For a greater part of this year, equity markets across the globe have been extremely volatile. In fact over the last one month, volatility has spiked to a level that has not been seen in the last few years. Long term investors should know that, once we get past this phase of high volatility, markets will be headed to higher levels and equity as an asset class will continue to outperform other asset classes. Different mutual funds do well relative to others in different market conditions. However the consistent performers usually do well in all market conditions on a relative basis. Consistent performers aim to outperform the market and generate good returns across all time scales from short to long term. In bear markets, while the returns of the consistent performers may be negative, the NAV does not fall in line with the market. Similarly when bull market returns, it outperforms the market by generating better returns. As such, consistent performance should be an important criterion for selecting a mutual fund for long term investment objectives. CRISIL accords special importance to consistent performers. As such, they have a separate ranking based on consistent performance. In this blog we will discuss the top 6 consistent performer large cap funds based on CRISIL most recent ranking.

CRISIL Consistent Performers Ranking Methodology

CRISIL ranks equity funds based on several parameters like average 3 year annualized returns, volatility, portfolio concentration risk (both industry and company) and portfolio liquidity risk. On each of these parameters, each scheme is accorded a cluster rank (from 1 to 5) relative to its peer group. To derive a composite cluster rank, CRISIL has assigned different weights to each parameter, with average 3 year annualized return given the highest weights at 50%, volatility 30%, industry concentration risk 10%, company concentration risk 5% and liquidity risk 5%. The period of analysis is broken into four periods, latest 36, 27, 18 and 9 months. Each period is assigned a progressive weight starting from the longest period as follows: 32.5%, 27.5%, 22.5% and 17.5% respectively. As discussed earlier, CRISIL has a separate ranking for consistent performers across all mutual fund categories. CRISIL ranks consistent performers based on mean return and volatility over 5 years, in addition to the CRISIL cluster rank derived by the methodology described above. CRISIL calculates mean return and volatility for five years, with each one-year period being weighted progressively with the most recent period having the highest weight.

Top 6 large cap consistent performers

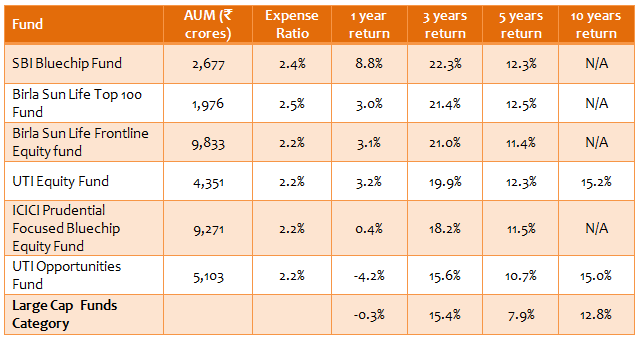

The table below lists the top 6 consistent large cap fund performers based on CRISIL ranking. The funds are listed in descending order of 3 years trailing annualized returns. Returns in the table are for growth options in regular plans. Trailing returns are based on NAVs on September 09, 2015. While the table shows trailing returns from the funds across different timescales, investors should not give too much importance to short term returns. Equity mutual fund investments should always be made with a long term investment horizon. Short term performance is influenced by the market conditions prevailing during the time period. Long term performance (over an investment horizon of 3 years or more) reflects the strength of the underlying fundamentals and the structural macro-economic growth.

If we compare the returns of the consistent performers with that of the large cap funds category, these funds have outperformed the category both in the short term and the long term.

Rolling Returns of the Top 6 most consistent performers

Rolling returns is the best measure of a fund's performance in terms of consistency. Trailing returns have a recency bias and point to point returns are specific to the period in consideration. Rolling returns, on the other hand, measures the fund's absolute and relative performance during the timescale in question, without bias. We will see that the funds in question have delivered outstanding rolling returns over the long term.

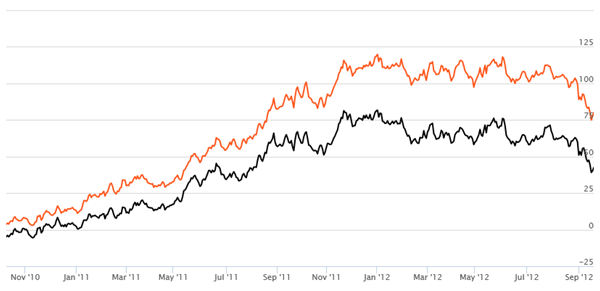

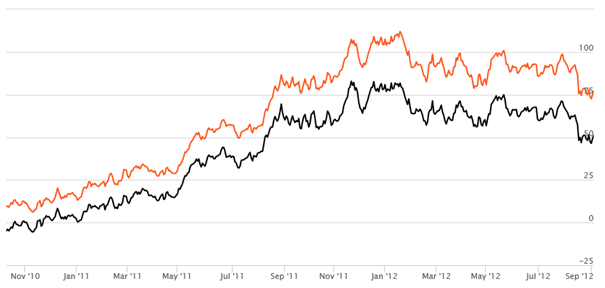

SBI Bluechip Fund

SBI Bluechip Fund is one the most well known large cap funds with great track record. The chart below shows the 3 year rolling returns of the fund over the last 5 years. Rolling returns are the absolute returns of the scheme taken for a specified period on every day/week/month and taken till the last day of the duration. We have chosen 3 years as the rolling returns time period because it is always recommended that long term investors should hold equity funds for at least 3 years. In this chart we are showing returns on every day during the specified period and comparing it with the benchmark. The orange line shows the 3 year rolling returns of SBI Bluechip Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark BSE 100. We can see that the fund has consistently given more than 60% absolute 3 year returns (17% on an annualized) since the middle of 2011. In fact even with the recent fairly deep correction in the market, the 3 year rolling returns are still quite high.

