what's more, the fund remains the same too.

On the face of it, a shift from a mid-cap to a large- and mid-cap fund is a big change. But dig a little deeper and you might not want to worry about it. According to capital markets regulator Securities and Exchange Board of India (Sebi), a large- and mid-cap fund must invest a minimum of 35% each in large- and mid-cap stocks. As it turns out, MEBF has been increasing its exposure to large-cap companies over time; from an average of 20% in 2014 and 26% in 2015 to 38% so far this year, as per Value Research.

We didn't want to tamper our existing portfolios too much. So, whichever categories our funds fitted into naturally, we have moved our funds there. Although a dynamic category fund can switch entirely between equity and debt, a person close to HPF said it can—and will—continue to invest 65-70% in equities like always. Of course, how the fund performs in falling markets in the face of its present equity allocation remains to be seen as the fund will now be compared to other dynamic funds. HPF refused to comment.

The tax implications

If your scheme merges with another or ceases to exist, there are no tax implications. If, however, you choose to withdraw, you may have to pay short-term capital gains tax of 15% (plus surcharge and cess) if you had bought the units in the past one year or long-term capital gains tax, otherwise.

The only respite is you don't pay an exit load, if any, even if you withdraw within the exit load period.

What should you do?

Each merger and re-categorisation poses a unique situation. How one investor reacts to a change could be different from another investor's reaction. Sit with your financial adviser to understand the ramifications of your scheme changes. But here are some broad principles you should follow.

* If your scheme's risk profile increases a little, there is no cause for alarm. For instance, a large-cap fund becoming a large- and mid-cap fund is acceptable. If your scheme's risk profile increases a lot, take a closer look. For instance, SBI Magnum Equity Fund (a large-cap fund) is now a thematic fund SBI Magnum Equity ESG (Environment, Social, and Governance).

* Just because the fund has changed its category or name does not necessarily mean the scheme has changed. Check if the scheme will continue with its strategy.

* But if the scheme's objective has changed—especially due to a merger with some other scheme—evaluate it. HDFC Gilt (government securities) Fund – short-term plan will now be merged with HDFC Corporate Bond Fund. Both schemes are different.

* New investors, beware. Past performance is set to become a bit hazier, especially for those schemes that have to alter their strategies, for the next three years. In this case, check who the fund manager is, and go by his track record.

* Debt funds are trickiest to navigate in this exercise. The good news is that they've become sharper and each of them now comes with a well-defined objective. Revamp your entire debt schemes portfolio.

SIPs are Best Investments when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich - Best ELSS Funds

For more information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com