Sukanya Samriddhi Account – Term Deposit Scheme for Minor Girl Child

Special Term Deposit Scheme Sukanya Samriddhi for Minor Girl Child launched

The Government has launched a new deposit scheme – Sukanya Samriddhi only for minor girl child. This is a small savings scheme which can be opened by the natural (biological) or legal guardian of the girl child aged below 10 years. However, Government has given a buffer time of 1 year if your child turned 10 within a year before the announcement. This means that if the girl child turned 10 anytime between December 2013 and December 2014, you can open such an account in her name.

Deposit account under this scheme can be opened either in public sector bank or post office.

Features of Sukanya Samriddhi Scheme

Opening of Account

Account under Sukanya Samriddhi can be opened and operated either by the minor girl child who has attained the age of 10 years or by guardian of the girl child. Only one account shall be opened in the name of a girl child under these rules after furnishing birth certificate of the girl child along with other documents relating to identity and residence proof of the depositor.

However, as part of the initial offer one year of grace period is being given. Any girl child born between 2 December 2003 and 1 December 2004 can open account up to till 1 December 2015.

Guardian of the girl child will be allowed to open and operate accounts of maximum of two girl children except in the case where depositor either blessed with three girl children in first birth or twin girls in the second birth.

Deposit Rules

The account can be opened with a minimum of Rs.1,000. Thereafter any amount in the multiples of Rs.100 may be deposited with a minimum amount of Rs.1,000 and maximum amount of Rs.1,50,000 in a financial year.

The deposit shall be made by cash, cheque or demand draft. The minimum deposit of Rs.1,000 is to be made each year else a penalty of Rs.50 shall be levied.

Rate of Interest

For the current fiscal year i.e. 2015-16, the deposit will fetch interest at the rate of 9.20% per annum (for fiscal year 2014-15 interest rate was 9.10% per annum).

For sake of simplicity, method of calculation of interest will be similar to Public Provident Fund (PPF). The rate of interest will be notified each year by the Government which will be compounded yearly.

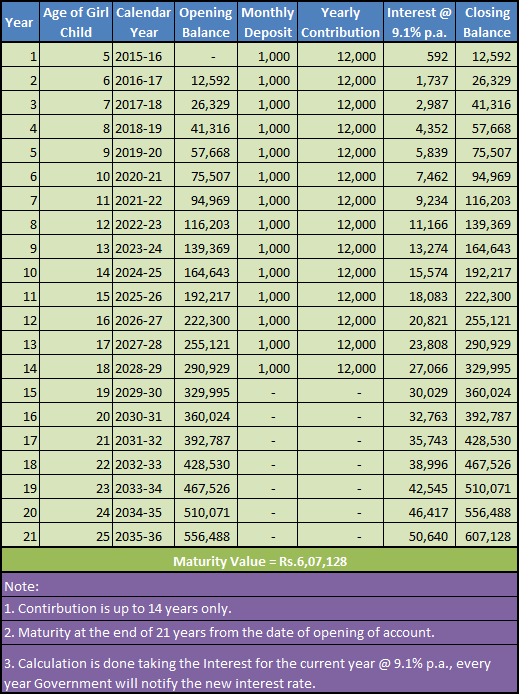

Sukanya Samriddhi Yojna Interest Calculation

Premature Withdrawal

Premature withdrawal up to 50% is allowed for the purpose of higher education and marriage only when the account holder girl child attains the age of 18 years.

Term Period

The deposit is to be made till the end of 14 years from the year of opening of account. The maturity of the account is 21 years from the date of opening of account or if the girl gets married before completion of such 21 years.

Maturity Amount

Taxation

On the Deposit made:

The amount deposited towards Sukanya Samriddhi Account is deductible under section 80C upto Rs.1.5 lakhs. This limit also includes other deductions under section 80C.

On the Interest

Budget 2015 has made Sukanya Samriddhi Yojana fully tax-free.

Sukanya Samriddhi Account vs Public Provident Fund (PPF)

Both Sukanya Samriddhi Account (SSA) and Public Provident Fund (PPF) aims to seed the savings habit but both schemes have their own pros and cons.

Recurring Deposits vs Sukanya Samriddhi Account

Recurring deposits are rather for short-term period like 6 months to 3 years while sukanya samriddhi yojana is a pretty long-term scheme.

Best Tax Saver Mutual Funds 2016 or Top ELSS Mutual Funds for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300