Mutual fund investors often come across the term "value investing". While value investing is very a popular concept in the investment world, it is not very well understood in the context of mutual funds, especially here in India. Based on investment style, mutual funds can be classified as:-

Growth Funds:

We should be clear about the distinction between growth funds and growth option. They are very different concepts. One refers to the investment style of the fund manager and the other to the profit distribution option. Growth funds invest in companies that will experience faster growth in revenues, earnings per share (EPS) and share price.Value funds:

Value funds, on the other hand, invest in value stocks, i.e. companies which are trading at a considerable discount to its intrinsic valuation. The can be a number of reasons for these companies to be undervalued in the market. There can be temporary industry specific or company specific issues, which can cause the share price to be depressed. Sometimes a temporary quarterly earnings shock can cause the share price to be depressed. An external event can have an unfavourable impact on the share price, for a limited period. However, over the long term, these stocks present good investment opportunities.Blended Funds:

This is a third category, which invests in both growth and value stocks.

In India "value funds" are a rather obscure classification for a number of reasons:-

- Equity market in India is largely momentum driven. Hence, fund managers prefer growth stocks.

- A vast majority of equity funds fall in the category of growth funds. In fact, 90% of the equity funds in India fall in this category. Most of the blended funds also fall in the growth funds category because large majority of the stocks in their portfolio are growth stocks.

- Inconsistent standard of corporate governance is another challenge for value investing. Corporate scams are serious concerns for value investing gains to be unlocked.

- Value funds are difficult to identify. Unlike the developed markets there is no clear labelling of growth and value funds. ICICI Prudential Value Discovery Fund is an example of value fund.

- Even if one tries to identify value funds based on information contained in the mutual fund factsheet regarding the investment style, it is not an easy task. Not all factsheets describe the investment style of the fund. Some AMCs do describe the investment style in their factsheets, but the investment style may change from month to month. Investors should study past factsheets to understand the investment style of the fund manager. Instead of relying on factsheets investors should refer to the fund research by the leading mutual fund research firms to understand the investment style of the fund manager.

Should you invest in value funds?

All the challenges above notwithstanding, value funds make compelling investment choices for the following reasons:-

Risk Management:

The downside risk of value funds is lower than growth funds, since the underlying stocks are already trading at a discount to the fair value. Growth funds, on the other hand, can be hit hard during a downturnLong term investment strategy:

Research has proven that, value investing offers superior returns in the long term in developed markets. Valuations in momentum driven market, such as ours, look stretched when not supported by strong GDP or corporate earnings growth. In such situations, the market enters a period of volatility, like the one we are seeing right now, in our equity markets. In such times, institutional investors look for stocks with deep value, instead of high beta stocks which already run up significantly.Portfolio diversification:

For reasons mentioned above value funds can help investors diversify their mutual fund portfolio. Value funds should not be seen as substitute of growth funds, but rather as a complement to growth funds. Growth funds and value funds work well in different market conditions, and therefore a combination of both with ensure more consistent of portfolio returns.

Good Value Funds

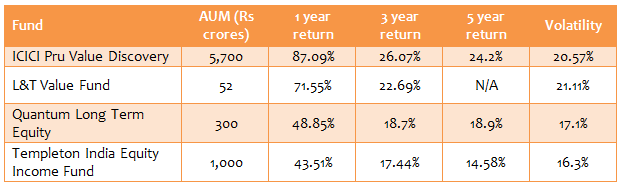

Though there are a very limited number of value funds in the market, some of the good ones are listed in the table below.

Apart from these four, there are other value funds like the Templeton India Growth fund and PPFAS Long Term Value fund. However, investors should be convinced about their track record before investing.

Conclusion

Value funds are a useful addition to your mutual fund portfolio, for reasons discussed in this article. Unfortunately investors have limited choices, since there are not too many value funds in the market. Investors should consult with their financial advisors, if value funds are suitable for their investment portfolio.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------