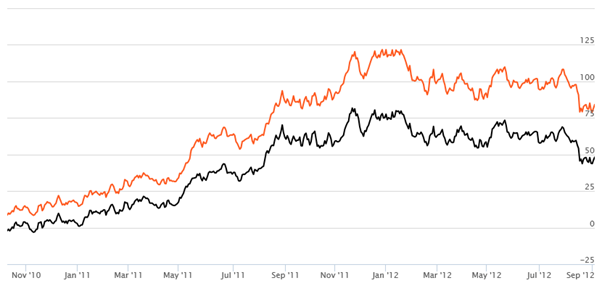

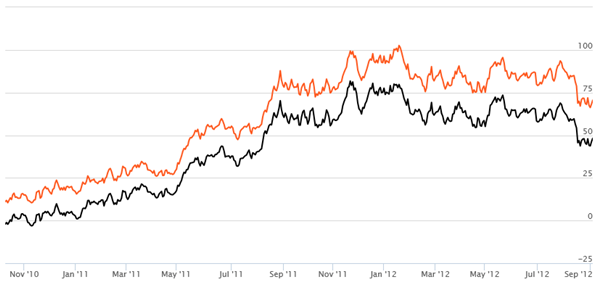

Birla Sun Life Top 100 Fund

Birla Sun Life Top 100 Fund is another popular large cap fund from the Birla Sun Life stable. The chart below shows the 3 year rolling returns of the Birla Sun Life Top 100 Fund over the last 5 years. The orange line shows the 3 year rolling returns of Birla Sun Life Top 100 Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX Nifty. We can see that the fund has consistently given more than 50% absolute 3 year returns (14% on an annualized) since the middle of 2011. The 3 year rolling returns are quite high, despite the volatile market situation over the past month or so.

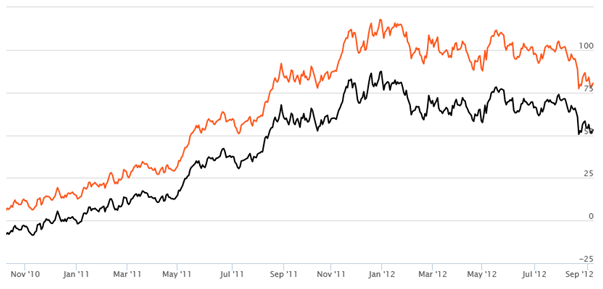

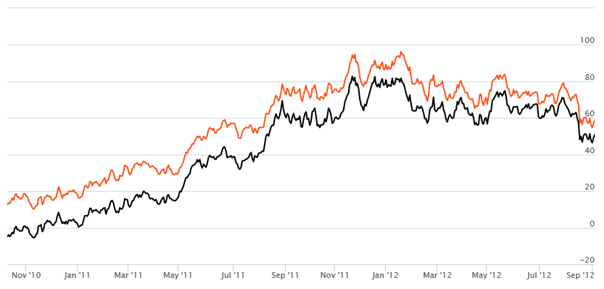

Birla Sun Life Frontline Equity Fund

Birla Sun Life Frontline Equity Fund is one of the most popular funds in the large cap category. The chart below shows the 3 year rolling returns of the fund over the last 5 years. The orange line shows the 3 year rolling returns of Birla Sun Life Frontline Equity Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark BSE 200. We can see that the fund has consistently given more than 50% absolute 3 year returns (14% on an annualized) since the middle of 2011. Even with the deep correction in the market in August and September, the 3 year rolling returns are still quite high.

UTI Equity Fund

UTI Equity Fund is also a very well known fund from the UTI Mutual Fund stable. The chart below shows the 3 year rolling returns of the fund over the last 5 years. The orange line shows the 3 year rolling returns of UTI Equity Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark BSE 200. We can see that the fund has also consistently given more than 50% absolute 3 year returns (14% on an annualized) since the middle of 2011.

ICICI Prudential Focused Bluechip Equity Fund

ICICI Prudential Focused Bluechip Equity Fund from the ICICI Prudential stable is one of the most popular equity funds. The chart below shows the 3 year rolling returns of the fund over the last 5 years. The orange line shows the 3 year rolling returns of ICICI Prudential Focused Bluechip Equity Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX Nifty. We can see that the fund has consistently given more than 50% absolute 3 year returns (14% on an annualized) since the middle of 2011. The fund has delivered excellent 3 year rolling returns despite the extreme volatility in the market over the last month or so.

UTI Opportunities Fund

UTI Opportunities Fund is a very well known fund from the UTI stable. The chart below shows the 3 year rolling returns of the fund over the last 5 years. The orange line shows the 3 year rolling returns of UTI Opportunities Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark BSE 100. We can see that the fund has consistently given more than 50% absolute 3 year returns (14% on an annualized) since the middle of 2011.

Conclusion

Consistent performance is the most important criterion in selecting a mutual fund for investment. Good financial planners suggest that consistent performers should form a large part of your mutual fund portfolio. In this article, we have discussed about the top 6 consistent performers among large cap funds, as per the most recent CRISIL ranking. In our next article, we will discuss the consistent performers among diversified multicap cap or flexicap funds.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------